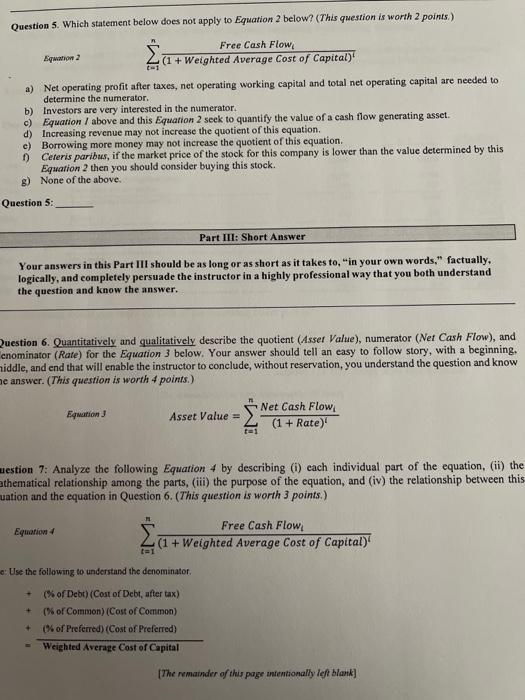

Question 5. Which statement below does not apply to Equation 2 below? (This question is worth 2 points) Free Cash Flow Equation 2 (1 + Weighted Average Cost of Capital) a) Net operating profit after taxes, net operating working capital and total net operating capital are needed to determine the numerator. b) Investors are very interested in the numerator. c) Equation / above and this Equation 2 seek to quantify the value of a cash flow generating asset. d) Increasing revenue may not increase the quotient of this equation c) Borrowing more money may not increase the quotient of this equation. Ceteris paribus, if the market price of the stock for this company is lower than the value determined by this Equation 2 then you should consider buying this stock. 8) None of the above. Questions: Part III: Short Answer Your answers in this part III should be as long or as short as it takes to "in your own words," factually, logically, and completely persuade the instructor in a highly professional way that you both understand the question and know the answer. Question 6. Quantitatively and qualitatively describe the quotient (Asser Value), numerator (Net Cash Flow), and enominator (Rate) for the Equation 3 below. Your answer should tell an easy to follow story, with a beginning. middle, and end that will enable the instructor to conclude, without reservation, you understand the question and know me answer. (This question is worth 4 points.) Equation J Asset Value = Net Cash Flow (1 + Rate) aestion 7: Analyze the following Equation 4 by describing (i) each individual part of the equation, (ii) the athematical relationship among the parts, (iii) the purpose of the equation, and (iv) the relationship between this uation and the equation in Question 6. (This question is worth 3 points.) Equation 4 Free Cash Flow (1 + Weighted Average Cost of Capital)' t=1 Use the following to understand the denominator + (% of Debt) (Cost of Debt, after tax) (% of Common) (Cost of Common) (% of Preferred) (Cost of Preferred) Weighted Average Cost of Capital + The remainder of this page intentionally left blank] Question 5. Which statement below does not apply to Equation 2 below? (This question is worth 2 points) Free Cash Flow Equation 2 (1 + Weighted Average Cost of Capital) a) Net operating profit after taxes, net operating working capital and total net operating capital are needed to determine the numerator. b) Investors are very interested in the numerator. c) Equation / above and this Equation 2 seek to quantify the value of a cash flow generating asset. d) Increasing revenue may not increase the quotient of this equation c) Borrowing more money may not increase the quotient of this equation. Ceteris paribus, if the market price of the stock for this company is lower than the value determined by this Equation 2 then you should consider buying this stock. 8) None of the above. Questions: Part III: Short Answer Your answers in this part III should be as long or as short as it takes to "in your own words," factually, logically, and completely persuade the instructor in a highly professional way that you both understand the question and know the answer. Question 6. Quantitatively and qualitatively describe the quotient (Asser Value), numerator (Net Cash Flow), and enominator (Rate) for the Equation 3 below. Your answer should tell an easy to follow story, with a beginning. middle, and end that will enable the instructor to conclude, without reservation, you understand the question and know me answer. (This question is worth 4 points.) Equation J Asset Value = Net Cash Flow (1 + Rate) aestion 7: Analyze the following Equation 4 by describing (i) each individual part of the equation, (ii) the athematical relationship among the parts, (iii) the purpose of the equation, and (iv) the relationship between this uation and the equation in Question 6. (This question is worth 3 points.) Equation 4 Free Cash Flow (1 + Weighted Average Cost of Capital)' t=1 Use the following to understand the denominator + (% of Debt) (Cost of Debt, after tax) (% of Common) (Cost of Common) (% of Preferred) (Cost of Preferred) Weighted Average Cost of Capital + The remainder of this page intentionally left blank]