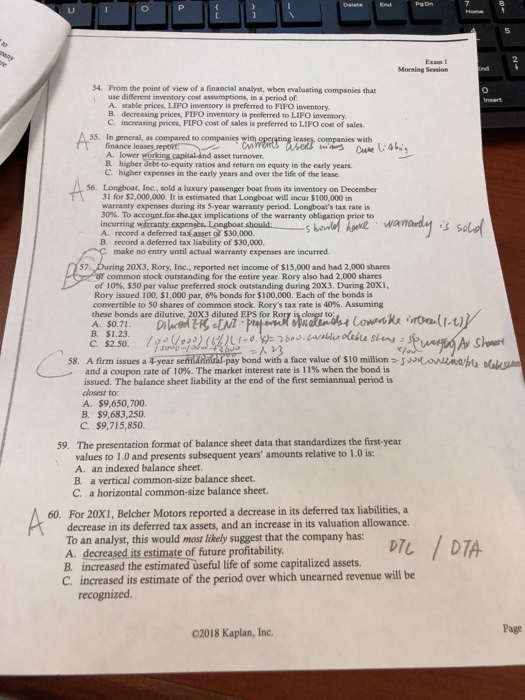

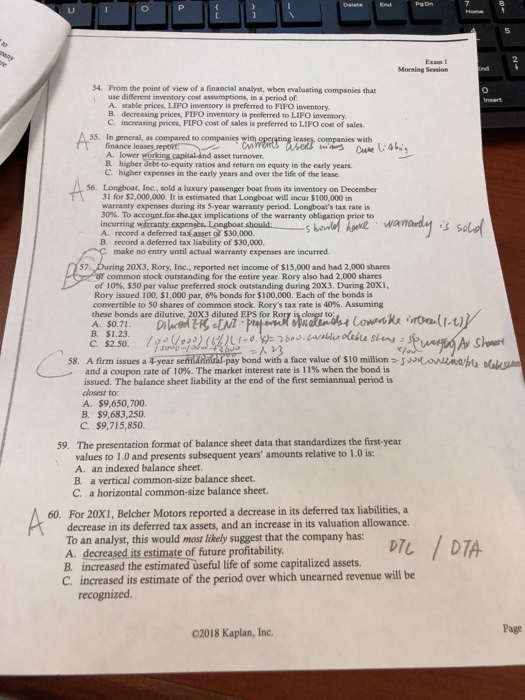

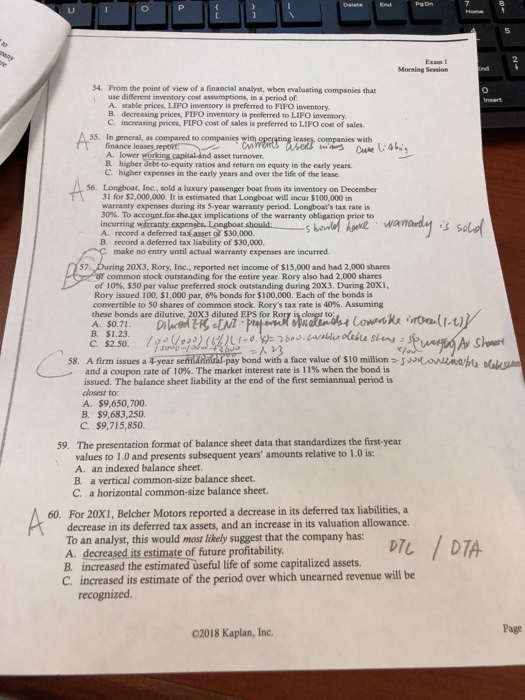

Question 54/59

Morning Session 54. From the point of view of a financial analyst, when evaluating companies that luse different inventory cost assumptions, in a period of A. stable prices, LIFO inventory is preferred to FIFO inventory B. decreasing prices, FIPO inventory is preferred to LIFO inventory C. increasing prices, FIFO cost of sales is preferred to LIFO cost of sales. 55. In general, as compared to companies finance leases A. lower working B. higher debt-to -equity ratios and return on equity in the early years C. higher expenses in the early years and over the life of the lease. 56. Longboat, Inc, sold a luxury passenger boat from its inventory on December 31 for $2,000,000. It is estimated that Longboat will incur $100,000 in warranty expenses during its 5-year warranty period. Longboat's tax rate is 30%. To accountfor thetax implications of the warranty incurring frranty .expenses, Le A. record a deferred ta(asset Of S30.000. B. record a deferred tax liability of $30,000. sold make no entry until actual warranty expenses are incurred 20x3, Rory, Inc., reported net income of $15,000 and had 2,000 shares common stock outstanding for the entire year. Rory also had 2,000 shares of 10%. S50 par value preferred stock outstanding during 20X3 During 20X1, Rory issued 100, $1,000 par, 6% bonds for $100,000. Each of the bonds is convertible to 50 shares of common stock. Rory's tax rate is 40%. Assuming these bonds are dilutive, 20X3 diluted EPS for B. $1.23. 12. /pth eplngbet-ele nb. (A Auu /yShwet a pay bond with a face value of $10 milionJssea un0% ou slevy, C. $2.50 m. 58. Afirm issues a 4-yearse in - and a coupon rate of 10%. The market interest rate is 11% when the bond is issued. The balance sheet liability at the end of the first semiannual period is closest to: A. $9,650,700. B. $9,683,250. C. $9,715,850. The presentation format of balance sheet data that standardizes the first-year values to 1.0 and presents subsequent years' amounts relative to 1.0 is: A. an indexed balance sheet. B. a vertical common-size balance sheet. C. a horizontal common-size balance sheet. 59. 60. For 20XI, Belcher Motors reported a decrease in its deferred tax liabilities, a decrease in its deferred tax assets, and an increase in its valuation allowance. To an analyst, this would most likely suggest that the company has: A. decreased its estimate of future profitability B. increased the estimated useful life of some capitalized assets C. increased its estimate of the period over which unearned revenue will be recognized 02018 Kaplan, Inc. Page