Question: Question 59 (Mandatory) (0.5 points) A company's current stock price is $84.50 and it is likely to pay a $3.50 dividend next year. Since analysts

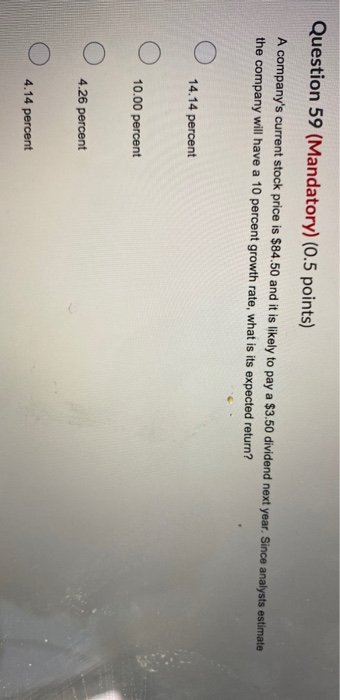

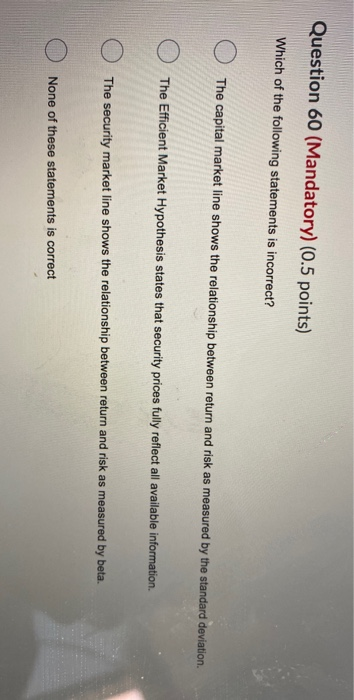

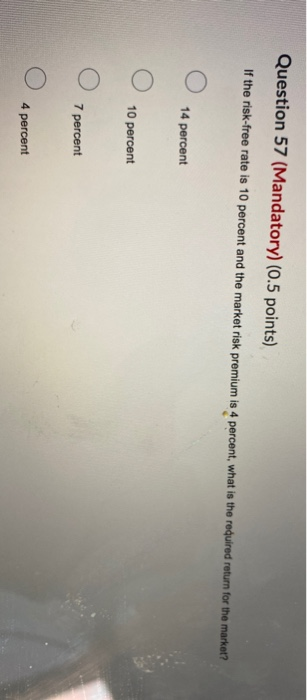

Question 59 (Mandatory) (0.5 points) A company's current stock price is $84.50 and it is likely to pay a $3.50 dividend next year. Since analysts estimate the company will have a 10 percent growth rate, what is its expected return? O 14.14 percent O 10.00 percent O 4.26 percent O 4.14 percent Question 60 (Mandatory) (0.5 points) Which of the following statements is incorrect? The capital market line shows the relationship between return and risk as measured by the standard deviation. The Efficient Market Hypothesis states that security prices fully reflect all available information. The security market line shows the relationship between return and risk as measured by beta. None of these statements is correct Question 57 (Mandatory) (0.5 points) If the risk-free rate is 10 percent and the market risk premium is 4 percent, what is the required return for the market? 14 percent 10 percent 7 percent 4 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts