Answered step by step

Verified Expert Solution

Question

1 Approved Answer

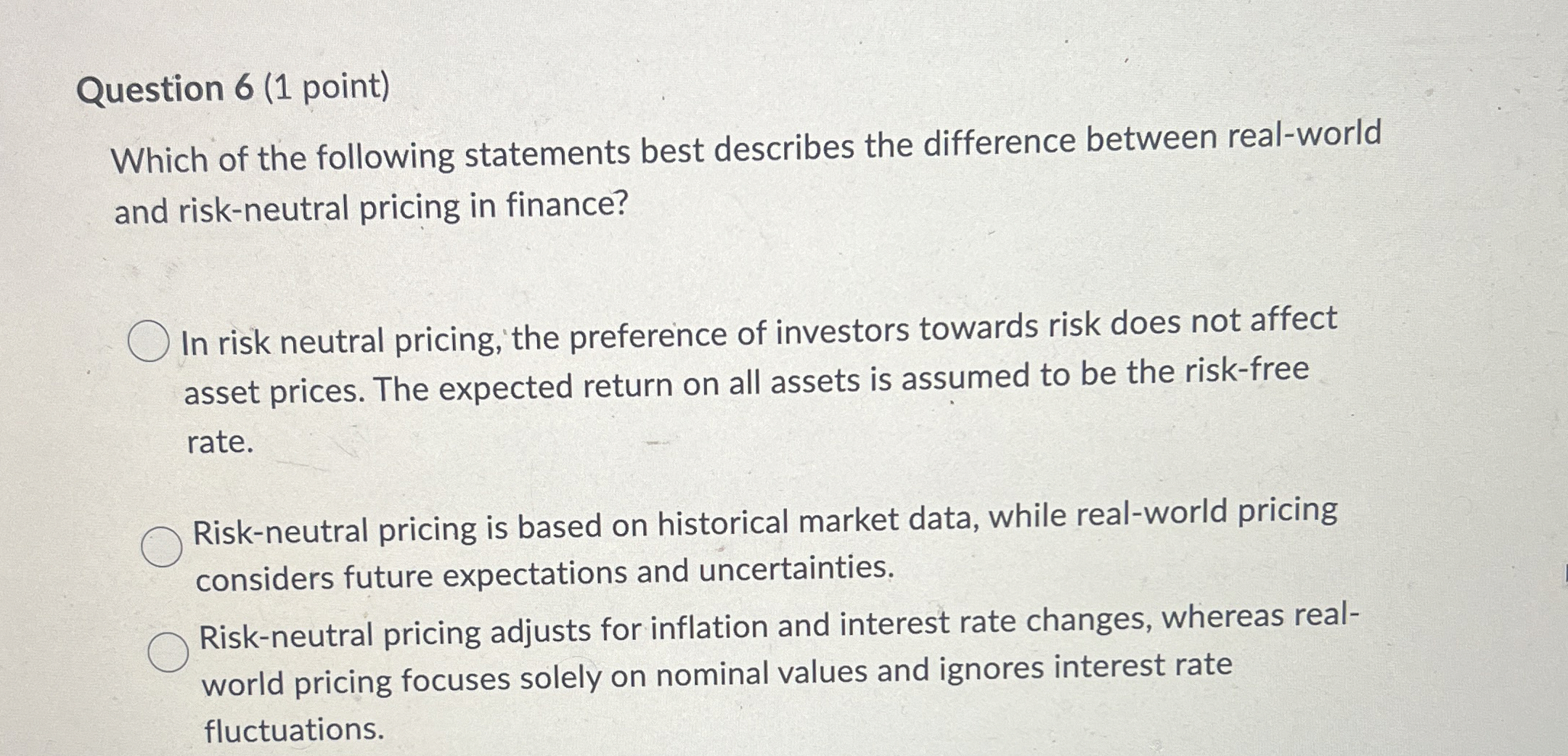

Question 6 ( 1 point ) Which of the following statements best describes the difference between real - world and risk - neutral pricing in

Question point

Which of the following statements best describes the difference between realworld

and riskneutral pricing in finance?

In risk neutral pricing; the preference of investors towards risk does not affect

asset prices. The expected return on all assets is assumed to be the riskfree

rate.

Riskneutral pricing is based on historical market data, while realworld pricing

considers future expectations and uncertainties.

Riskneutral pricing adjusts for inflation and interest rate changes, whereas real

world pricing focuses solely on nominal values and ignores interest rate

fluctuations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started