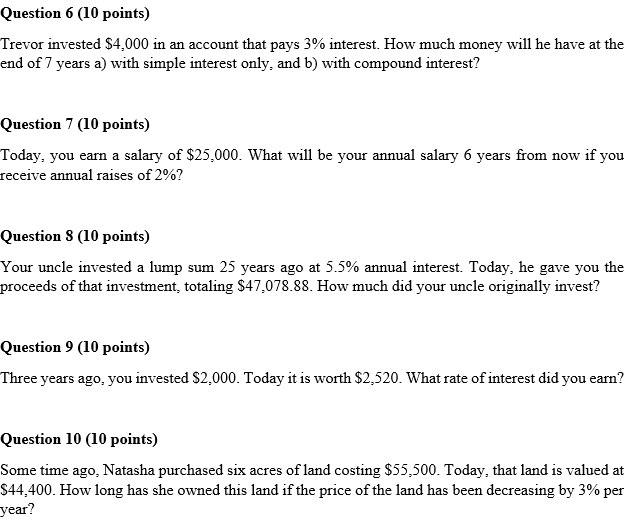

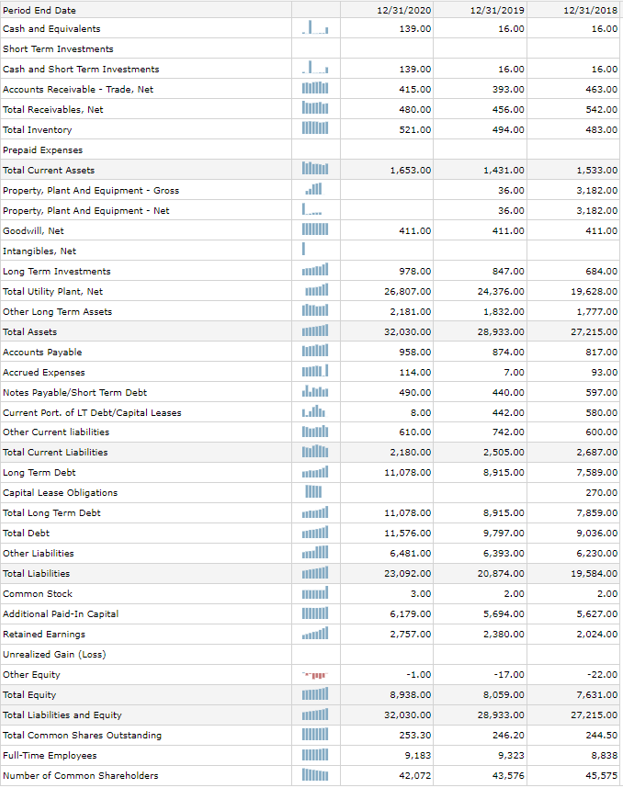

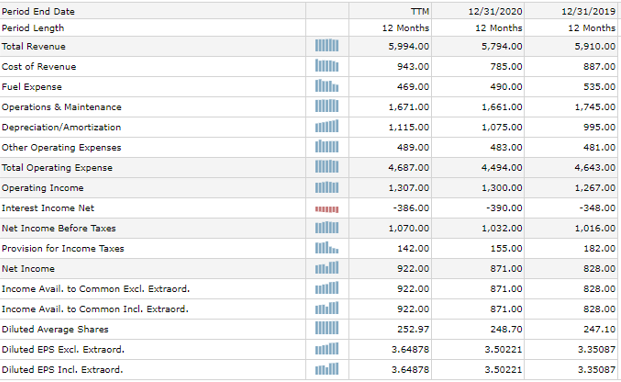

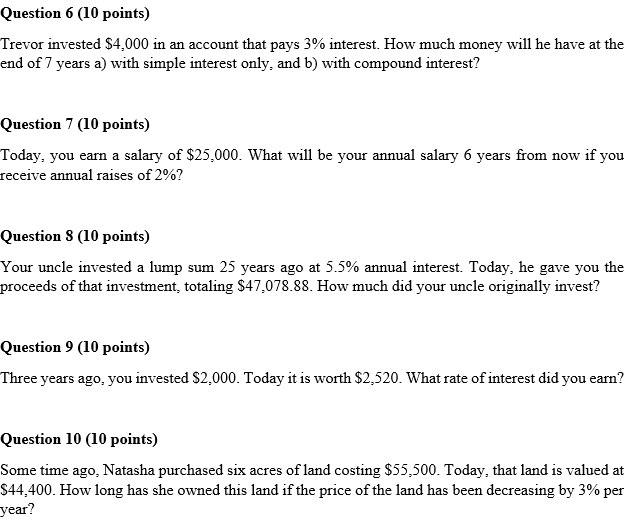

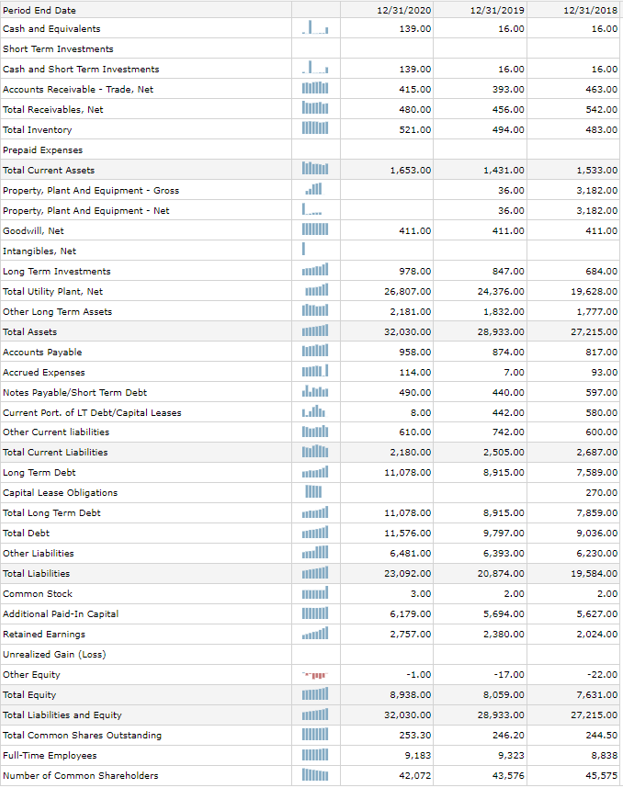

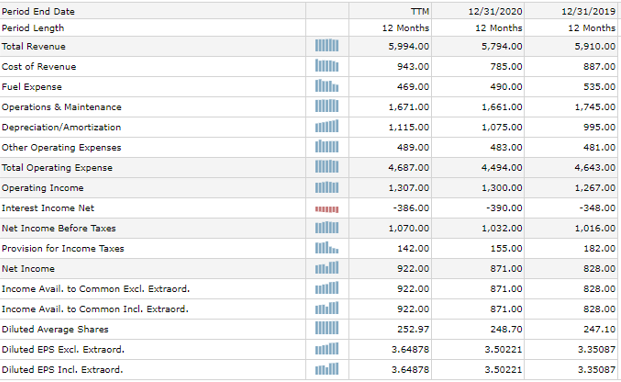

Question 6 (10 points) Trevor invested $4,000 in an account that pays 3% interest. How much money will he have at the end of 7 years a) with simple interest only, and b) with compound interest? Question 7 (10 points) Today, you earn a salary of $25,000. What will be your annual salary 6 years from now if you receive annual raises of 2%? Question 8 (10 points) Your uncle invested a lump sum 25 years ago at 5.5% annual interest. Today, he gave you the proceeds of that investment, totaling $47,078.88. How much did your uncle originally invest? Question 9 (10 points) Three years ago, you invested $2.000. Today it is worth $2,520. What rate of interest did you earn? Question 10 (10 points) Some time ago, Natasha purchased six acres of land costing $55.500. Today, that land is valued at $44,400. How long has she owned this land if the price of the land has been decreasing by 3% per year? 12/31/2018 12/31/2020 139.00 12/31/2019 16.00 16.00 . 139.00 16.00 16.00 415.00 393.00 463.00 480.00 456.00 542.00 521.00 494.00 483.00 lilul 1,653.00 1,431.00 1,533.00 36.00 3,182.00 L... 36.00 3,182.00 411.00 411.00 411.00 I 978.00 847.00 684.00 26,807.00 24,376.00 19,628.00 2,181.00 1,832.00 1,777.00 32,030.00 28,933.00 27,215.00 958.00 874.00 817.00 114.00 7.00 93.00 Period End Date Cash and Equivalents Short Term Investments Cash and Short Term Investments Accounts Receivable - Trade, Net Total Receivables, Net Total Inventory Prepaid Expenses Total Current Assets Property, Plant And Equipment - Gross Property, Plant And Equipment - Net Goodwill, Net Intangibles, Net Long Term Investments Total Utility Plant, Net Other Long Term Assets Total Assets Accounts Payable Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt/Capital Leases Other Current liabilities Total Current Liabilities Long Term Debt Capital Lease Obligations Total Long Term Debt Total Debt Other Liabilities Total Liabilities Common Stock Additional Paid-in Capital Retained Earnings Unrealized Gain (Loss) Other Equity Total Equity Total Liabilities and Equity Total Common Shares Outstanding Full-Time Employees Number of Common Shareholders Labai 490.00 440.00 597.00 8.00 442.00 580.00 610.00 742.00 600.00 2,180.00 2,505.00 2,687.00 11,078.00 8,915.00 7,589.00 270.00 11,078.00 8,915.00 7,859.00 11,576.00 9,797.00 9,036.00 6,481.00 6,393.00 6.230.00 23,092.00 20,874.00 19,584.00 3.00 2.00 2.00 6,179.00 5,694.00 5,627.00 2,757.00 2,380.00 2.024.00 -1.00 -17.00 -22.00 8,938.00 8,059.00 7,631.00 32,030.00 28,933.00 27,215.00 253.30 246.20 244.50 9.183 9,323 8,838 42,072 43,576 45,575 TTM 12 Months 12/31/2020 12 Months 5,794.00 12/31/2019 12 Months 5.910.00 5,994.00 943.00 785.00 887.00 469.00 490.00 535.00 1,671.00 1,661.00 1,745.00 1,115.00 1.075.00 995.00 489.00 483.00 481.00 4,687.00 4,494.00 4,643.00 Period End Date Period Length Total Revenue Cost of Revenue Fuel Expense Operations & Maintenance Depreciation/Amortization Other Operating Expenses Total Operating Expense Operating Income Interest Income Net Net Income Before Taxes Provision for Income Taxes Net Income Income Avail. to Common Excl. Extraord. Income Avail. to Common Incl. Extraord. Diluted Average Shares Diluted EPS Excl. Extraord. Diluted EPS Incl. Extraord. 1,307.00 1,300.00 1,267.00 -386.00 -390.00 -348.00 1,070.00 1,032.00 1,016.00 142.00 155.00 182.00 922.00 871.00 828.00 922.00 871.00 828.00 922.00 871.00 828.00 252.97 248.70 247.10 3.64878 3.50221 3.35087 3.64878 3.50221 3.35087