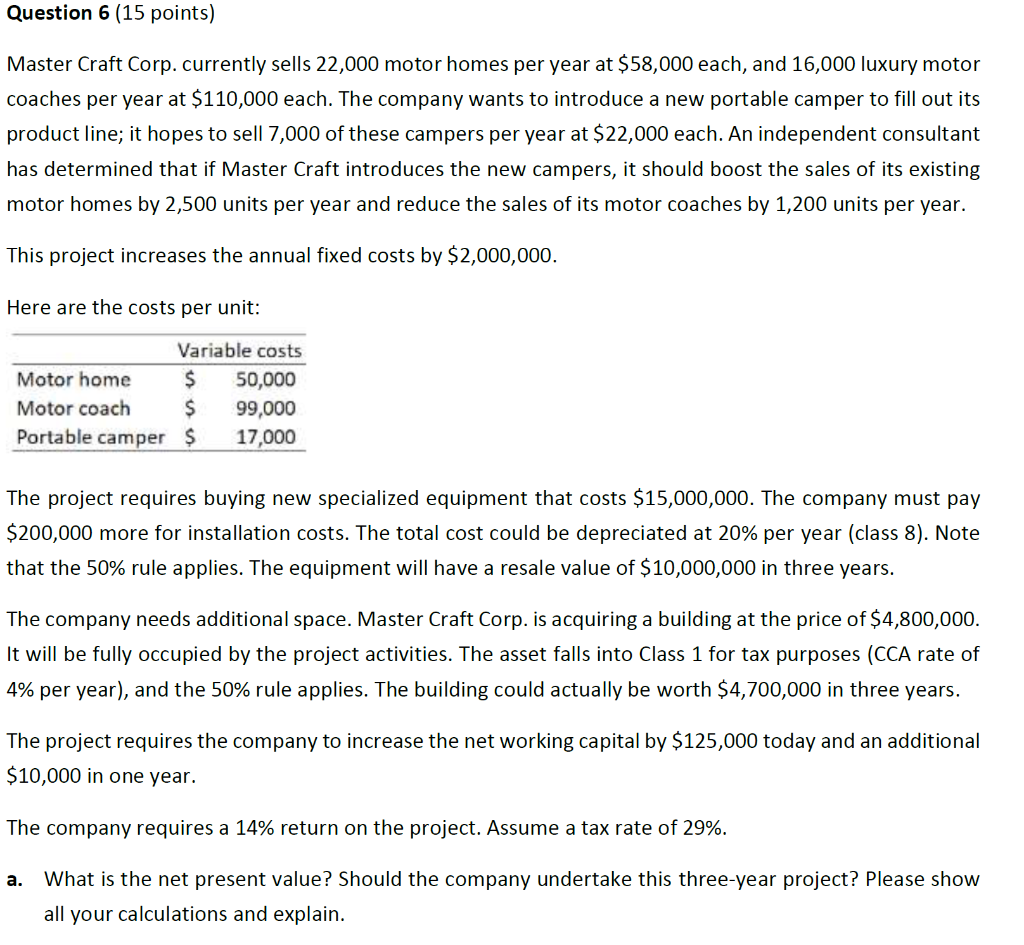

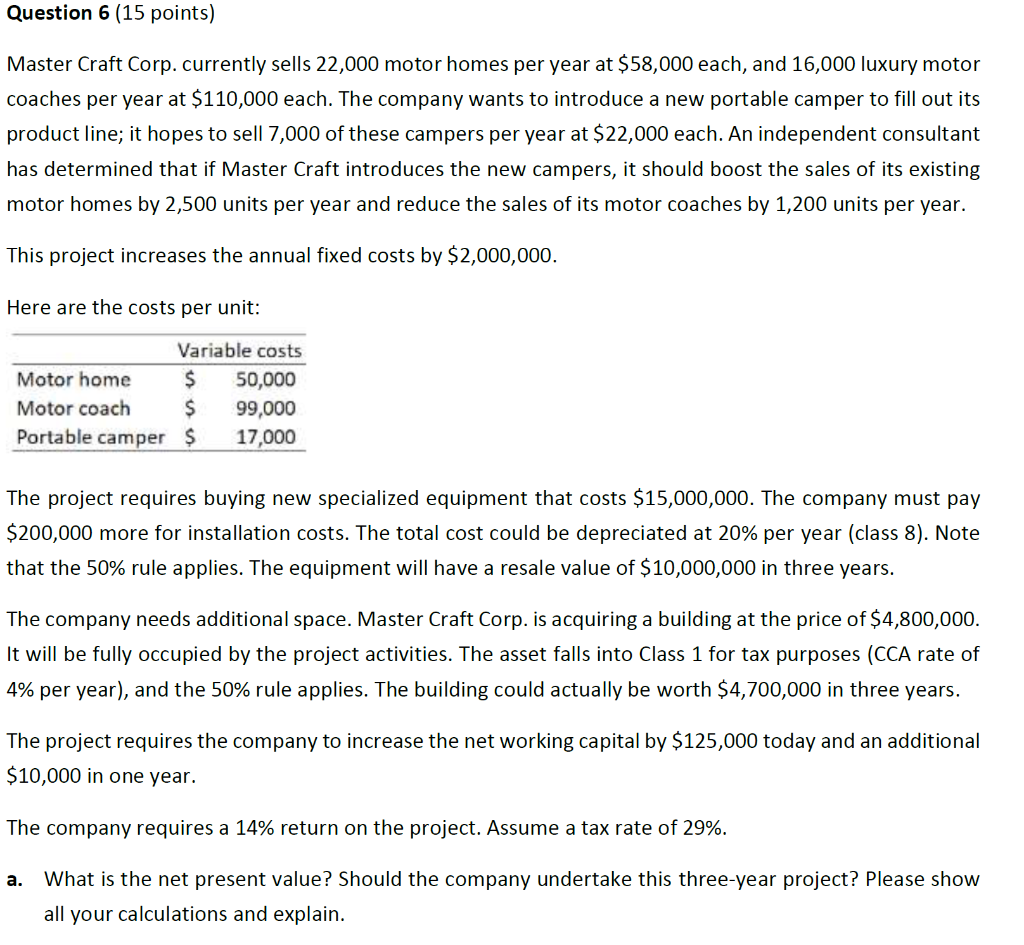

Question 6 (15 points) Master Craft Corp. currently sells 22,000 motor homes per year at $58,000 each, and 16,000 luxury motor coaches per year at $110,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 7,000 of these campers per year at $22,000 each. An independent consultant has determined that if Master Craft introduces the new campers, it should boost the sales of its existing motor homes by 2,500 units per year and reduce the sales of its motor coaches by 1,200 units per year. This project increases the annual fixed costs by $2,000,000. Here are the costs per unit: Variable costs Motor home $ 50,000 Motor coach $ 99,000 Portable camper $ 17,000 The project requires buying new specialized equipment that costs $15,000,000. The company must pay $200,000 more for installation costs. The total cost could be depreciated at 20% per year (class 8). Note that the 50% rule applies. The equipment will have a resale value of $10,000,000 in three years. The company needs additional space. Master Craft Corp. is acquiring a building at the price of $4,800,000. It will be fully occupied by the project activities. The asset falls into Class 1 for tax purposes (CCA rate of 4% per year), and the 50% rule applies. The building could actually be worth $4,700,000 in three years. The project requires the company to increase the networking capital by $125,000 today and an additional $10,000 in one year. The company requires a 14% return on the project. Assume a tax rate of 29%. a. What is the net present value? Should the company undertake this three-year project? Please show all your calculations and explain. Question 6 (15 points) Master Craft Corp. currently sells 22,000 motor homes per year at $58,000 each, and 16,000 luxury motor coaches per year at $110,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 7,000 of these campers per year at $22,000 each. An independent consultant has determined that if Master Craft introduces the new campers, it should boost the sales of its existing motor homes by 2,500 units per year and reduce the sales of its motor coaches by 1,200 units per year. This project increases the annual fixed costs by $2,000,000. Here are the costs per unit: Variable costs Motor home $ 50,000 Motor coach $ 99,000 Portable camper $ 17,000 The project requires buying new specialized equipment that costs $15,000,000. The company must pay $200,000 more for installation costs. The total cost could be depreciated at 20% per year (class 8). Note that the 50% rule applies. The equipment will have a resale value of $10,000,000 in three years. The company needs additional space. Master Craft Corp. is acquiring a building at the price of $4,800,000. It will be fully occupied by the project activities. The asset falls into Class 1 for tax purposes (CCA rate of 4% per year), and the 50% rule applies. The building could actually be worth $4,700,000 in three years. The project requires the company to increase the networking capital by $125,000 today and an additional $10,000 in one year. The company requires a 14% return on the project. Assume a tax rate of 29%. a. What is the net present value? Should the company undertake this three-year project? Please show all your calculations and explain