Question

Question 6 [5 marks] At the end of 2060, Abbott Lab added a new production capacity to its cardiovascular devices. The new production line, ABT-2060,

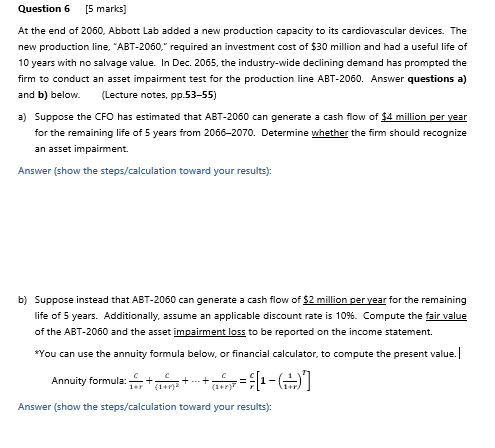

Question 6 [5 marks] At the end of 2060, Abbott Lab added a new production capacity to its cardiovascular devices. The new production line, ABT-2060, required an investment cost of $30 million and had a useful life of 10 years with no salvage value. In Dec. 2065, the industry-wide declining demand has prompted the firm to conduct an asset impairment test for the production line ABT-2060. Answer questions a) and b) below. (Lecture notes, pp.5355) Suppose the CFO has estimated that ABT-2060 can generate a cash flow of $4 million per year for the remaining life of 5 years from 20662070. Determine whether the firm should recognize an asset impairment. Answer (show the steps/calculation toward your results): Suppose instead that ABT-2060 can generate a cash flow of $2 million per year for the remaining life of 5 years. Additionally, assume an applicable discount rate is 10%. Compute the fair value of the ABT-2060 and the asset impairment loss to be reported on the income statement. *You can use the annuity formula below, or financial calculator, to compute the present value. Annuity formula: C/(1+r)+C/(1+r)^2 ++C/(1+r)^T =C/r [1-(1/(1+r))^T ] Answer (show the steps/calculation toward your results):

At the end of 2060 , Abbott Lab added a new production capacity to its cardiovascular devices. The new production line, "ABT-2060," required an investment cost of $30 million and had a useful life of 10 years with no salvage value. In Dec. 2065, the industry-wide declining demand has prompted the firm to conduct an asset impairment test for the production line ABT-2060. Answer questions a) and b) below. (Lecture notes, pp.53-55) a) Suppose the CFO has estimated that ABT-2060 can generate a cash flow of $4 million per year for the remaining life of 5 years from 2066-2070. Determine whether the firm should recognize an asset impairment. Answer (show the steps/calculation toward your results): b) Suppose instead that ABT-2060 can generate a cash flow of $2 million per year for the remaining life of 5 years. Additionally, assume an applicable discount rate is 10%. Compute the fair value of the ABT-2060 and the asset impairment loss to be reported on the income statement. *You can use the annuity formula below, or financial calculator, to compute the present value.| Annuity formula: 1+rc+(1+r)2c++(1+r)Tc=rc[1(1+r1)T] Answer (show the steps/calculation toward your results)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started