Answered step by step

Verified Expert Solution

Question

1 Approved Answer

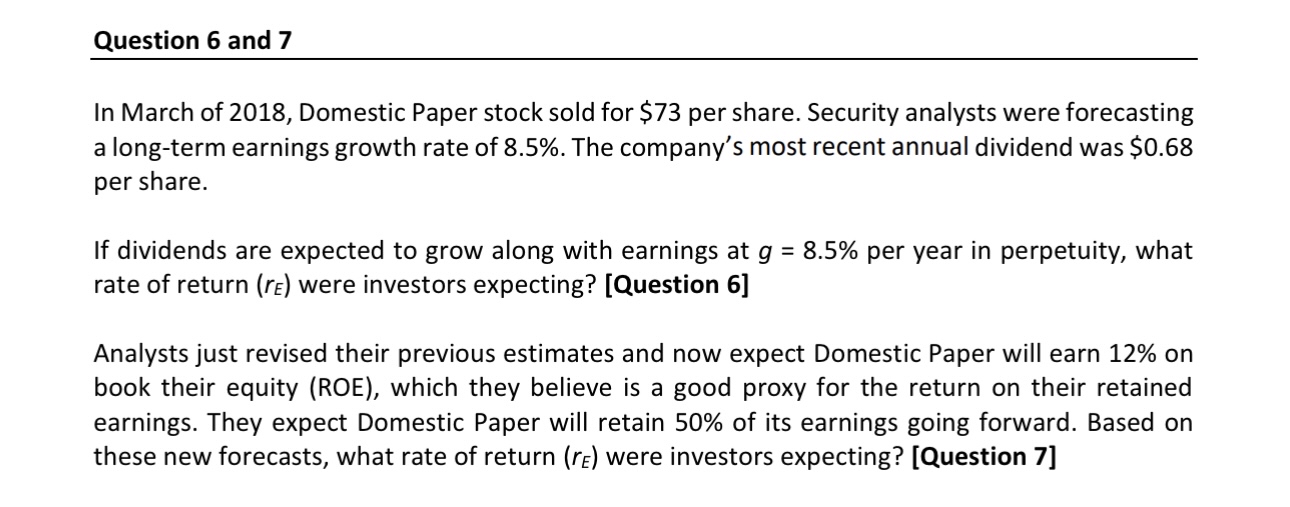

Question 6 and 7 In March of 2 0 1 8 , Domestic Paper stock sold for $ 7 3 per share. Security analysts were

Question and

In March of Domestic Paper stock sold for $ per share. Security analysts were forecasting

a longterm earnings growth rate of The company's most recent annual dividend was $

per share.

If dividends are expected to grow along with earnings at per year in perpetuity, what

rate of return were investors expecting? Question

Analysts just revised their previous estimates and now expect Domestic Paper will earn on

book their equity ROE which they believe is a good proxy for the return on their retained

earnings. They expect Domestic Paper will retain of its earnings going forward. Based on

these new forecasts, what rate of return were investors expecting? Question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started