Question 6 of 12 A $190,000 mortgage was amortized over 15 years by monthly repayments. The interest rate on the mortgage was fixed at

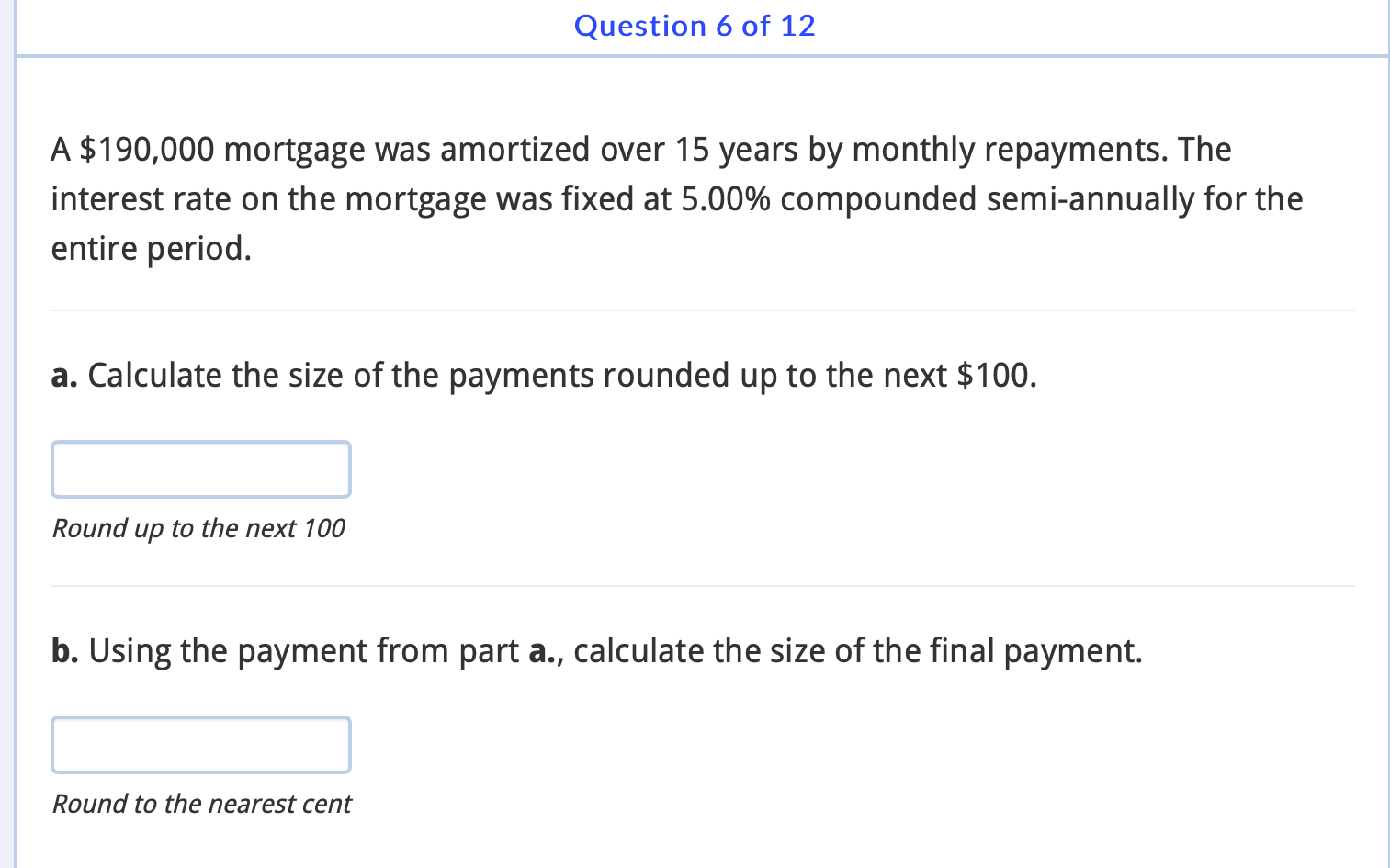

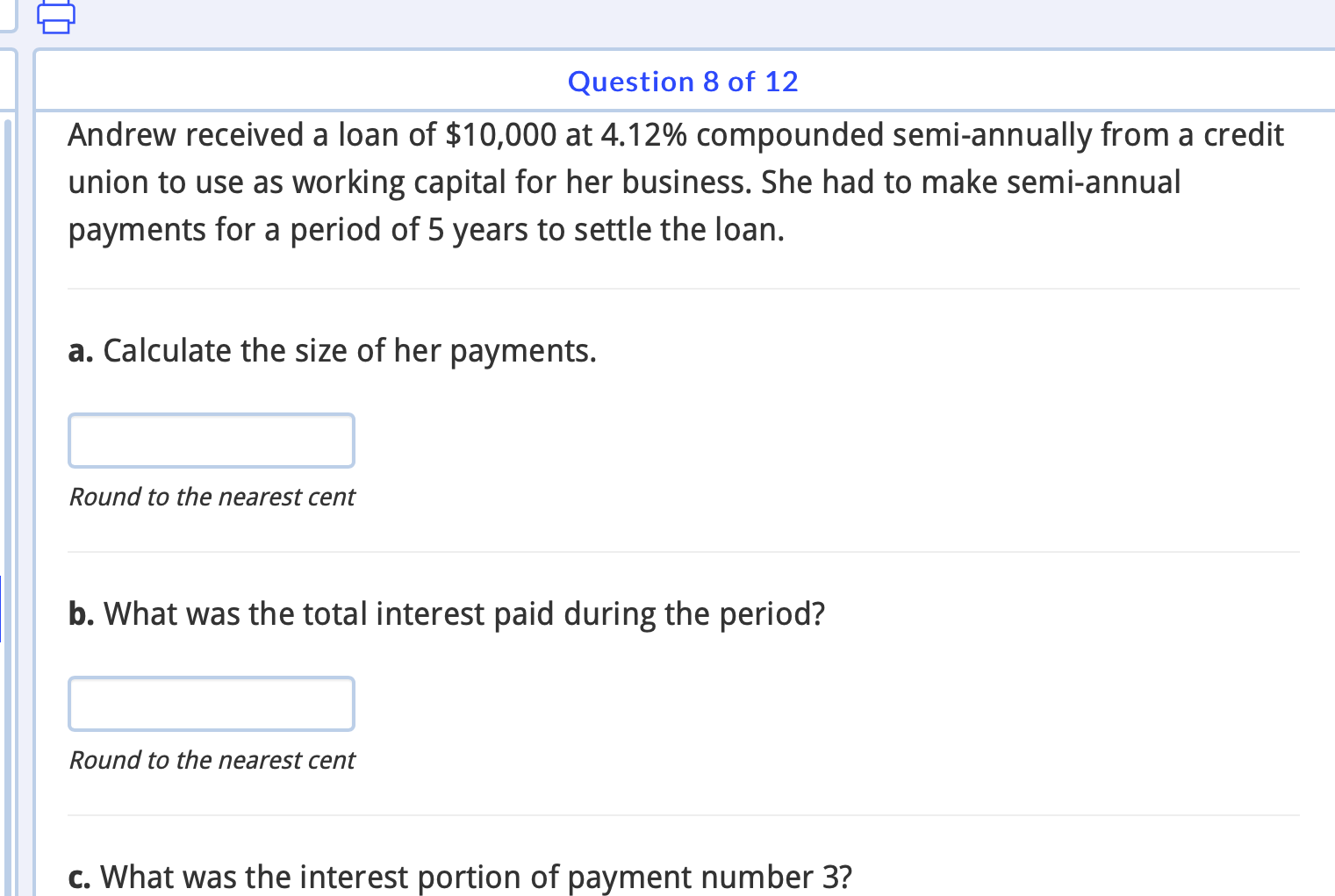

Question 6 of 12 A $190,000 mortgage was amortized over 15 years by monthly repayments. The interest rate on the mortgage was fixed at 5.00% compounded semi-annually for the entire period. a. Calculate the size of the payments rounded up to the next $100. Round up to the next 100 b. Using the payment from part a., calculate the size of the final payment. Round to the nearest cent 2 Question 8 of 12 Andrew received a loan of $10,000 at 4.12% compounded semi-annually from a credit union to use as working capital for her business. She had to make semi-annual payments for a period of 5 years to settle the loan. a. Calculate the size of her payments. Round to the nearest cent b. What was the total interest paid during the period? Round to the nearest cent c. What was the interest portion of payment number 3?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Mortgage Calculation Given 1 Principal 190000 2 Term 15 years 3 Interest rate 500 compounded semiannually 4 Payments Monthly The mortgage formu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started