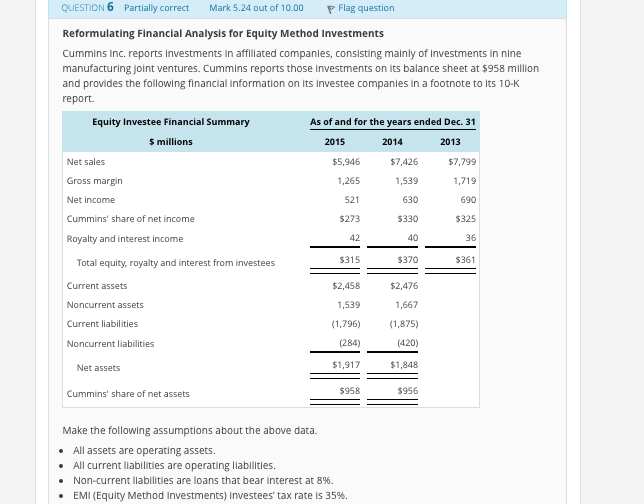

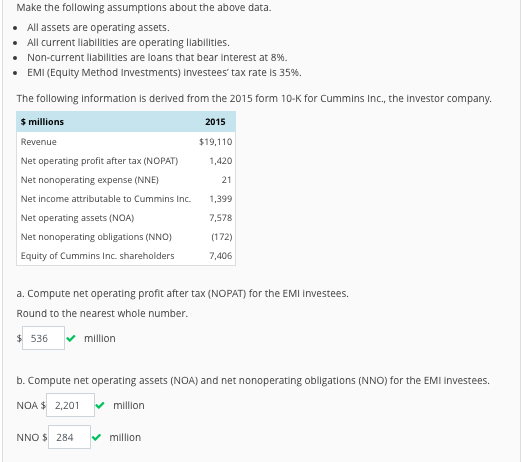

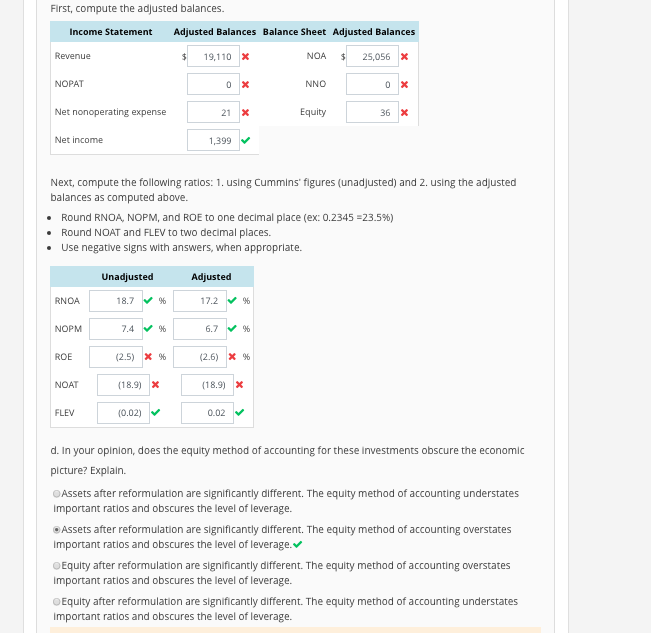

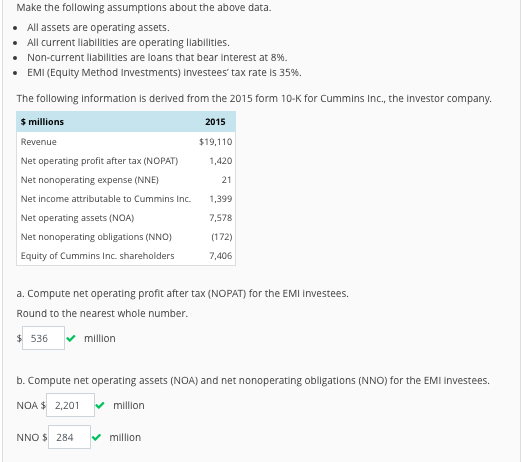

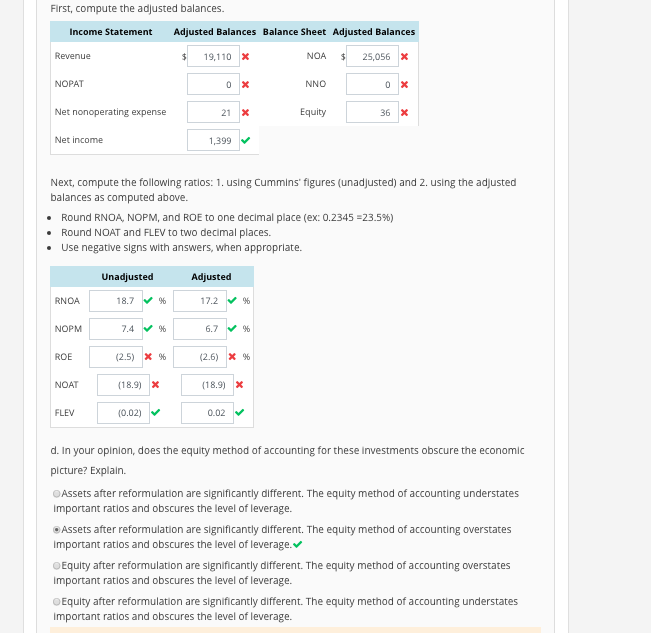

QUESTION 6 Partially correct Mark 5.24 out of 10.00 Flag question Reformulating Financial Analysis for Equity Method Investments Cummins Inc. reports Investments in affillated companles, consisting malnly of investments in nine manufacturing joint ventures. Cummins reports those investments on its balance sheet at $958 million and provides the following financial information on Its Investee companles in a footnote to its 10-K report. Equity Investee Financial Summary As of and for the years ended Dec. 31 $ millions 2015 2014 2013 Net sales Gross margin Net income Cummins' share of net income Royalty and interest income $5,946 1,265 521 $273 42 $315 7,426 1,539 630 $330 40 $370 $7,799 1,719 690 $325 36 361 Total equity, royalty and interest from investees Current assets Noncurrent assets Current liabilities Noncurrent liabilities $2,458 1,539 1,796) (284) $1,917 $2,476 1,667 (1,875) (420) 1,848 956 Net assets $958 Cummins' share of net assets Make the following assumptions about the above data. . All assets are operating assets. . All current labilities are operating labilities. Non-current liabilities are loans that bear interest at 8%. EMI (Equity Method investments) investees' tax rate is 35%. . Make the following assumptions about the above data. All assets are operating assets. All current llabilities are operating llabilitles. Non-current liabilities are loans that bear interest at 8%. EMI (Equity Method Investments)Investees' tax rate is 35%. The following information is derived from the 2015 form 10-K for Cummins Inc., the Investor company $ millions Revenue Net operating profit after tax (NOPAT) 2015 $19,110 1,420 21 Net nonoperating expense (NNE Net income attributable to Cummins Inc. ,399 Net operating assets (NOA) Net nonoperating obligations (NNO) Equity of Cummins Inc. shareholders 7,578 (172) 7,406 a. Compute net operating profit after tax (NOPAT) for the EMI Investees. Round to the nearest whole number 536 million b. Compute net operating assets (NOA) and net nonoperating oblgations (NNO) for the EMI investees. million NOA $ 2,201 million NNO $ 284 First, compute the adjusted balances. Income Statement Adjusted Balances Balance Sheet Adjusted Balances Revenue NOA 19,110 25,056 X NOPAT NNO t nonoperating expense Equity 21 x 36 Net income 1,399 Next, compute the following ratlos: 1. using Cummins' figures (unadjusted) and 2. using the adjusted balances as computed above. Round RNOA, NOPM, and ROE to one decimal place (ex: 0.2345-23.5%) Round NOAT and FLEV to two decimal places. Use negative signs with answers, when appropriate. . Unadjusted Adjusted RNOA 18.7 17.2 NOPM 7.4 6.7 (26) X % (18.9)x (25) X % (18.9)x (0.02) V ROE NOAT FLEV 0.02 d. In your opinion, does the equity method of accounting for these Investments obscure the economic picture? Explain. OAssets after reformulation are significantly different. The equity method of accounting understates important ratios and obscures the level of leverage. Assets after reformulation are significantly different. The equity method of accounting overstates important ratlos and obscures the level of leverage. Equity after reformulation are significantly different. The equity method of accounting overstates important ratios and obscures the level of leverage. Equity after reformulation are significantly different. The equity method of accounting understates important ratios and obscures the level of leverage. QUESTION 6 Partially correct Mark 5.24 out of 10.00 Flag question Reformulating Financial Analysis for Equity Method Investments Cummins Inc. reports Investments in affillated companles, consisting malnly of investments in nine manufacturing joint ventures. Cummins reports those investments on its balance sheet at $958 million and provides the following financial information on Its Investee companles in a footnote to its 10-K report. Equity Investee Financial Summary As of and for the years ended Dec. 31 $ millions 2015 2014 2013 Net sales Gross margin Net income Cummins' share of net income Royalty and interest income $5,946 1,265 521 $273 42 $315 7,426 1,539 630 $330 40 $370 $7,799 1,719 690 $325 36 361 Total equity, royalty and interest from investees Current assets Noncurrent assets Current liabilities Noncurrent liabilities $2,458 1,539 1,796) (284) $1,917 $2,476 1,667 (1,875) (420) 1,848 956 Net assets $958 Cummins' share of net assets Make the following assumptions about the above data. . All assets are operating assets. . All current labilities are operating labilities. Non-current liabilities are loans that bear interest at 8%. EMI (Equity Method investments) investees' tax rate is 35%. . Make the following assumptions about the above data. All assets are operating assets. All current llabilities are operating llabilitles. Non-current liabilities are loans that bear interest at 8%. EMI (Equity Method Investments)Investees' tax rate is 35%. The following information is derived from the 2015 form 10-K for Cummins Inc., the Investor company $ millions Revenue Net operating profit after tax (NOPAT) 2015 $19,110 1,420 21 Net nonoperating expense (NNE Net income attributable to Cummins Inc. ,399 Net operating assets (NOA) Net nonoperating obligations (NNO) Equity of Cummins Inc. shareholders 7,578 (172) 7,406 a. Compute net operating profit after tax (NOPAT) for the EMI Investees. Round to the nearest whole number 536 million b. Compute net operating assets (NOA) and net nonoperating oblgations (NNO) for the EMI investees. million NOA $ 2,201 million NNO $ 284 First, compute the adjusted balances. Income Statement Adjusted Balances Balance Sheet Adjusted Balances Revenue NOA 19,110 25,056 X NOPAT NNO t nonoperating expense Equity 21 x 36 Net income 1,399 Next, compute the following ratlos: 1. using Cummins' figures (unadjusted) and 2. using the adjusted balances as computed above. Round RNOA, NOPM, and ROE to one decimal place (ex: 0.2345-23.5%) Round NOAT and FLEV to two decimal places. Use negative signs with answers, when appropriate. . Unadjusted Adjusted RNOA 18.7 17.2 NOPM 7.4 6.7 (26) X % (18.9)x (25) X % (18.9)x (0.02) V ROE NOAT FLEV 0.02 d. In your opinion, does the equity method of accounting for these Investments obscure the economic picture? Explain. OAssets after reformulation are significantly different. The equity method of accounting understates important ratios and obscures the level of leverage. Assets after reformulation are significantly different. The equity method of accounting overstates important ratlos and obscures the level of leverage. Equity after reformulation are significantly different. The equity method of accounting overstates important ratios and obscures the level of leverage. Equity after reformulation are significantly different. The equity method of accounting understates important ratios and obscures the level of leverage