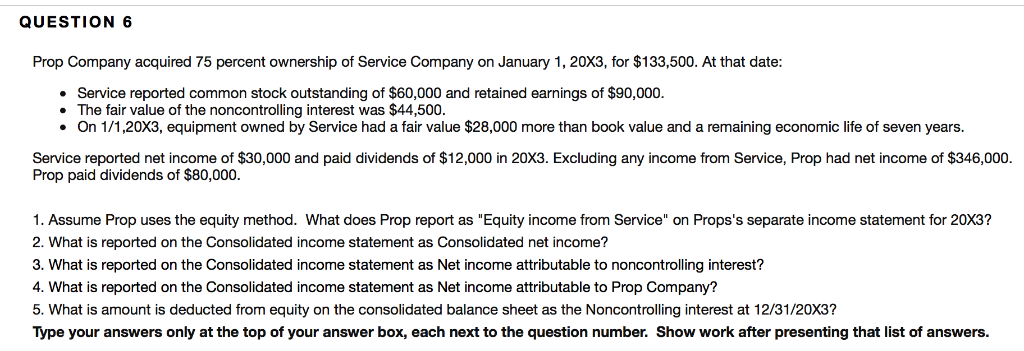

QUESTION 6 Prop Company acquired 75 percent ownership of Service Company on January 1, 20X3, for $133,500. At that date Service reported common stock outstanding of $60,000 and retained earnings of $90,000 . The fair value of the noncontrolling interest was $44,500 On 1/1,20X3, equipment owned by Service had a fair value $28,000 more than book value and a remaining economic life of seven years. Service reported net income of $30,000 and paid dividends of $12,000 in 20X3. Excluding any income from Service, Prop had net income of $346,000 Prop paid dividends of $80,000 1. Assume Prop uses the equity method. What does Prop report as "Equity income from Service" on Props's separate income statement for 20X3? 2. What is reported on the Consolidated income statement as Consolidated net income? 3. What is reported on the Consolidated income statement as Net income attributable to noncontrolling interest? 4. What is reported on the Consolidated income statement as Net income attributable to Prop Company? 5. What is amount is deducted from equity on the consolidated balance sheet as the Noncontrolling interest at 12/31/20X3? Type your answers only at the top of your answer box, each next to the question number. Show work after presenting that list of answers QUESTION 6 Prop Company acquired 75 percent ownership of Service Company on January 1, 20X3, for $133,500. At that date Service reported common stock outstanding of $60,000 and retained earnings of $90,000 . The fair value of the noncontrolling interest was $44,500 On 1/1,20X3, equipment owned by Service had a fair value $28,000 more than book value and a remaining economic life of seven years. Service reported net income of $30,000 and paid dividends of $12,000 in 20X3. Excluding any income from Service, Prop had net income of $346,000 Prop paid dividends of $80,000 1. Assume Prop uses the equity method. What does Prop report as "Equity income from Service" on Props's separate income statement for 20X3? 2. What is reported on the Consolidated income statement as Consolidated net income? 3. What is reported on the Consolidated income statement as Net income attributable to noncontrolling interest? 4. What is reported on the Consolidated income statement as Net income attributable to Prop Company? 5. What is amount is deducted from equity on the consolidated balance sheet as the Noncontrolling interest at 12/31/20X3? Type your answers only at the top of your answer box, each next to the question number. Show work after presenting that list of answers