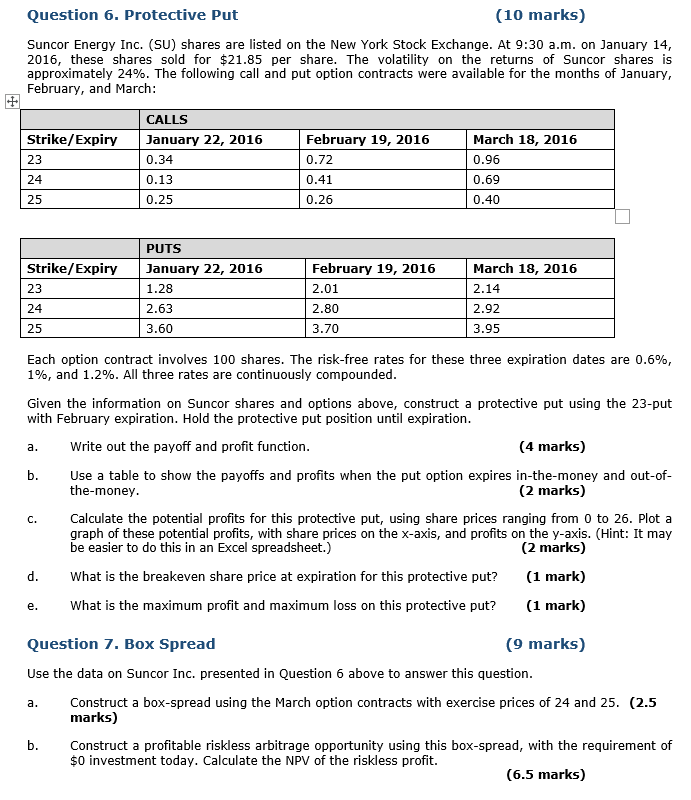

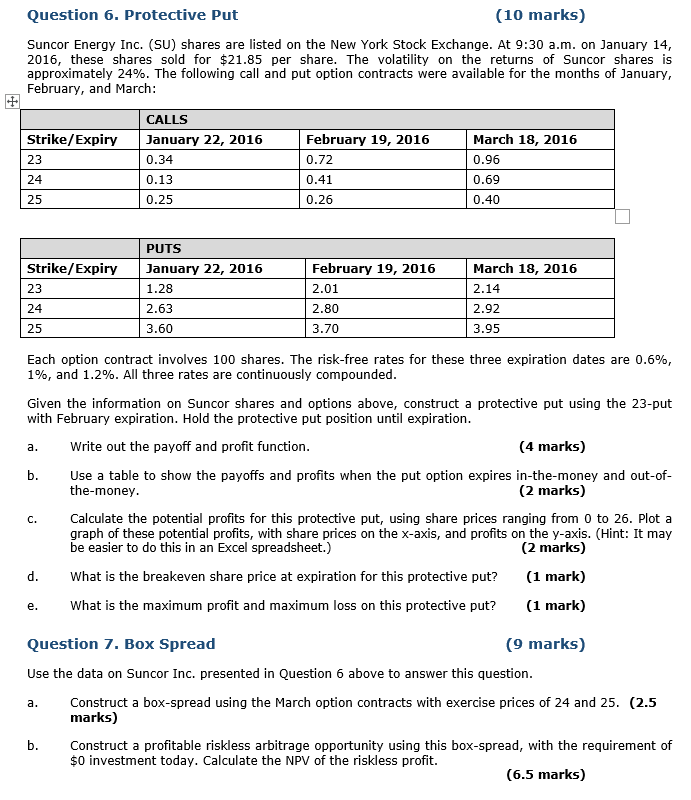

Question 6. Protective Put (10 marks) Suncor Energy Inc. (SU) shares are listed on the New York Stock Exchange. At 9:30 a.m. on January 14, 2016 , these shares sold for $21.85 per share. The volatility on the returns of Suncor shares is approximately 24%. The following call and put option contracts were available for the months of January, February, and March: Each option contract involves 100 shares. The risk-free rates for these three expiration dates are 0.6%, 1%, and 1.2%. All three rates are continuously compounded. Given the information on Suncor shares and options above, construct a protective put using the 23-put with February expiration. Hold the protective put position until expiration. a. Write out the payoff and profit function. (4 marks) b. Use a table to show the payoffs and profits when the put option expires in-the-money and out-ofthe-money. (2 marks) c. Calculate the potential profits for this protective put, using share prices ranging from 0 to 26 . Plot a graph of these potential profits, with share prices on the x-axis, and profits on the y-axis. (Hint: It may be easier to do this in an Excel spreadsheet.) (2 marks) d. What is the breakeven share price at expiration for this protective put? (1 mark) e. What is the maximum profit and maximum loss on this protective put? (1 mark) Question 7. Box Spread (9 marks) Use the data on Suncor Inc. presented in Question 6 above to answer this question. a. Construct a box-spread using the March option contracts with exercise prices of 24 and 25 . (2.5 marks) b. Construct a profitable riskless arbitrage opportunity using this box-spread, with the requirement of $0 investment today. Calculate the NPV of the riskless profit. (6.5 marks) Question 6. Protective Put (10 marks) Suncor Energy Inc. (SU) shares are listed on the New York Stock Exchange. At 9:30 a.m. on January 14, 2016 , these shares sold for $21.85 per share. The volatility on the returns of Suncor shares is approximately 24%. The following call and put option contracts were available for the months of January, February, and March: Each option contract involves 100 shares. The risk-free rates for these three expiration dates are 0.6%, 1%, and 1.2%. All three rates are continuously compounded. Given the information on Suncor shares and options above, construct a protective put using the 23-put with February expiration. Hold the protective put position until expiration. a. Write out the payoff and profit function. (4 marks) b. Use a table to show the payoffs and profits when the put option expires in-the-money and out-ofthe-money. (2 marks) c. Calculate the potential profits for this protective put, using share prices ranging from 0 to 26 . Plot a graph of these potential profits, with share prices on the x-axis, and profits on the y-axis. (Hint: It may be easier to do this in an Excel spreadsheet.) (2 marks) d. What is the breakeven share price at expiration for this protective put? (1 mark) e. What is the maximum profit and maximum loss on this protective put? (1 mark) Question 7. Box Spread (9 marks) Use the data on Suncor Inc. presented in Question 6 above to answer this question. a. Construct a box-spread using the March option contracts with exercise prices of 24 and 25 . (2.5 marks) b. Construct a profitable riskless arbitrage opportunity using this box-spread, with the requirement of $0 investment today. Calculate the NPV of the riskless profit. (6.5 marks)