Answered step by step

Verified Expert Solution

Question

1 Approved Answer

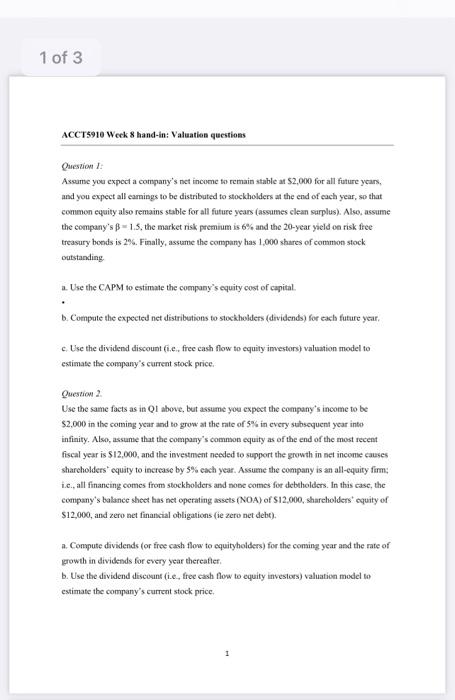

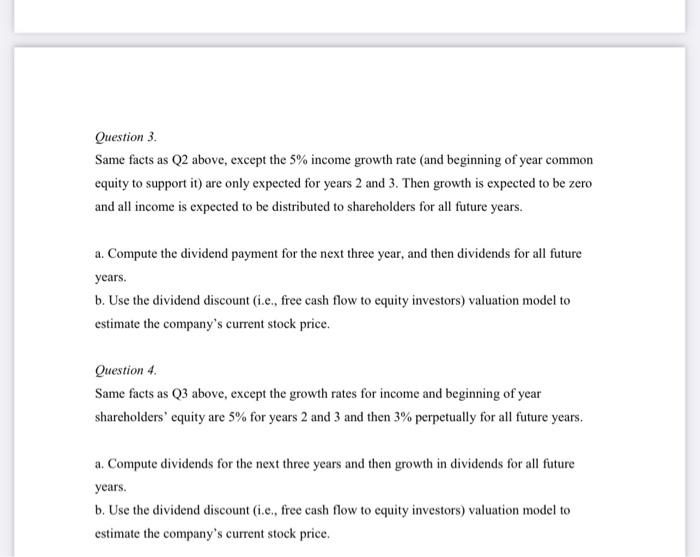

question 6 Same facts as Q4 in photos attached, except derive the value of the firm and the price per common share using the earnings-based

question 6

Same facts as Q4 in photos attached, except derive the value of the firm and the price per common share using the earnings-based valuation model.

- Compute residual income for the next 5 years, and verify that residual income is growing at a constant rate after year 3. What is that rate?

- Use the residual income (abnormal earnings) model to derive derive the value of the company and the price per common share. Compare your answer to the answer you got using the free cash flow to equity investors (dividend discount model) in (4) above.

- Define the concept of residual income (abnormal earnings).

- Explain why positive (negative residual income in all future periods causes price-to-book ratios greater (less) than one

See your computation of residual income in (a) above and notice the eftect of positive and

negative values added to the book value of common equity in the computation ot value in (b)

anove

In this example, what is the company's P/B ratio? Why is it greater or less than 1.0?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started