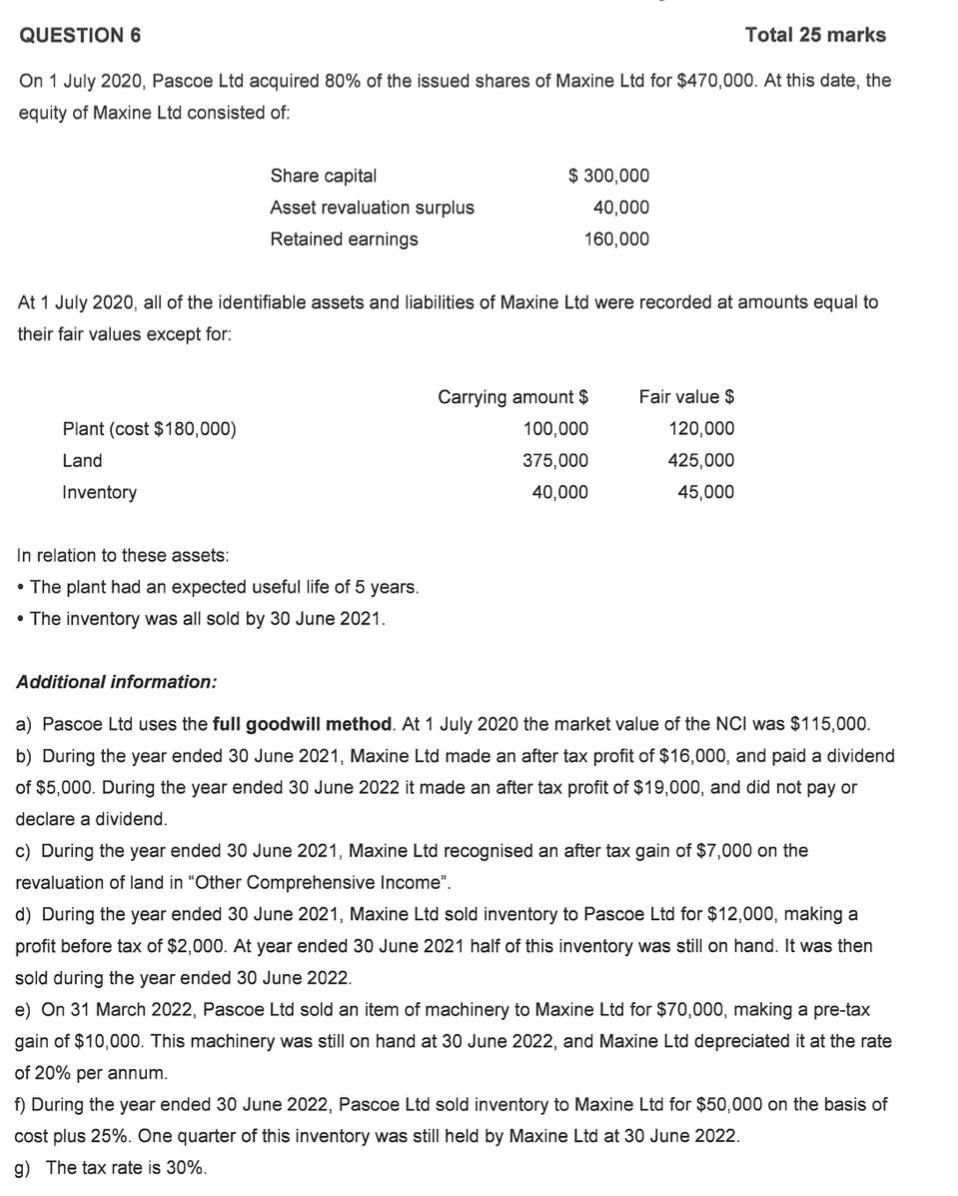

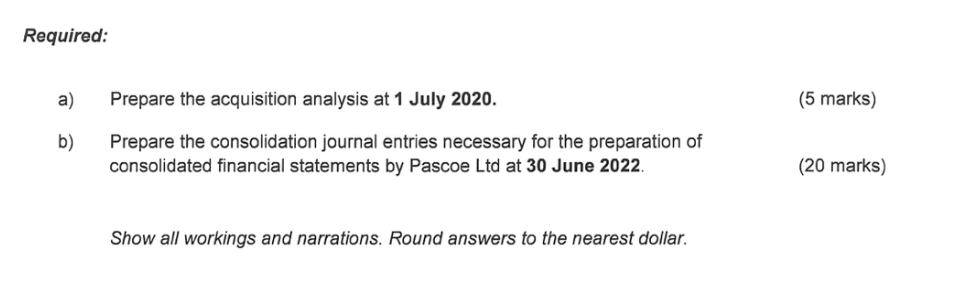

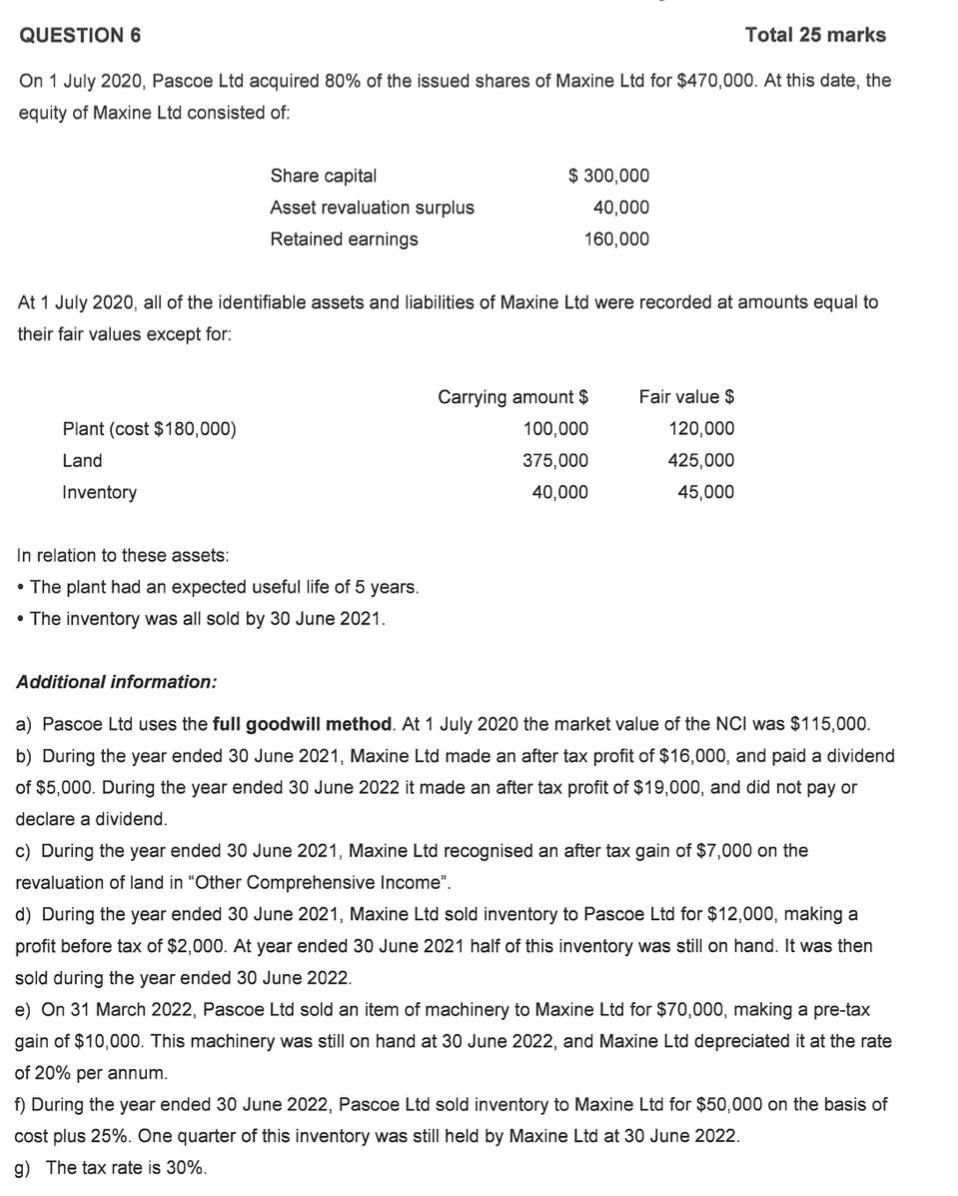

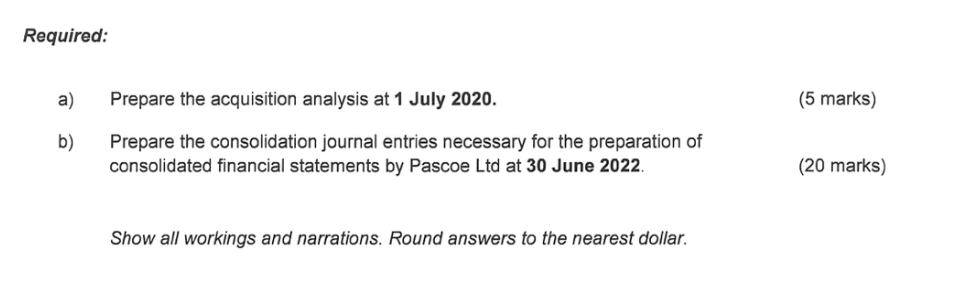

QUESTION 6 Total 25 marks On 1 July 2020, Pascoe Ltd acquired 80% of the issued shares of Maxine Ltd for $470,000. At this date, the equity of Maxine Ltd consisted of: $ 300,000 Share capital Asset revaluation surplus 40,000 Retained earnings 160,000 At 1 July 2020, all of the identifiable assets and liabilities of Maxine Ltd were recorded at amounts equal to their fair values except for: Carrying amount $ Fair value $ Plant (cost $180,000) 100,000 120,000 Land 375,000 425,000 Inventory 40,000 45,000 In relation to these assets: The plant had an expected useful life of 5 years. The inventory was all sold by 30 June 2021. Additional information: a) Pascoe Ltd uses the full goodwill method. At 1 July 2020 the market value of the NCI was $115,000. b) During the year ended 30 June 2021, Maxine Ltd made an after tax profit of $16,000, and paid a dividend of $5,000. During the year ended 30 June 2022 it made an after tax profit of $19,000, and did not pay or declare a dividend. c) During the year ended 30 June 2021, Maxine Ltd recognised an after tax gain of $7,000 on the revaluation of land in "Other Comprehensive Income". d) During the year ended 30 June 2021, Maxine Ltd sold inventory to Pascoe Ltd for $12,000, making a profit before tax of $2,000. At year ended 30 June 2021 half of this inventory was still on hand. It was then sold during the year ended 30 June 2022. e) On 31 March 2022, Pascoe Ltd sold an item of machinery to Maxine Ltd for $70,000, making a pre-tax gain of $10,000. This machinery was still on hand at 30 June 2022, and Maxine Ltd depreciated it at the rate of 20% per annum. f) During the year ended 30 June 2022, Pascoe Ltd sold inventory to Maxine Ltd for $50,000 on the basis of cost plus 25%. One quarter of this inventory was still held by Maxine Ltd at 30 June 2022. g) The tax rate is 30%. QUESTION 6 Total 25 marks On 1 July 2020, Pascoe Ltd acquired 80% of the issued shares of Maxine Ltd for $470,000. At this date, the equity of Maxine Ltd consisted of: $ 300,000 Share capital Asset revaluation surplus 40,000 Retained earnings 160,000 At 1 July 2020, all of the identifiable assets and liabilities of Maxine Ltd were recorded at amounts equal to their fair values except for: Carrying amount $ Fair value $ Plant (cost $180,000) 100,000 120,000 Land 375,000 425,000 Inventory 40,000 45,000 In relation to these assets: The plant had an expected useful life of 5 years. The inventory was all sold by 30 June 2021. Additional information: a) Pascoe Ltd uses the full goodwill method. At 1 July 2020 the market value of the NCI was $115,000. b) During the year ended 30 June 2021, Maxine Ltd made an after tax profit of $16,000, and paid a dividend of $5,000. During the year ended 30 June 2022 it made an after tax profit of $19,000, and did not pay or declare a dividend. c) During the year ended 30 June 2021, Maxine Ltd recognised an after tax gain of $7,000 on the revaluation of land in "Other Comprehensive Income". d) During the year ended 30 June 2021, Maxine Ltd sold inventory to Pascoe Ltd for $12,000, making a profit before tax of $2,000. At year ended 30 June 2021 half of this inventory was still on hand. It was then sold during the year ended 30 June 2022. e) On 31 March 2022, Pascoe Ltd sold an item of machinery to Maxine Ltd for $70,000, making a pre-tax gain of $10,000. This machinery was still on hand at 30 June 2022, and Maxine Ltd depreciated it at the rate of 20% per annum. f) During the year ended 30 June 2022, Pascoe Ltd sold inventory to Maxine Ltd for $50,000 on the basis of cost plus 25%. One quarter of this inventory was still held by Maxine Ltd at 30 June 2022. g) The tax rate is 30%