Question

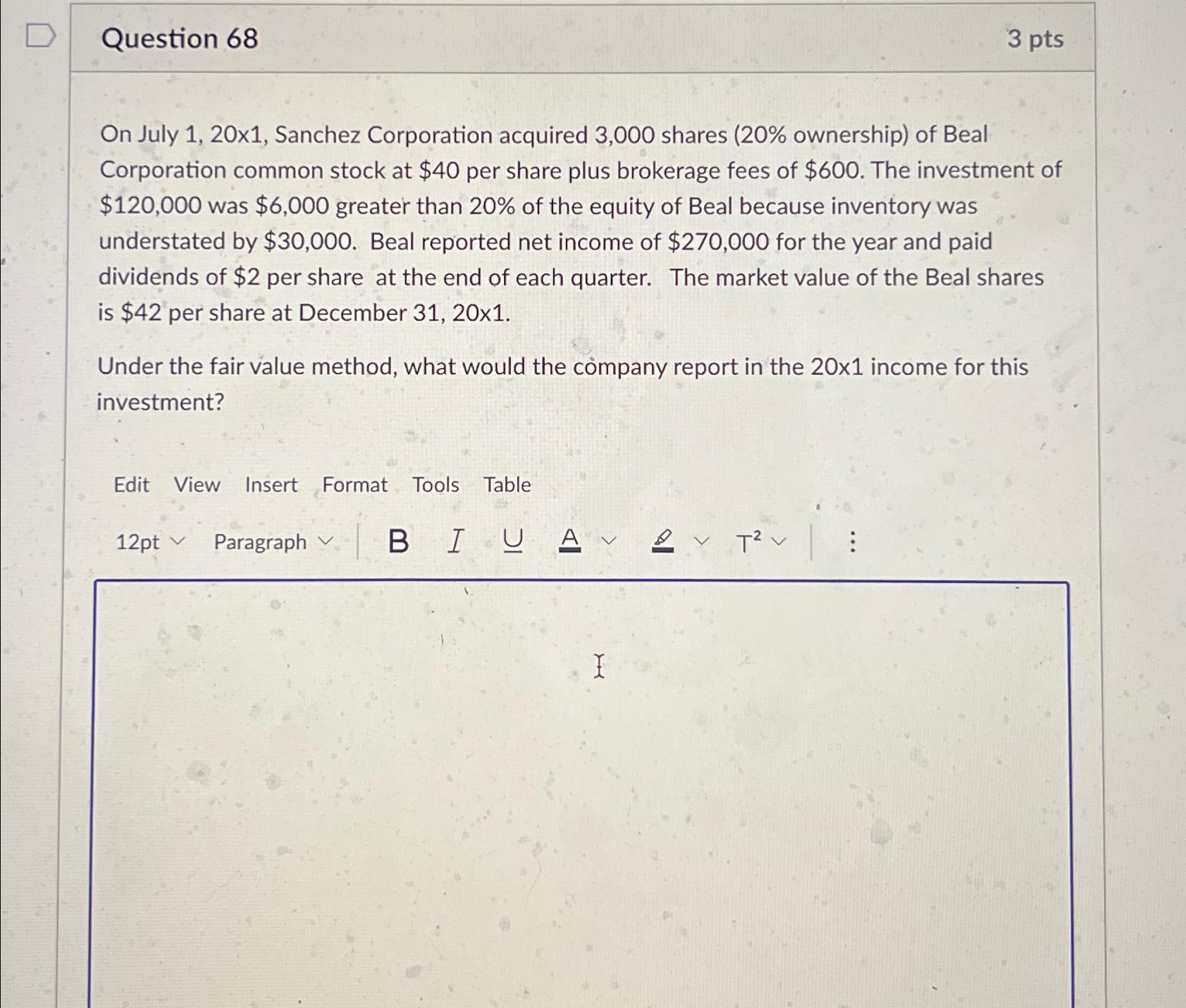

Question 68 3 pts On July 1,20times 1 , Sanchez Corporation acquired 3,000 shares ( 20% ownership) of Beal Corporation common stock at $40 per

Question 68\ 3 pts\ On July

1,20\\\\times 1, Sanchez Corporation acquired 3,000 shares (

20%ownership) of Beal Corporation common stock at

$40per share plus brokerage fees of

$600. The investment of

$120,000was

$6,000greater than

20%of the equity of Beal because inventory was understated by

$30,000. Beal reported net income of

$270,000for the year and paid dividends of

$2per share at the end of each quarter. The market value of the Beal shares is

$42per share at December

31,20\\\\times 1.\ Under the fair value method, what would the company report in the

20\\\\times 1income for this investment?\ Edit View Insert Format Tools Table\

12ptvvParagraph

vv|B,I,U_(A)_(v)vB_(v)vT^(2)vv|vdots

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started