Question

QUESTION 7 [2 + 2 + 2 + 2 + 2 = 10 MARKS] Suns Corporation, located in Gilbert, Arizona, USA, manufactures components for high-performance

QUESTION 7 [2 + 2 + 2 + 2 + 2 = 10 MARKS]

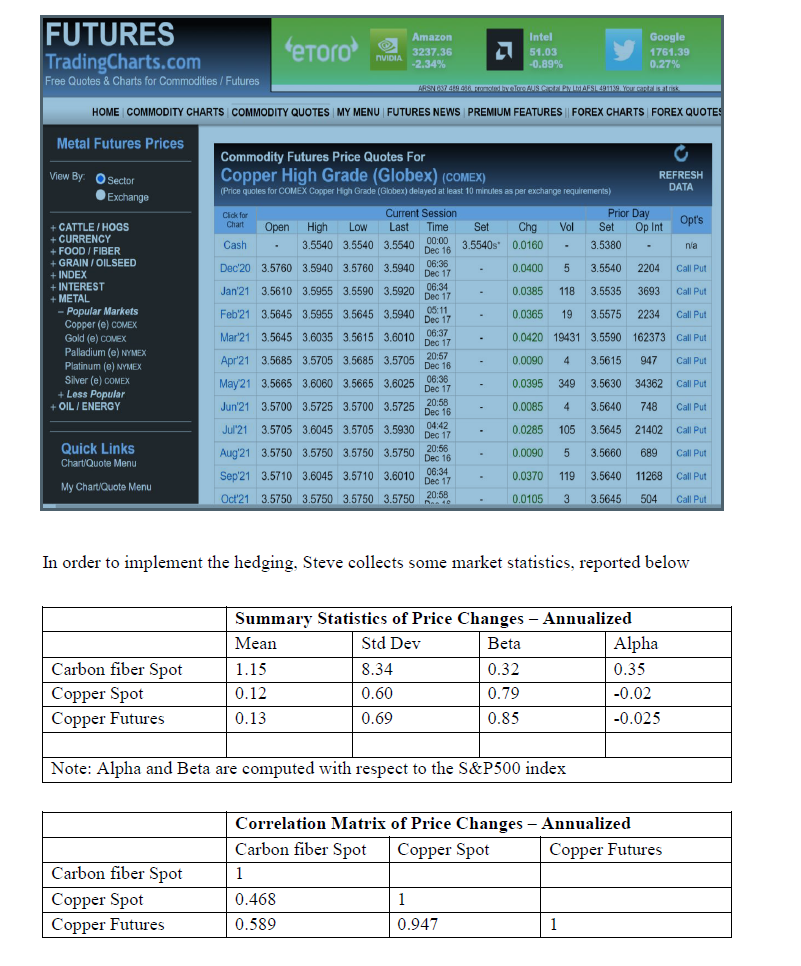

Suns Corporation, located in Gilbert, Arizona, USA, manufactures components for high-performance race bikes. A major input for those components is carbon fiber. It is December 18th, 2020 and Steve Nash, the head of risk management at Suns Corp, is considering how to best hedge the risk generated by unexpected fluctuations in the price of carbon fiber. Currently (December 18th, 2020), the spot price of carbon fiber is $25 per pound and the company is planning to purchase 100,000 pounds of carbon fiber on March 18th, 2021. Specifically, Steve wants to implement a strategy that minimizes the price risk (as measured by the variance) of the carbon fiber position. He knows that futures contracts on carbon fiber are not available and, therefore, decides to use copper futures, given that a) they are very liquid and b) their price is fairly well correlated with the price of carbon fiber. He looks at his computer screen and observes the quotes reported below: notice that the price quotes are in $ per pound, while the contract size is 25,000. Assume Steve can trade at the last recorded price. Further, assume that the futures curve identified by the price quotes below will not shift until the end of March 2021.

a) What hedging strategy should Suns Corp. follow? Why?

Note: you are not required to work out the number of contracts in this part of the question.

b) What CME copper futures contract (i.e., what maturity) should Steve Nash trade in? Explain your answer.

c) How many contracts does Nash need to buy or sell in order to achieve the hedging objective outlined above? Round to the nearest integer.

d) Given your answers in a), b) and c) above, summarize the hedging strategy for Suns Corp. I.e., specify what needs to be done and when in order to open and close the hedge.

e) If the spot price of carbon fibre is $27.5 per pound on March 18th, 2021, what is the effective cost of carbon fibre for Suns Corp.? Ignore the impact of daily marking to market. Round to 4 decimal digits at each step.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started