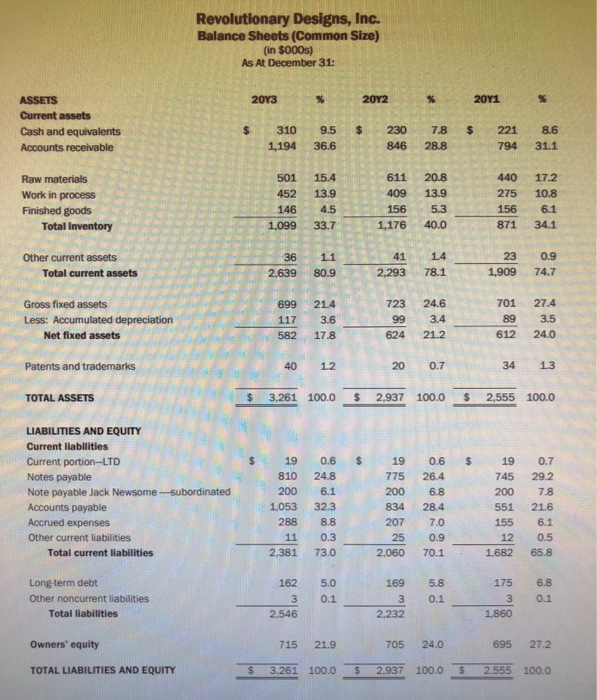

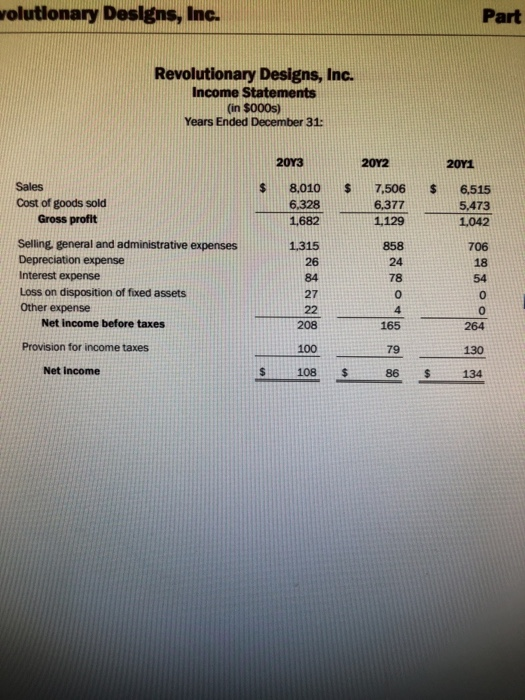

Question (7) Directions: Click the case link above and use the information provided in Revolutionary Designs, Part B, to answer this question: The company's leverage is steadily increasing. Which of the following is the best explanation? The company is repaying its long-term debt more slowly than its net worth is increasing, Uabilities are growing faster than owners' equity due to dividend payments and increases in accounts payable. The company's net profit margin is too narrow to permit it to maintain a constant leverage Most of the company's ability growth is in current liabilities, which have a greater Impact on leverage Revolutionary Designs, Inc. Balance Sheets (Common Size) (in $000s) As At December 31: 20Y3 2012 2011 ASSETS Current assets Cash and equivalents Accounts receivable 221 794 8.6 31.1 611 20.8 Raw materials Work in process 440 275 17.2 10.8 Finished goods- 409 156 1,176 13.9 5.3 40.0 156 Total Inventory 1 871 34.1 41 14 Other current assets Total current assets 23 1,909 2,293 78.1 24.6 27.4 Gross fixed assets Less: Accumulated depreciation Net fixed assets 3.4 701 89 612 21. 2 24.0 Patents and trademarks 40 1.2 20 0.7 34 TOTAL ASSETS $ 3,261 100.0 $ 2,937 100.0 $ 2,555 100.0 19 $ 24.8 775 LIABILITIES AND EQUITY Current liabilities Current portion-LTD Notes payable Note payable Jack Newsome-subordinated Accounts payable Accrued expenses Other current liabilities Total current liabilities 200 834 0.6 26.4 6.8 28.4 7.0 19 745 200 551 155 32.3 0.7 29.2 7.8 21.6 6.1 0.5 65.8 1.682 Long-term debt Other noncurrent liabilities Total liabilities 162 3 2,546 5.0 0.1 6.8 0.1 60 Owners' equity 715 21.9 3.261 100.0 705 2.937 24.0 100.0 695 27.2 2,555 100.0 TOTAL LIABILITIES AND EQUITY $ $ 5 wolutionary Designs, In Part Revolutionary Designs, Inc. Income Statements (in $000s) Years Ended December 31: 2013 20Y2 20Y1 8.010 6.328 1.682 7,506 6,377 1,129 6,515 5.473 1,042 1.315 Sales Cost of goods sold Gross profit Selling general and administrative expenses Depreciation expense Interest expense Loss on disposition of foed assets Other expense Net Income before taxes 26 208 100 Provision for income taxes 79 130 Net Income 108 86 134