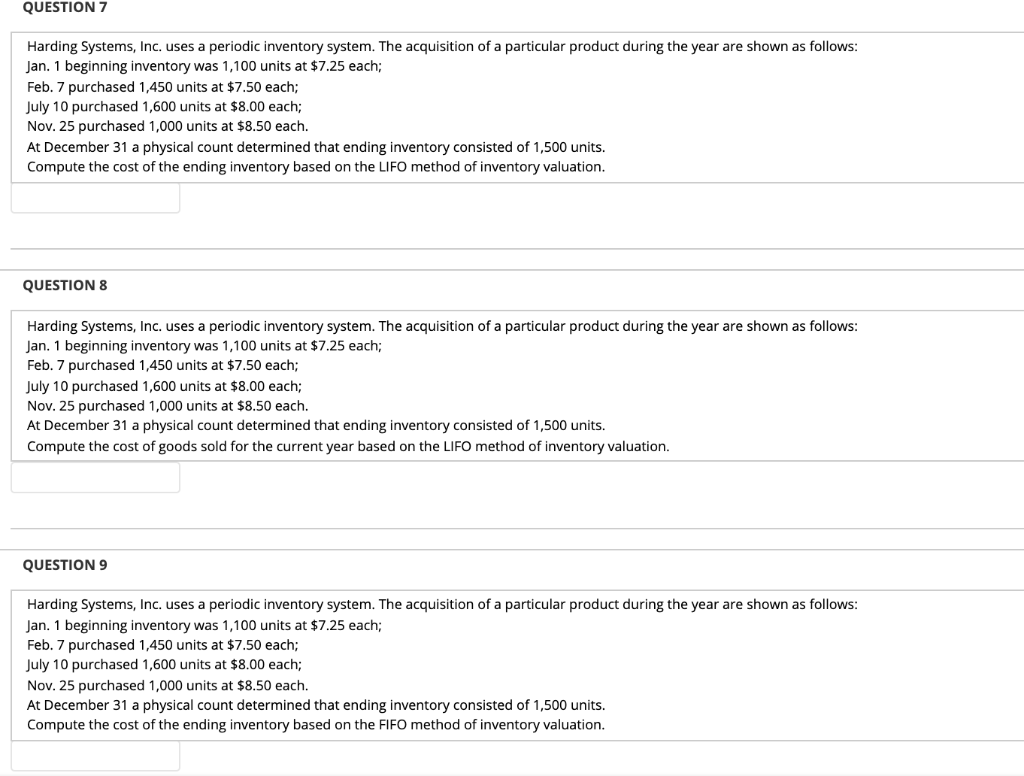

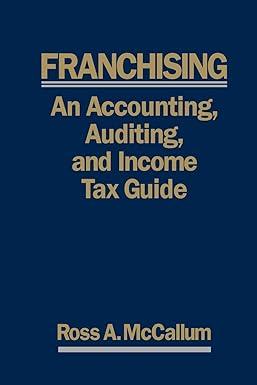

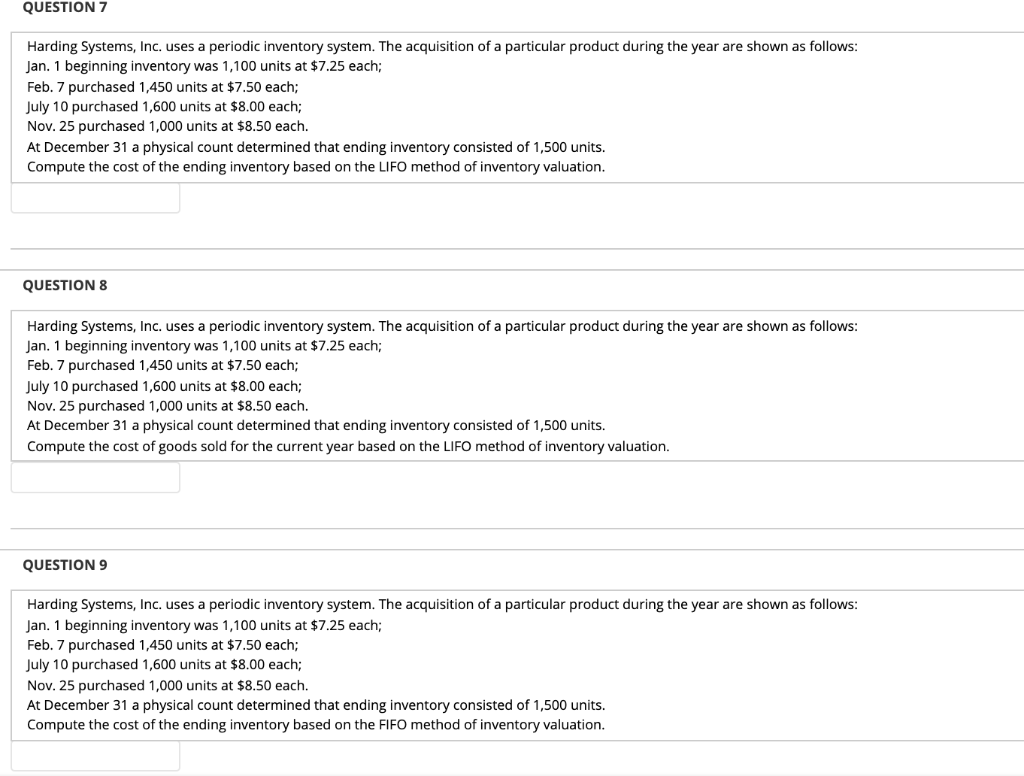

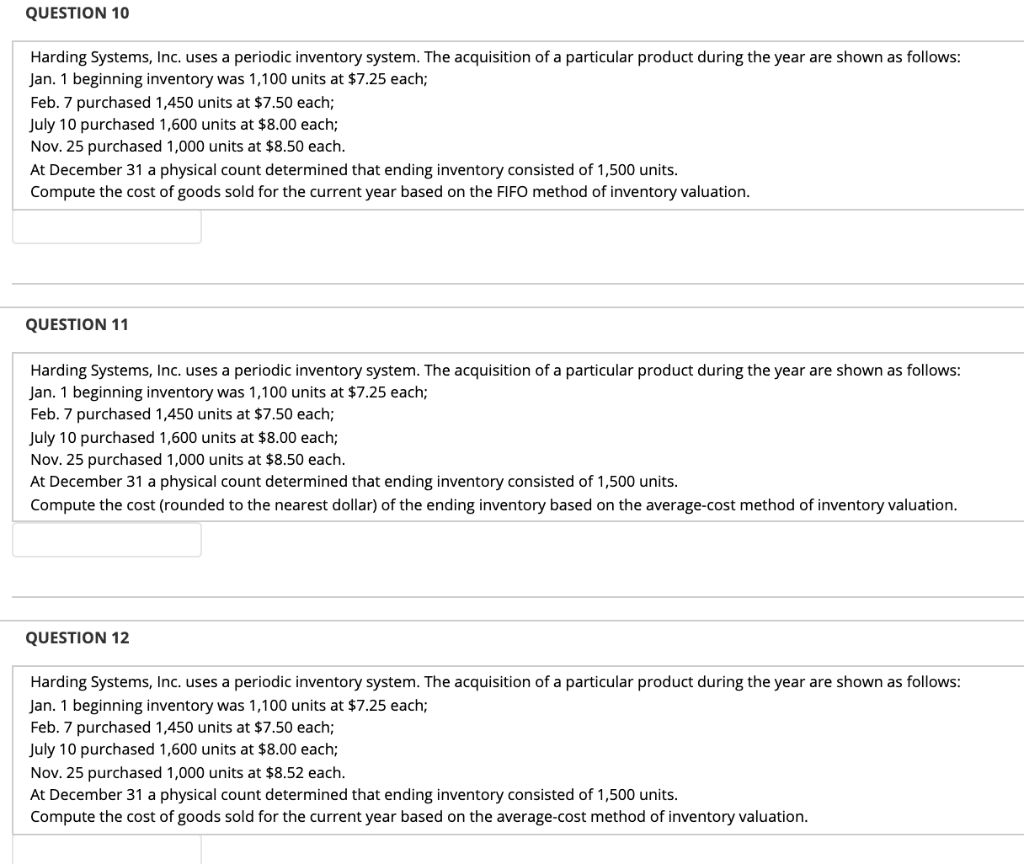

QUESTION 7 Harding Systems, Inc. uses a periodic inventory system. The acquisition of a particular product during the year are shown as follows: Jan. 1 beginning inventory was 1,100 units at $7.25 each; Feb. 7 purchased 1,450 units at $7.50 each; July 10 purchased 1,600 units at $8.00 each; Nov. 25 purchased 1,000 units at $8.50 each At December 31 a physical count determined that ending inventory consisted of 1,500 units. Compute the cost of the ending inventory based on the LIFO method of inventory valuation QUESTION 8 Harding Systems, Inc. uses a periodic inventory system. The acquisition of a particular product during the year are shown as follows: Jan. 1 beginning inventory was 1,100 units at $7.25 each; Feb. 7 purchased 1,450 units at $7.50 each; July 10 purchased 1,600 units at $8.00 each; Nov. 25 purchased 1,000 units at $8.50 each At December 31 a physical count determined that ending inventory consisted of 1,500 units. Compute the cost of goods sold for the current year based on the LIFO method of inventory valuation. QUESTION 9 Harding Systems, Inc. uses a periodic inventory system. The acquisition of a particular product during the year are shown as follows: Jan. 1 beginning inventory was 1,100 units at $7.25 each; Feb. 7 purchased 1,450 units at $7.50 each; July 10 purchased 1,600 units at $8.00 each; Nov. 25 purchased 1,000 units at $8.50 each At December 31 a physical count determined that ending inventory consisted of 1,500 units. Compute the cost of the ending inventory based on the FIFO method of inventory valuation. QUESTION 10 Harding Systems, Inc. uses a periodic inventory system. The acquisition of a particular product during the year are shown as follows: Jan. 1 beginning inventory was 1,100 units at $7.25 each; Feb. 7 purchased 1,450 units at $7.50 each; July 10 purchased 1,600 units at $8.00 each; Nov. 25 purchased 1,000 units at $8.50 each. At December 31 a physical count determined that ending inventory consisted of 1,500 units. Compute the cost of goods sold for the current year based on the FIFO method of inventory valuation QUESTION 11 Harding Systems, Inc. uses a periodic inventory system. The acquisition of a particular product during the year are shown as follows: Jan. 1 beginning inventory was 1,100 units at $7.25 each; Feb. 7 purchased 1,450 units at $7.50 each; July 10 purchased 1,600 units at $8.00 each; Nov. 25 purchased 1,000 units at $8.50 each At December 31 a physical count determined that ending inventory consisted of 1,500 units. Compute the cost (rounded to the nearest dollar) of the ending inventory based on the average-cost method of inventory valuation. QUESTION 12 Harding Systems, Inc. uses a periodic inventory system. The acquisition of a particular product during the year are shown as follows: Jan. 1 beginning inventory was 1,100 units at $7.25 each; Feb. 7 purchased 1,450 units at $7.50 each; July 10 purchased 1,600 units at $8.00 each; Nov. 25 purchased 1,000 units at $8.52 each At December 31 a physical count determined that ending inventory consisted of 1,500 units. Compute the cost of goods sold for the current year based on the average-cost method of inventory valuation