Answered step by step

Verified Expert Solution

Question

1 Approved Answer

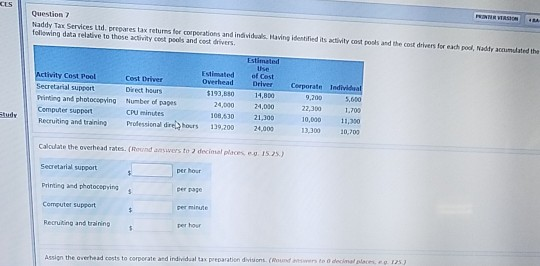

Question 7 Naddy Tax Services Ltd. prepares tax returns for corporations and individuals. Having identified its activity cod pools and the cost drivers for each

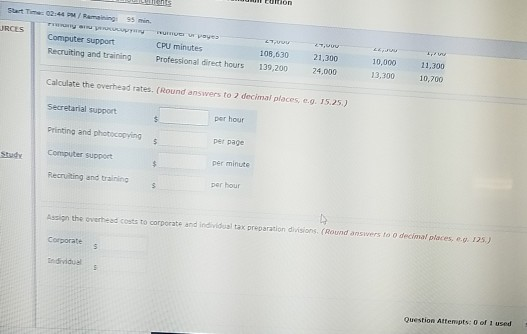

Question 7 Naddy Tax Services Ltd. prepares tax returns for corporations and individuals. Having identified its activity cod pools and the cost drivers for each pod Naddy cumulated the following data relative to these activity contpools and cost drivers. Estimated Use Estimated of Cost Activity Cost Pool Cost Driver Overhead Driver Corporate Individual Secretarial support Direct hours $193,850 14,800 9,200 5,600 Printing and photocopying Number of pages 24,000 22,300 1.700 Computer support Cpu minutes 108,630 21 300 10,000 11,000 Recruiting and training Professional dire hours 139.200 24,000 13,300 10.700 24.000 Calculate the overhead roles. (Round answers to decimal 15) Secretarial support per hour Printing and photocopying $ per page Computer support $ per minute Recruiting and training $ per hour Ass on the overhead costs to corporate and individual tax preparation dont (Rondta decimal 12 95 min JRCES Computer support Recruiting and training CPU minutes Professional direct hours 27. 105,630 139,200 21,300 24.000 10,000 13,300 11,300 10,700 Calculate the overhead rates. (Round answers to 2 decimal places, c.0.15.25.) Secretarial support $ per hour Printing and photocopying $ per page Study Computer Support $ per minute Recruiting and training $ per hour Assign the overhead costs to corporate and individual tax preparation disons (Round answers to o decimal places... 125) Corporate $ Question Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started