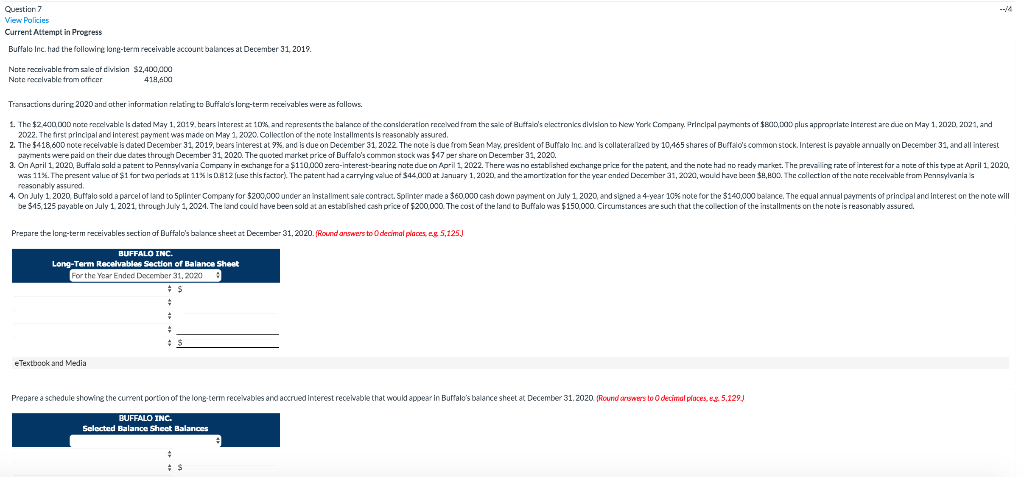

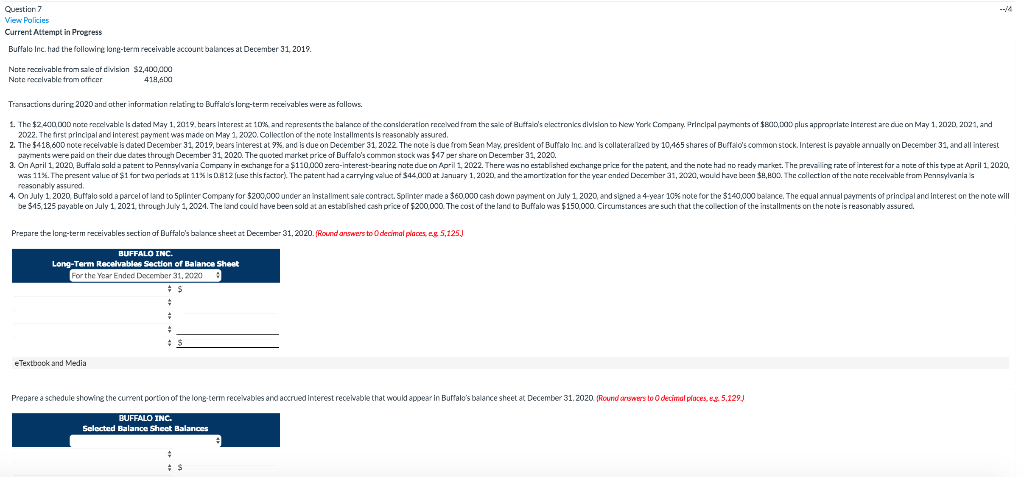

Question 7 View Policies Current Attempt in Progress Buffalo Inc. had the following long-term receivable account balances at December 31, 2012 Note receivable from sa ca division $2,400,000 Not receivable from officer 418,600 Transactions during 2020 and other information relating to Buffalo's long-term receivables were as follows 1. The $2 400.000 note receivable is dated May 1, 2019 cars interest at 10% and represents the balance of the consideration received from the sale of Buffalo's electronics division to New York Comaany. Principal payments of $800,000 plus appropriate Interest are due on May 1, 2020 2021, and 2022. The first princioal and interest payment was made on May 1, 2020, Collection of the note Installments is reasonably assured. 2. The $418 600 note receivable is dated December 31, 2012.beans interest at 9% and is due on December 31 2022 The note is due from Seon Mi president of Buffalo Inc. and collateralized by 10,165 shares of Buffalo's common stock. Interest is payable annually on December 31, and all interest Dayments were paid on their due dates through December 31, 2020. The quoted market price of Buffalo's common stock was $47 per share on December 31, 2020. 3. On April 1. 2020, Buffala salda patent to Pennsylvania Company in exchange for a $110.000 zera-interest-bearing nate cue on April 1, 2022. There was no established exchange price for the patent and the note had no ready market. The prevailing rate of interest for a note of this type at Aaril 1.2020, was 11%. The present value of $1 for twa periods at 11% is D.B12 (use this factor. The patent had a carrying value of $44000 at January 1, 2020, and tha amortization for the year anded December 31, 2020, would have been $.. The collection of the nate recevable from Pennsylvaniais reasonably assured 4. On July 1, 2020 Buffalo sold a parcel of land to Splinter Company for $200,000 under an installment sale contract, Splinter made a $60000 chdown ment on July 1 2020. and stened a 4-year 10% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $15,125 payable on July 1 2021, through July 1, 2024. The land could have been sold at an established cash price of $200,000. The cost of the land to Buffalo was $150,000. Circumstances are such that the collection of the installments on the note is reasonably assured. Prepare the long-term receivables section of Buffalo's balance sheet at December 31, 2020. Round answers to decimal placeseg 5,125) BUFFALO INC. Long-Term Recolvables Section of Balance Sheet For the Year Ended December 31, 2020 : eTextbook and Media Prepare a schedule showine the current portion of the lone-term receivables and accrued interest receivable that would appear in Buffalo's balance sheet at December 31, 2020. Round answers to decimal process. 5.129 BUFFALO INC. Selected Balance Sheet Balances Question 7 View Policies Current Attempt in Progress Buffalo Inc. had the following long-term receivable account balances at December 31, 2012 Note receivable from sa ca division $2,400,000 Not receivable from officer 418,600 Transactions during 2020 and other information relating to Buffalo's long-term receivables were as follows 1. The $2 400.000 note receivable is dated May 1, 2019 cars interest at 10% and represents the balance of the consideration received from the sale of Buffalo's electronics division to New York Comaany. Principal payments of $800,000 plus appropriate Interest are due on May 1, 2020 2021, and 2022. The first princioal and interest payment was made on May 1, 2020, Collection of the note Installments is reasonably assured. 2. The $418 600 note receivable is dated December 31, 2012.beans interest at 9% and is due on December 31 2022 The note is due from Seon Mi president of Buffalo Inc. and collateralized by 10,165 shares of Buffalo's common stock. Interest is payable annually on December 31, and all interest Dayments were paid on their due dates through December 31, 2020. The quoted market price of Buffalo's common stock was $47 per share on December 31, 2020. 3. On April 1. 2020, Buffala salda patent to Pennsylvania Company in exchange for a $110.000 zera-interest-bearing nate cue on April 1, 2022. There was no established exchange price for the patent and the note had no ready market. The prevailing rate of interest for a note of this type at Aaril 1.2020, was 11%. The present value of $1 for twa periods at 11% is D.B12 (use this factor. The patent had a carrying value of $44000 at January 1, 2020, and tha amortization for the year anded December 31, 2020, would have been $.. The collection of the nate recevable from Pennsylvaniais reasonably assured 4. On July 1, 2020 Buffalo sold a parcel of land to Splinter Company for $200,000 under an installment sale contract, Splinter made a $60000 chdown ment on July 1 2020. and stened a 4-year 10% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $15,125 payable on July 1 2021, through July 1, 2024. The land could have been sold at an established cash price of $200,000. The cost of the land to Buffalo was $150,000. Circumstances are such that the collection of the installments on the note is reasonably assured. Prepare the long-term receivables section of Buffalo's balance sheet at December 31, 2020. Round answers to decimal placeseg 5,125) BUFFALO INC. Long-Term Recolvables Section of Balance Sheet For the Year Ended December 31, 2020 : eTextbook and Media Prepare a schedule showine the current portion of the lone-term receivables and accrued interest receivable that would appear in Buffalo's balance sheet at December 31, 2020. Round answers to decimal process. 5.129 BUFFALO INC. Selected Balance Sheet Balances