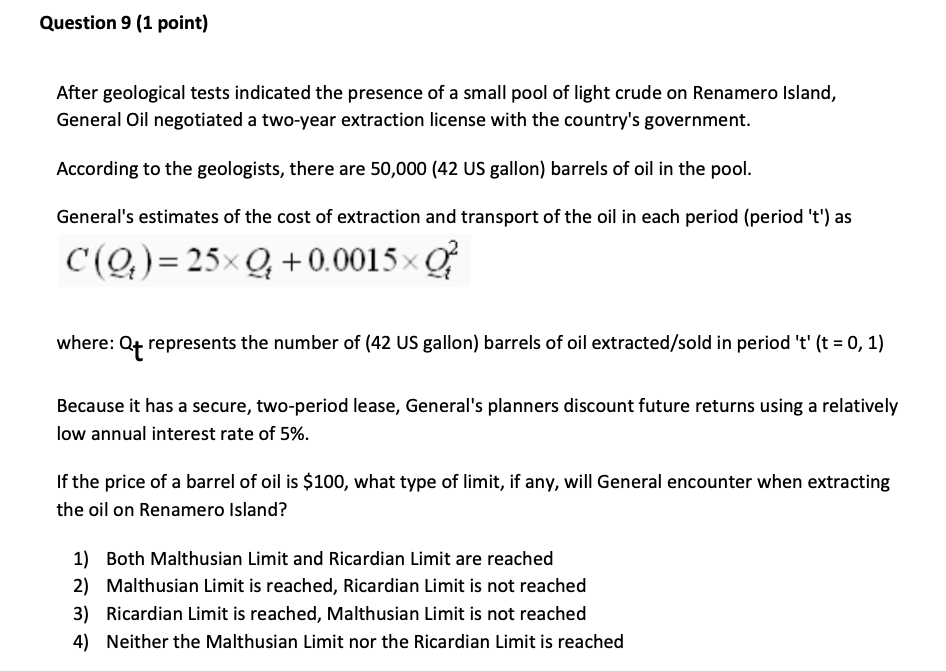

Question 8 (1 point) In order to solve this optimal-age-at-harvest problem, you will need to apply the Product Rule of Differentiation, and be able to differentiate an exponential function. Also, recall the quadratic formula (formula for 'roots' of a quadratic equation): ar +bx+c=0 =x=-bivb' -4ac 2a The volume of saleable timber (W...wood) from a stand of newly-planted trees depends on time ('t' measured in years), and can be described by the function W = f(t) =50xt+2xt Mr. Wilson, the owner of the stand of trees can invest assets with his broker, who promises a return of 6.18%, Mr. Wilson translates this to a continuous rate of return (continuous growth) of exactly 6% . Mr. Wilson wants to harvest (cut down) the stand of trees when the present value of the wood is at its maximum. Mr. Wilson ignores the cost of cutting and removing the wood from his land, optimistically believing that his young daughters (one of whom is still in diapers) will marry lumberjacks who will do this in return for nothing more than thanks and admiration from their father-in-law. What is the optimal value of 't', at which the present value of the stand, PVsund (1) = e- [f (t)] reaches its maximum? 1) 't' greater than 24 years 2) 't' not greater than 15 years 3) 't' greater than 21 years but not greater than 24 years 4) 't' greater than 15 years but not greater than 18 years 5) 't' greater than 18 years but not greater than 21 yearsQuestion 9 (1 point] After geological tests indicated the presence of a small pool of light crude on Renamero Island, General Oil negotiated a two-year extraction license with the country's government. According to the geologists, there are 50,000 {42 US gallon} barrels of oil in the pool. General's estimates of the cost of extraction and transport of the oil in each period {period 't'} as C(Q,)=2:5:ng,+0.0015xg,2 where: Qt represents the number of {42 US gallon} barrels of oil extracted/sold in period 't' {t = 0, 1} Because it has a secure, two-period lease, General's planners discount future returns using a relatively low annual interest rate of 5%. If the price of a barrel of oil is 5100, what type of limit, if any, will General encounter when extracting the oil on Renamero Island? 1} Both Malthusian Limit and Ricardian Limit are reached 2} Malthusian Limit is reached, Ricardian Limit is not reached 3} Ricardian Limit is reached, Malthusian Limit is not reached 4} Neither the Malthusian Limit nor the Ricardian Limit is reached