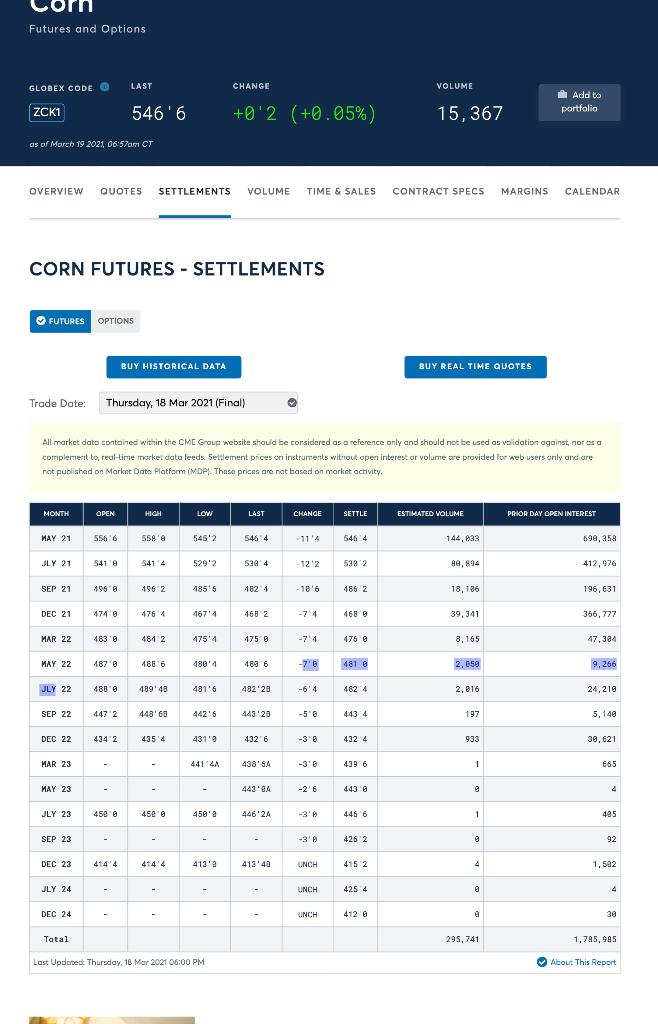

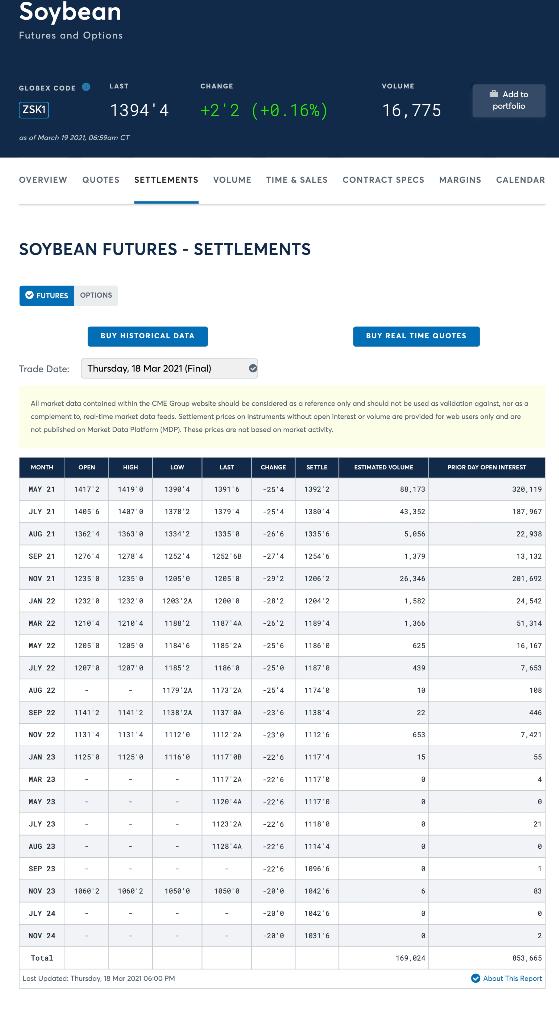

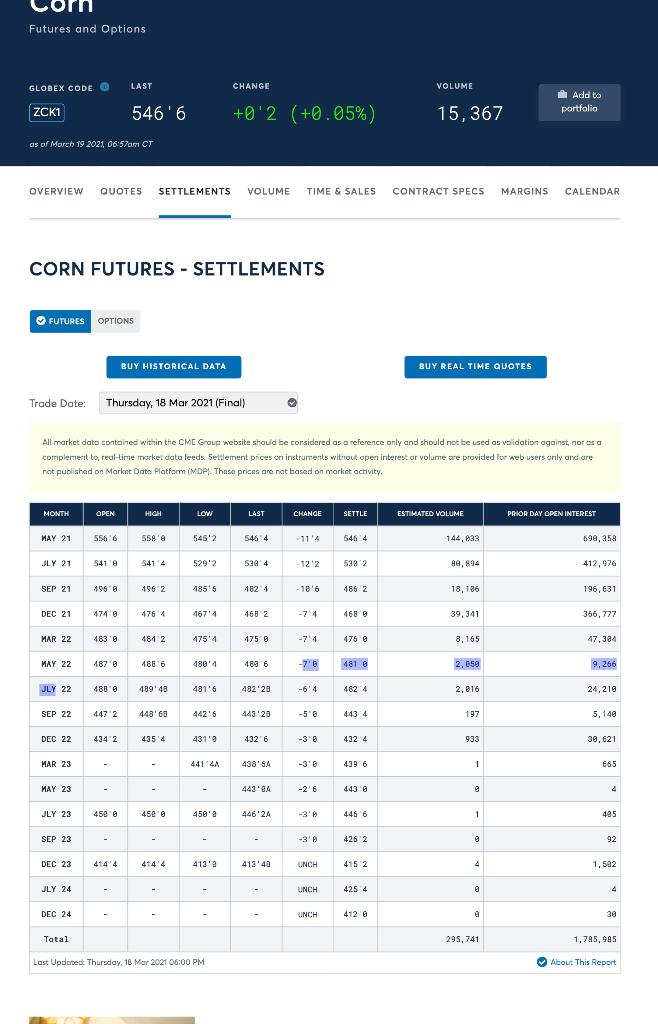

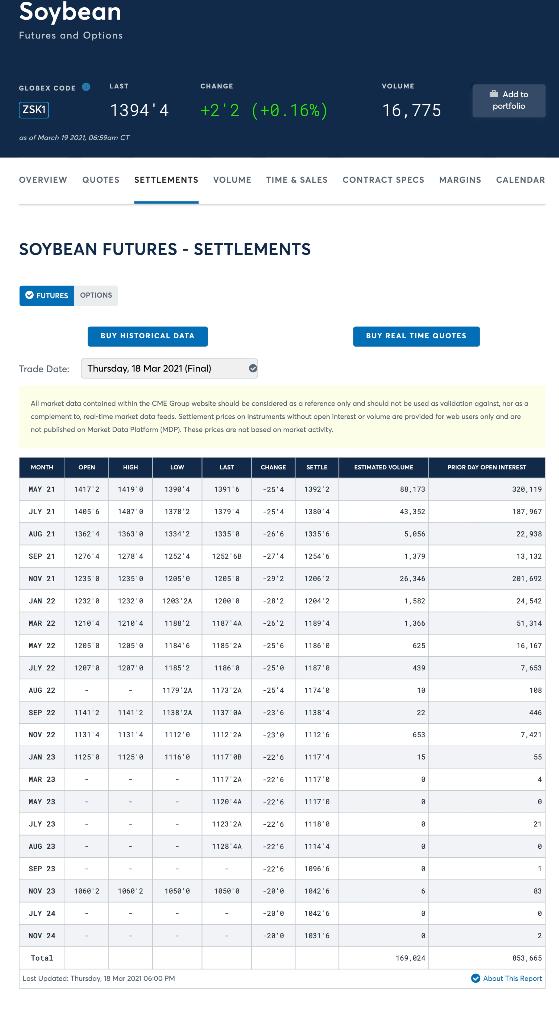

Question 8 (1 point) Saved Use the D2L file, "March 18th 2021 Futures Settlement Prices" for the next series of questions. Which is the more reasonable explanation for the difference between the May 21 and the May 22 Corn futures settle prices? traders expect the supply of corn will be higher in May 2022 than in May 2021 traders expect the supply of corn will be lower in May 2022 than in May 2021 Question 9 (1 point) Given the difference between the May 21 and the May 22 Soybeans futures settle prices, then for a farmer that owns some extra soybeans in a silo, it would make more sense to sell May 22 Soybean futures, if the storage cost is less than $2.06 per bushel per year sell May 21 Soybean futures orn Futures and Options GLOBEX CODE O O LAST CHANGE VOLUME 546'6 ZCK1 Add to portfolio +0'2 (+0.95%) 15,367 as of March 19 2021, 06:57am CT OVERVIEW QUOTES SETTLEMENTS VOLUME TIME & SALES CONTRACT SPECS MARGINS CALENDAR CORN FUTURES - SETTLEMENTS FUTURES OPTIONS BUY HISTORICAL DATA BUY REAL TIME QUOTES Trade Date: Thursday, 18 Mar 2021 (Final) All market date contained within the CME Group website should be considered as a reference only and should not be used as validation against nor as a complement to, real-time market data feeds Settlement prices on instruments without open interest or volume are provided for web users only and are not published on Market Dato Platform (MDP). These prices are not based on market activity. . MONTH OPEN HICH LOW LAST CHANGE SETTLE ESTIMATED VOLUME PRIOR DAY OPEN INTEREST MAY 21 5566 554'e 5452 546 4 -114 546 4 144, 699, 358 JLY 21 5418 5414 5292 536 4 -12'2 538 2 2 89, 894 412,976 SEP 21 495 2 485'6 4824 -106 485 2 18,186 196,631 DEC 21 4748 4764 4674 468 2 -74 168 G 39,341 366,777 MAR 22 463 4842 4754 475 6 -7'4 475 8,165 47,394 MAY 22 487 8 1886 4884 4896 -78 481 @ 2,650 9.266 JLY 22 488 48948 481'5 482'23 -64 4824 2, B16 24,218 SEP 22 4472 448' 68 442'6 443 20 -56 443 4 197 5,146 DEC 22 4342 435 4 431'9 432 6 -36 432 4 933 38,621 MAR 23 - 441' 4A 438' 6A -3' 439 6 1 1 665 MAY 23 - 443'9A -2'6 443 @ JLY 23 458 458 450 a 446'2A -3 446 6 1 485 SEP 23 - -38 426 2 9 92 DEC 23 4144 4144 413' 41348 UNCH 415 2 4 1.522 JLY 24 - UNCH 425 4 @ 4 DEC 24 UNCH 412 8 9 30 Tatal 295,741 1,745, 945 Last Update Thursday, 18 Mar 2021 06:00 PM About This Report Soybean Futures and Options GLODEX CODE LAST CHANGE VOLUME Add to portfolio ZSK1 1394'4 +2'2 (+0.16%) 16,775 as of March 192021. OS:Sam CT OVERVIEW QUOTES SETTLEMENTS VOLUME TIME & SALES CONTRACT SPECS MARGINS CALENDAR SOYBEAN FUTURES - SETTLEMENTS FUTURES OPTIONS BUY HISTORICAL DATA BUY REAL TIME QUOTES Trade Date: Thursday, 18 Mar 2021(Final) All market data contained within the CME Group website should be considered as o reference only and should not be used as vollection galnst, nor as a component to rea- te market data teeds. Settlement prices on instruments without opon interest or volume are provided for web users only and are not published on Market Data Plotion (MDP. These prices are not based on market activity MONTH OPEN HIGH LAST LOW CHANGE SETTLE ESTIMATED VOLUNE PRIOR DAY OPEN INTEREST MAY 21 1417 2 14190 73984 13910 -25 1392'2 89,973 329, 119 JLY 21 1485 6 14078 1278'2 1379 4 -754 13884 43,952 187,967 AUG 21 13621 13639 1931'2 13358 -25'6 13356 5,656 22,938 SEP 21 12264 12524 1252 12540 1,379 13, 132 NOV 21 1235 1235 1205'e 125 H -292 12052 25,345 281,602 JAN 22 1292 12326 120324 1269 -28'2 12642 1.582 24,542 MAR 22 12194 12104 11902 1107 44 -262 11694 1,360 57,314 MAY 22 125 H 1225 @ 1 1846 1185 2A -256 1186' 625 16, 167 JLY 22 1207 A 12879 1185'2 1186 a -256 11876 190 7,683 AUG 22 2A'9* 1123 2A -2514 11748 18 nes SEP 22 1141 2 71412 1132A 1137 a -23'6 11984 22 446 NOV 22 1131 4 71314 1 112'e 11122 -23'6 1112'6 653 7,421 JAN 23 1125 a 11259 1116'6 1117 a -22'0 1117'1 15 55 MAR 22 1117 2 -226 11178 9 3 4 MAY 23 1120 4A -226 1117' a a 6 JLY 23 - 1123 2A -22' 1118' a 21 AUG 23 - - 1128 4A -226 1114'4 3 SEP 23 -226 1806 a NOV 23 1860 2 1958 2 1653' 10500 18426 6 5 63 JLY 24 - -20e 1842' a NOV 94 2a's 18316 a 2 Total 169.624 053,665 Last Update: Thursday, 19 Mar 2021 0600 PM About This report