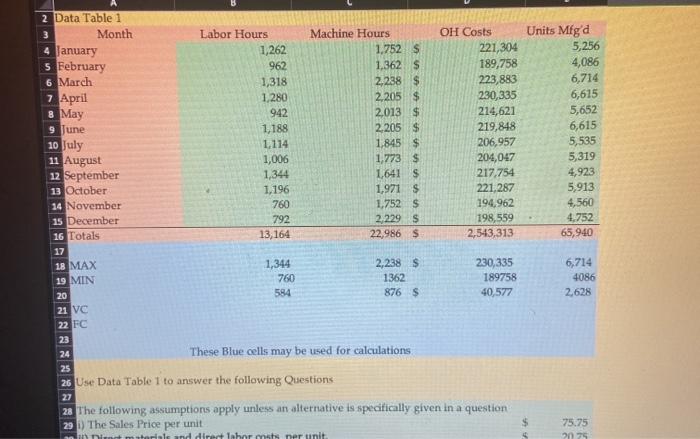

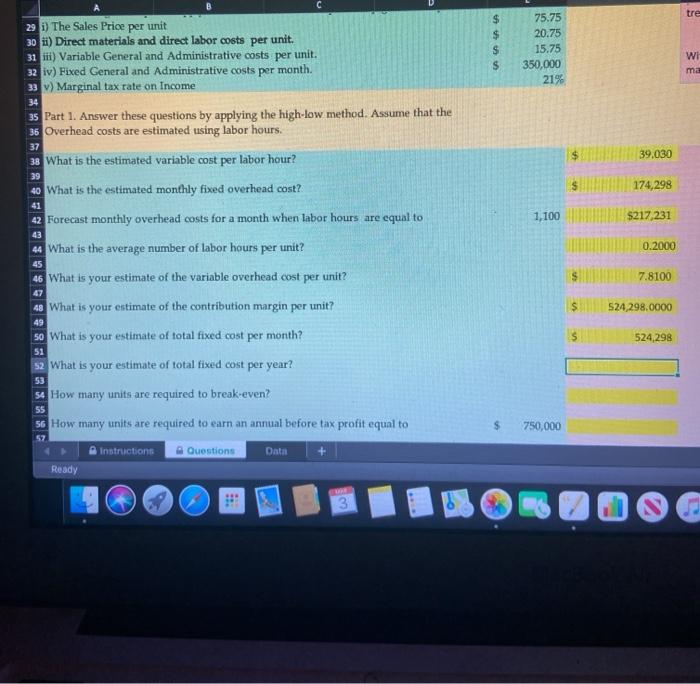

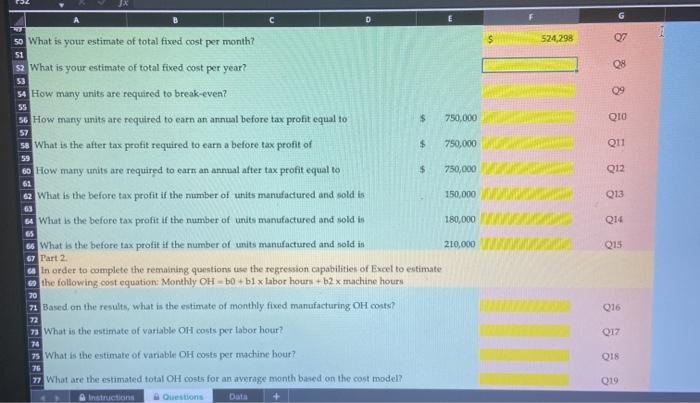

2 Data Table 1 3 Month 4 January 5 February 6 March 7 April 8 May 9 June 10 July 11 August 12 September 13 October 14 November 15 December 16 Totals 17 18 MAX 19 MIN 20 21 VC Labor Hours 1,262 962 1,318 1,280 942 1,188 1,114 1,006 1,344 1.196 760 792 13,164 Machine Hours 1,752 $ 1,362 $ 2.238 $ 2,205 $ 2013 $ 2,205 $ 1,845 $ 1,773 $ 1.641 S 1,971 $ 1,752 $ 2,229 $ 22,986 $ OH Costs 221,304 189,758 223,883 230,335 214,621 219,848 206,957 204,047 217,754 221,287 194,962 198,559 2,543,313 Units Mfgd 5,256 4,086 6,714 6,615 5,652 6,615 5,535 5,319 4,923 5,913 4,560 4,752 65,940 1,344 760 584 2,238 $ 1362 876 $ 230,335 189758 40,577 6,714 4086 2,628 22 FC 23 24 These Blue cells may be used for calculations 25 26 Use Data Table 1 to answer the following Questions 27 28 The following assumptions apply unless an alternative is specifically given in a question 29 The Sales Price per unit Timant materials and direct Inhorst ner unit 75.75 2075 tre $ * 75.75 20.75 15.75 350,000 21% $ WI ma 29 i) The Sales Price per unit 30 ii) Direct materials and direct labor costs per unit. 31 ) Variable General and Administrative costs per unit. 32 iv) Fixed General and Administrative costs per month. 33 ) Marginal tax rate on Income 34 35 Part 1. Answer these questions by applying the high-low method. Assume that the 35 Overhead costs are estimated using labor hours. 38 What is the estimated variable cost per labor hour? 39 40 What is the estimated monthly fixed overhead cost? 37 39.030 174,298 41 1,100 $217,231 43 42 Forecast monthly overhead costs for a month when labor hours are equal to 44 What is the average number of labor hours 46 What is your estimate of the variable overhead cost per unit? per unit? 0.2000 45 7.8100 47 524,298.0000 524,298 48 What is your estimate of the contribution margin per unit? 49 50 What is your estimate of total fixed cost per month? 51 52 What is your estimate of total fixed cost per year? 53 54 How many units are required to break-even? 56 How many units are required to earn an annual before tax profit equal to 55 $ 750,000 57 Instructions Questions Data Ready G D 524,298 07 51 08 53 09 55 $ Q10 57 011 59 $ Q12 61 Q13 63 50 What is your estimate of total fixed cost per month? S2 What is your estimate of total fixed cost per year? 54 How many units are required to break-even? 56 How many units are required to earn an annual before tax profit equal to 750,000 S8 What is the after tax profit required to earn a before tax profit of $ 750,000 60 How many units are required to earn an annual after tax profit equal to 750,000 62 What is the before tax profit if the number of units manufactured and sold is 150,000 What is the before tax profit if the number of units manufactured and sold in 180,000 es What is the before tax profit if the number of units manufactured and sold in - Part 2 In order to complete the remaining questions use the regression capabilities of Excel to estimate the following cost equation Monthly OHb b1 x labor hours + b2 x machine hours 71 Based on the results, what is the estimate of monthly fixed manufacturing OH conts? 7. What is the estimate of variable Oh costs per labor hour? What is the estimate of variable OH costs per machine hour? 76 77 What are the estimated total OH costs for an average month based on the cost model? A instructions Questions Data + Q14 210,000 Q15 70 016 72 017 76 Q18 019