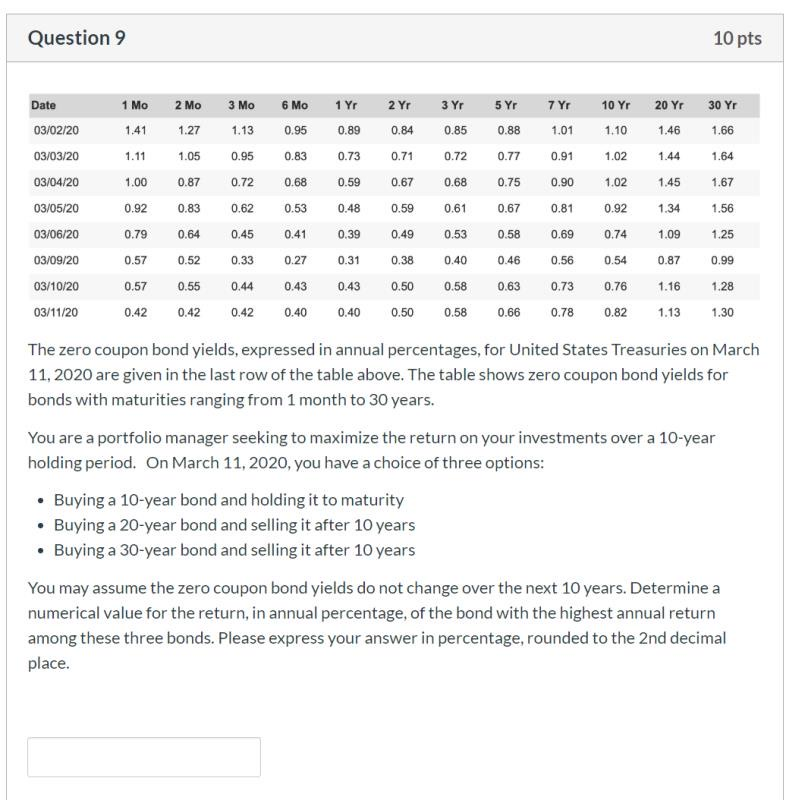

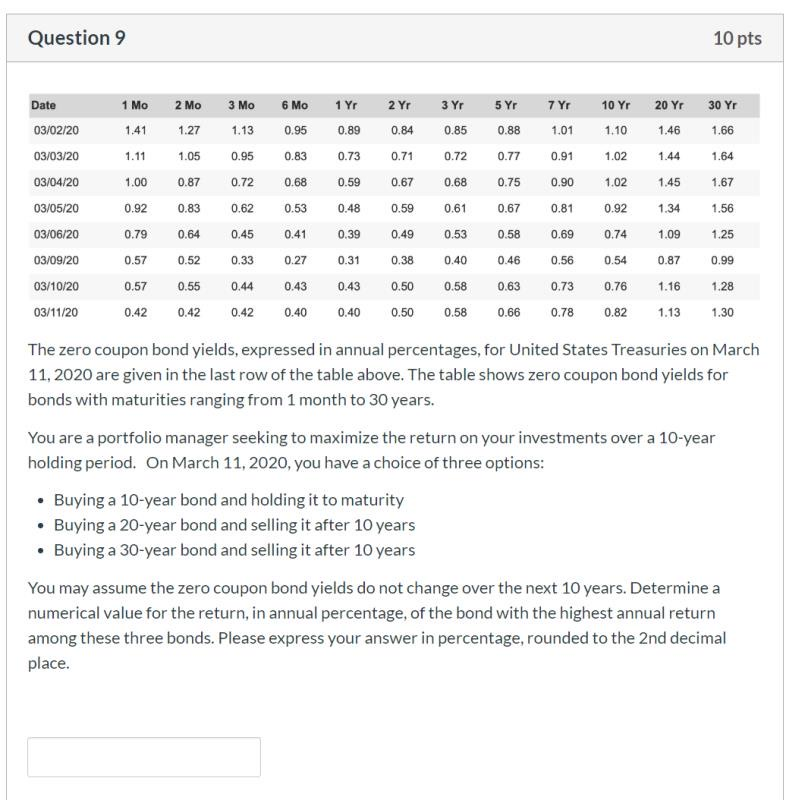

Question 9 10 pts Date 1 Mo 2 Mo 3 Mo 6 Mo 1 yr 2 Yr 3 Yr 5 Yr 7 Yr 10 Yr 20 Yr 30 Yr 03/02/ 20 1 03/03/20 1.10 1.02 1.02 03/04/20 03/05/20 .41 1.11 1.00 0.92 0.79 0.57 0.57 0.42 1.27 1.13 1.05 0.95 0.870.72 0.83 0.62 0.64 0.45 0.52 0.33 0.55 0.44 0.42 0.42 0.95 0.83 0.68 0.53 0.41 0.27 0.43 0.40 0.89 0.73 0.59 0.48 0.39 0.31 0.43 0.40 0.84 0.71 0.67 0.59 0.49 0.38 0.50 0.50 0.85 0.72 0.68 0.61 0.53 0.40 0.58 0.58 0.88 0.77 0.75 0.67 0.58 0.46 0.63 0.66 1.01 0.91 0.90 0.81 0.69 0.56 0.73 0.78 1.46 1.44 1.45 1.34 1.09 0.87 1.16 1.13 1.66 1.64 1.67 1.56 1.25 0.99 1.28 1.30 03/06/20 03/09/20 0.74 0.54 0.76 0.82 03/10/20 03/11/20 The zero coupon bond yields, expressed in annual percentages, for United States Treasuries on March 11, 2020 are given in the last row of the table above. The table shows zero coupon bond yields for bonds with maturities ranging from 1 month to 30 years. You are a portfolio manager seeking to maximize the return on your investments over a 10-year holding period. On March 11, 2020, you have a choice of three options: Buying a 10-year bond and holding it to maturity Buying a 20-year bond and selling it after 10 years Buying a 30-year bond and selling it after 10 years You may assume the zero coupon bond yields do not change over the next 10 years. Determine a numerical value for the return, in annual percentage of the bond with the highest annual return among these three bonds. Please express your answer in percentage, rounded to the 2nd decimal place. Question 18 1 pts Suppose you go long 10 Eurodollar futures contracts at a price of 97. When the futures contracts settle at expiration, 3-month LIBOR is 1.25%. Ignoring commissions and margin interest, your position results in a $50,000 loss. True False Question 19 1 pts The current U.S. dollar / Chinese yuan currency spot rate is $0.130 per yuan. The fair value price for the U.S. dollar / Chinese yuan exchange rate for a 2-year forward contract is $0.1408. If the U.S. dollar denominated annual interest rate is 6.0%, the Chinese yuan-denominated annual interest rate must be 3%. True False Question 9 10 pts Date 1 Mo 2 Mo 3 Mo 6 Mo 1 yr 2 Yr 3 Yr 5 Yr 7 Yr 10 Yr 20 Yr 30 Yr 03/02/ 20 1 03/03/20 1.10 1.02 1.02 03/04/20 03/05/20 .41 1.11 1.00 0.92 0.79 0.57 0.57 0.42 1.27 1.13 1.05 0.95 0.870.72 0.83 0.62 0.64 0.45 0.52 0.33 0.55 0.44 0.42 0.42 0.95 0.83 0.68 0.53 0.41 0.27 0.43 0.40 0.89 0.73 0.59 0.48 0.39 0.31 0.43 0.40 0.84 0.71 0.67 0.59 0.49 0.38 0.50 0.50 0.85 0.72 0.68 0.61 0.53 0.40 0.58 0.58 0.88 0.77 0.75 0.67 0.58 0.46 0.63 0.66 1.01 0.91 0.90 0.81 0.69 0.56 0.73 0.78 1.46 1.44 1.45 1.34 1.09 0.87 1.16 1.13 1.66 1.64 1.67 1.56 1.25 0.99 1.28 1.30 03/06/20 03/09/20 0.74 0.54 0.76 0.82 03/10/20 03/11/20 The zero coupon bond yields, expressed in annual percentages, for United States Treasuries on March 11, 2020 are given in the last row of the table above. The table shows zero coupon bond yields for bonds with maturities ranging from 1 month to 30 years. You are a portfolio manager seeking to maximize the return on your investments over a 10-year holding period. On March 11, 2020, you have a choice of three options: Buying a 10-year bond and holding it to maturity Buying a 20-year bond and selling it after 10 years Buying a 30-year bond and selling it after 10 years You may assume the zero coupon bond yields do not change over the next 10 years. Determine a numerical value for the return, in annual percentage of the bond with the highest annual return among these three bonds. Please express your answer in percentage, rounded to the 2nd decimal place. Question 18 1 pts Suppose you go long 10 Eurodollar futures contracts at a price of 97. When the futures contracts settle at expiration, 3-month LIBOR is 1.25%. Ignoring commissions and margin interest, your position results in a $50,000 loss. True False Question 19 1 pts The current U.S. dollar / Chinese yuan currency spot rate is $0.130 per yuan. The fair value price for the U.S. dollar / Chinese yuan exchange rate for a 2-year forward contract is $0.1408. If the U.S. dollar denominated annual interest rate is 6.0%, the Chinese yuan-denominated annual interest rate must be 3%. True False