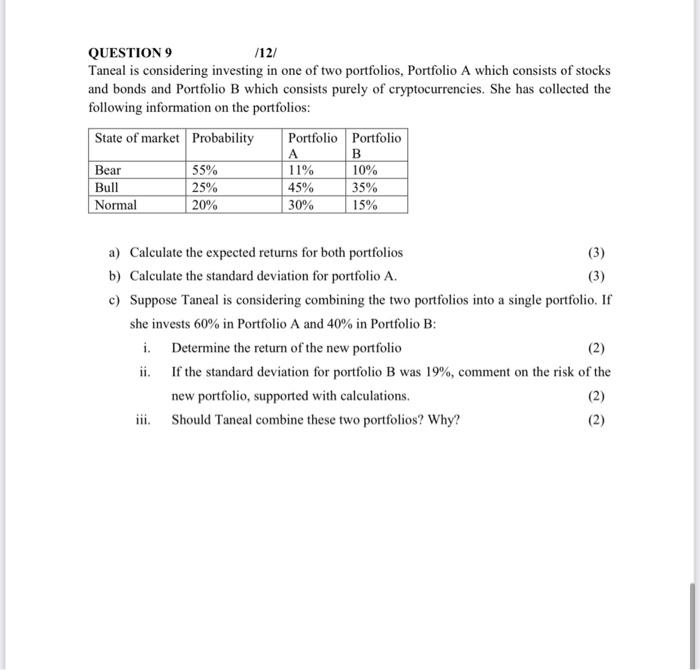

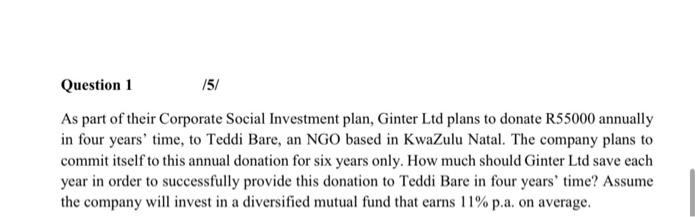

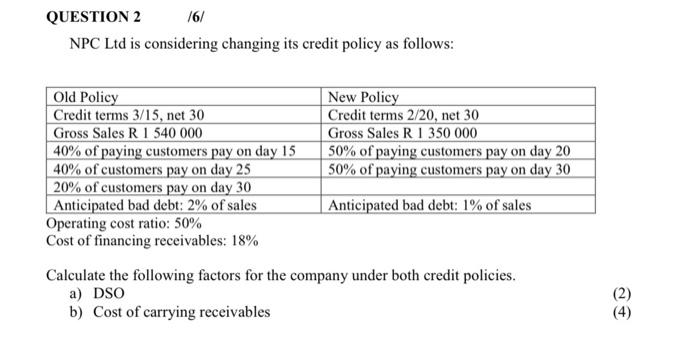

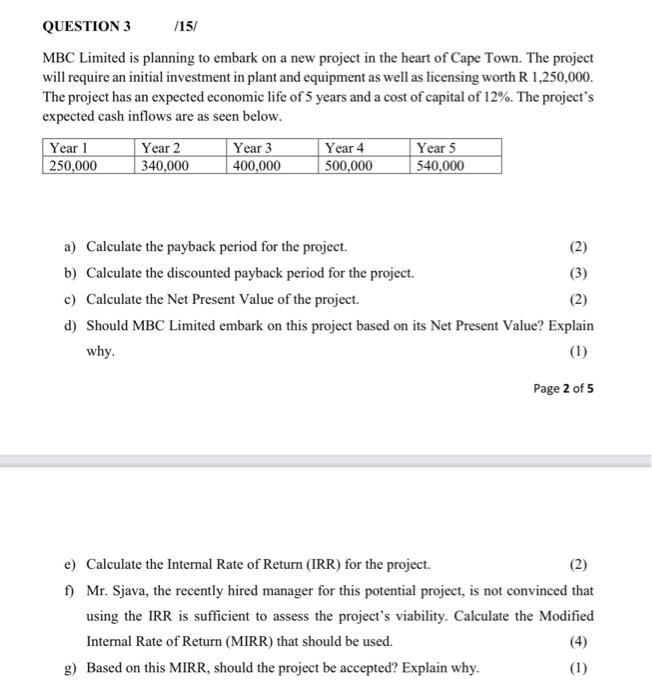

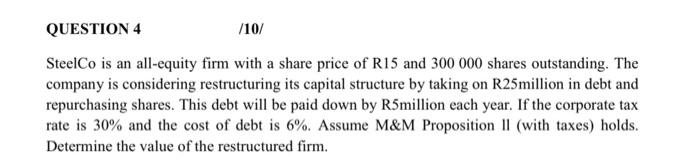

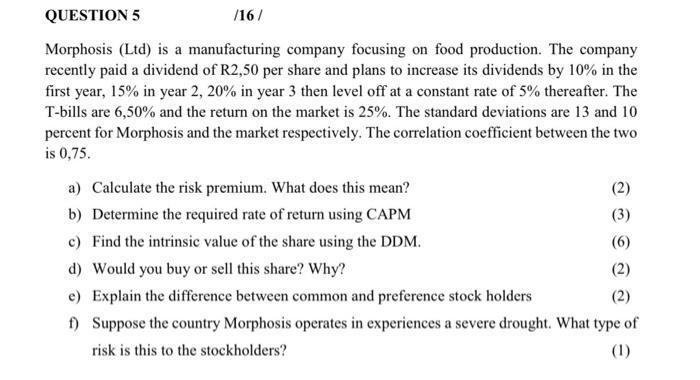

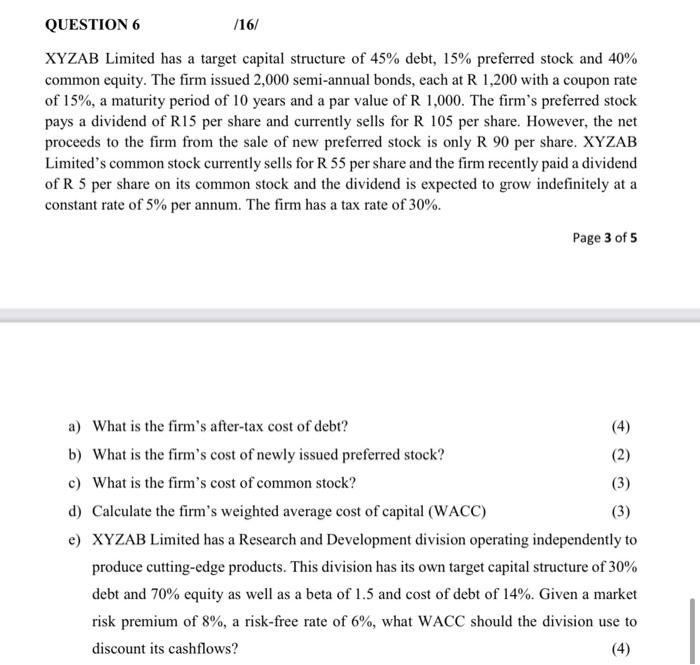

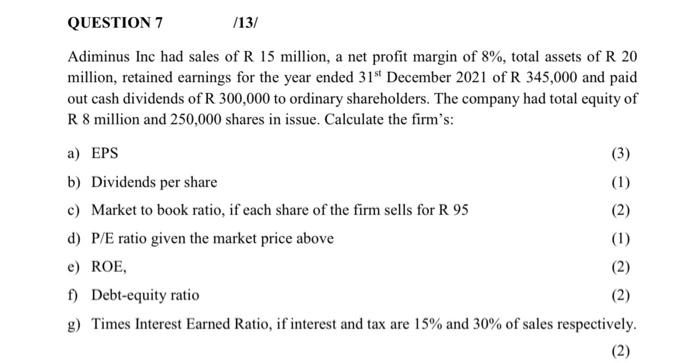

QUESTION 9 /12/ Taneal is considering investing in one of two portfolios, Portfolio A which consists of stocks and bonds and Portfolio B which consists purely of cryptocurrencies. She has collected the following information on the portfolios: a) Calculate the expected returns for both portfolios b) Calculate the standard deviation for portfolio A. c) Suppose Taneal is considering combining the two portfolios into a single portfolio. If she invests 60% in Portfolio A and 40% in Portfolio B: i. Determine the return of the new portfolio ii. If the standard deviation for portfolio B was 19%, comment on the risk of the new portfolio, supported with calculations. iii. Should Taneal combine these two portfolios? Why? As part of their Corporate Social Investment plan, Ginter Ltd plans to donate R55000 annually in four years' time, to Teddi Bare, an NGO based in KwaZulu Natal. The company plans to commit itself to this annual donation for six years only. How much should Ginter Ltd save each year in order to successfully provide this donation to Teddi Bare in four years' time? Assume the company will invest in a diversified mutual fund that earns 11% p.a. on average. NPC Ltd is considering changing its credit policy as follows: Cost of financing receivables: 18% Calculate the following factors for the company under both credit policies. a) DSO b) Cost of carrying receivables MBC Limited is planning to embark on a new project in the heart of Cape Town. The project will require an initial investment in plant and equipment as well as licensing worth R1,250,000. The project has an expected economic life of 5 years and a cost of capital of 12%. The project's expected cash inflows are as seen below. a) Calculate the payback period for the project. b) Calculate the discounted payback period for the project. c) Calculate the Net Present Value of the project. d) Should MBC Limited embark on this project based on its Net Present Value? Explain why. Page 2 of 5 e) Calculate the Internal Rate of Return (IRR) for the project. f) Mr. Sjava, the recently hired manager for this potential project, is not convinced that using the IRR is sufficient to assess the project's viability. Calculate the Modified Internal Rate of Return (MIRR) that should be used. g) Based on this MIRR, should the project be accepted? Explain why. SteelCo is an all-equity firm with a share price of R15 and 300000 shares outstanding. The company is considering restructuring its capital structure by taking on R25million in debt and repurchasing shares. This debt will be paid down by R5 million each year. If the corporate tax rate is 30% and the cost of debt is 6\%. Assume M\&M Proposition II (with taxes) holds. Determine the value of the restructured firm. Morphosis (Ltd) is a manufacturing company focusing on food production. The company recently paid a dividend of R2,50 per share and plans to increase its dividends by 10% in the first year, 15% in year 2, 20% in year 3 then level off at a constant rate of 5% thereafter. The T-bills are 6,50% and the return on the market is 25%. The standard deviations are 13 and 10 percent for Morphosis and the market respectively. The correlation coefficient between the two is 0,75 . a) Calculate the risk premium. What does this mean? b) Determine the required rate of return using CAPM c) Find the intrinsic value of the share using the DDM. d) Would you buy or sell this share? Why? e) Explain the difference between common and preference stock holders f) Suppose the country Morphosis operates in experiences a severe drought. What type of risk is this to the stockholders? XYZAB Limited has a target capital structure of 45% debt, 15% preferred stock and 40% common equity. The firm issued 2,000 semi-annual bonds, each at R1,200 with a coupon rate of 15%, a maturity period of 10 years and a par value of R1,000. The firm's preferred stock pays a dividend of R 15 per share and currently sells for R105 per share. However, the net proceeds to the firm from the sale of new preferred stock is only R90 per share. XYZAB Limited's common stock currently sells for R55 per share and the firm recently paid a dividend of R 5 per share on its common stock and the dividend is expected to grow indefinitely at a constant rate of 5% per annum. The firm has a tax rate of 30%. Page 3 of 5 a) What is the firm's after-tax cost of debt? b) What is the firm's cost of newly issued preferred stock? c) What is the firm's cost of common stock? d) Calculate the firm's weighted average cost of capital (WACC) e) XYZAB Limited has a Research and Development division operating independently to produce cutting-edge products. This division has its own target capital structure of 30% debt and 70% equity as well as a beta of 1.5 and cost of debt of 14%. Given a market risk premium of 8%, a risk-free rate of 6%, what WACC should the division use to discount its cashflows? Adiminus Inc had sales of R 15 million, a net profit margin of 8%, total assets of R 20 million, retained earnings for the year ended 31st December 2021 of R 345,000 and paid out cash dividends of R300,000 to ordinary shareholders. The company had total equity of R 8 million and 250,000 shares in issue. Calculate the firm's: a) EPS b) Dividends per share c) Market to book ratio, if each share of the firm sells for R 95 d) P/E ratio given the market price above e) ROE, f) Debt-equity ratio g) Times Interest Earned Ratio, if interest and tax are 15\% and 30\% of sales respectively. A 20-year, 15\% semi-annual coupon bond with a R1,000 par value bond is selling for R1,245 with a 10% yield to maturity. It can be called after five years at R1,020. a) Calculate the Yield to Call. b) Explain what hat is a callable bond is and why a company would issue one. c) Explain how a bond issuer benefits from a callable bond and how a bondholder may lose in this type of contract XYZAB Limited has a target capital structure of 45% debt, 15% preferred stock and 40% common equity. The firm issued 2,000 semi-annual bonds, each at R1,200 with a coupon rate of 15%, a maturity period of 10 years and a par value of R1,000. The firm's preferred stock pays a dividend of R 15 per share and currently sells for R105 per share. However, the net proceeds to the firm from the sale of new preferred stock is only R90 per share. XYZAB Limited's common stock currently sells for R55 per share and the firm recently paid a dividend of R 5 per share on its common stock and the dividend is expected to grow indefinitely at a constant rate of 5% per annum. The firm has a tax rate of 30%. Page 3 of 5 a) What is the firm's after-tax cost of debt? b) What is the firm's cost of newly issued preferred stock? c) What is the firm's cost of common stock? d) Calculate the firm's weighted average cost of capital (WACC) e) XYZAB Limited has a Research and Development division operating independently to produce cutting-edge products. This division has its own target capital structure of 30% debt and 70% equity as well as a beta of 1.5 and cost of debt of 14%. Given a market risk premium of 8%, a risk-free rate of 6%, what WACC should the division use to discount its cashflows? A 20-year, 15\% semi-annual coupon bond with a R1,000 par value bond is selling for R1,245 with a 10% yield to maturity. It can be called after five years at R1,020. a) Calculate the Yield to Call. b) Explain what hat is a callable bond is and why a company would issue one. c) Explain how a bond issuer benefits from a callable bond and how a bondholder may lose in this type of contract Adiminus Inc had sales of R 15 million, a net profit margin of 8%, total assets of R 20 million, retained earnings for the year ended 31st December 2021 of R 345,000 and paid out cash dividends of R300,000 to ordinary shareholders. The company had total equity of R 8 million and 250,000 shares in issue. Calculate the firm's: a) EPS b) Dividends per share c) Market to book ratio, if each share of the firm sells for R 95 d) P/E ratio given the market price above e) ROE, f) Debt-equity ratio g) Times Interest Earned Ratio, if interest and tax are 15\% and 30\% of sales respectively