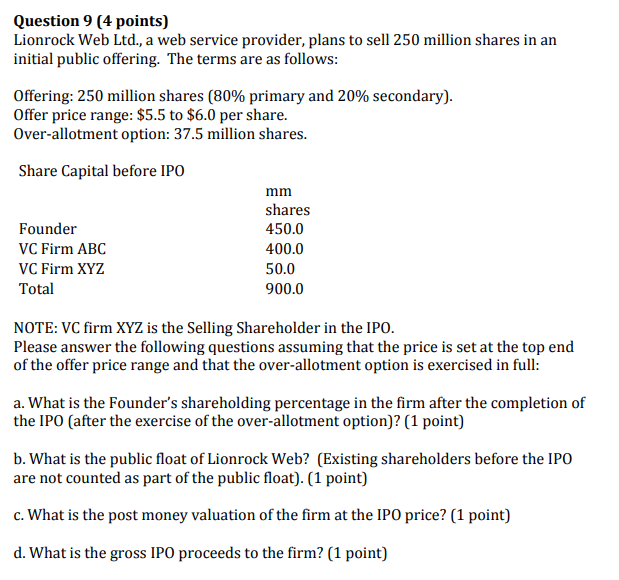

Question 9 (4 points) Lionrock Web Ltd., a web service provider, plans to sell 250 million shares in an initial public offering. The terms are as follows: Offering: 250 million shares (80% primary and 20% secondary). Offer price range: $5.5 to $6.0 per share. Over-allotment option: 37.5 million shares. Share Capital before IPO Founder VC Firm ABC VC Firm XYZ Total mm shares 450.0 400.0 50.0 900.0 NOTE: VC firm XYZ is the Selling Shareholder in the IPO. Please answer the following questions assuming that the price is set at the top end of the offer price range and that the over-allotment option is exercised in full: a. What is the Founder's shareholding percentage in the firm after the completion of the IPO (after the exercise of the over-allotment option)? (1 point) b. What is the public float of Lionrock Web? (Existing shareholders before the IPO are not counted as part of the public float). (1 point) c. What is the post money valuation of the firm at the IPO price? (1 point) d. What is the gross IPO proceeds to the firm? (1 point) Question 9 (4 points) Lionrock Web Ltd., a web service provider, plans to sell 250 million shares in an initial public offering. The terms are as follows: Offering: 250 million shares (80% primary and 20% secondary). Offer price range: $5.5 to $6.0 per share. Over-allotment option: 37.5 million shares. Share Capital before IPO Founder VC Firm ABC VC Firm XYZ Total mm shares 450.0 400.0 50.0 900.0 NOTE: VC firm XYZ is the Selling Shareholder in the IPO. Please answer the following questions assuming that the price is set at the top end of the offer price range and that the over-allotment option is exercised in full: a. What is the Founder's shareholding percentage in the firm after the completion of the IPO (after the exercise of the over-allotment option)? (1 point) b. What is the public float of Lionrock Web? (Existing shareholders before the IPO are not counted as part of the public float). (1 point) c. What is the post money valuation of the firm at the IPO price? (1 point) d. What is the gross IPO proceeds to the firm? (1 point)