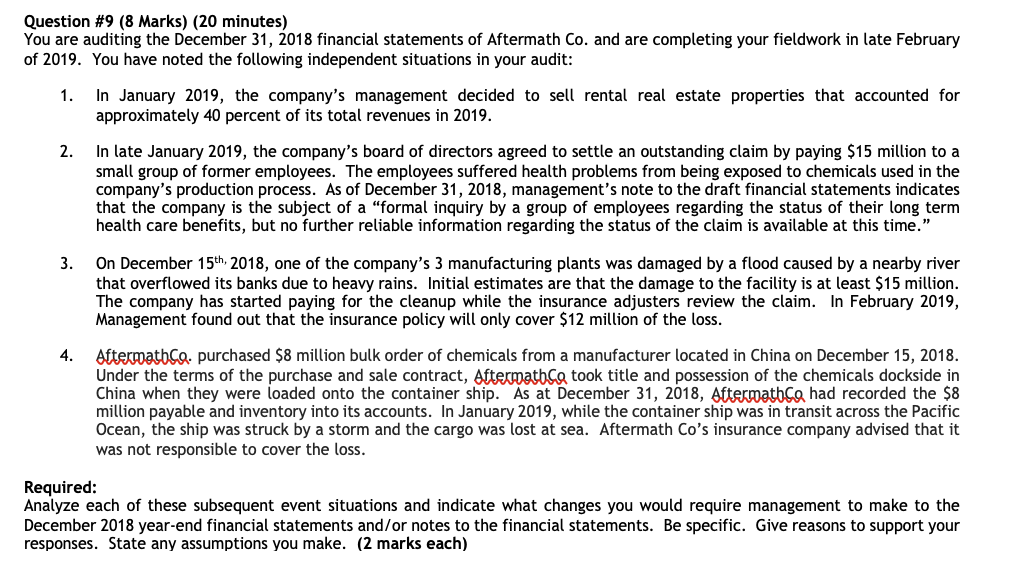

Question #9 [8 Marks) (20 minutes) You are auditing the December 31, 2018 financial statements of Aftermath Co. and are completing your eldwork in late February of 2019. You have noted the following independent situations in your audit: 1. In January 2019, the company's management decided to sell rental real estate properties that accounted for approximately 40 percent of its total revenues in 2019. In late January 2019, the company's board of directors agreed to settle an outstanding claim by paying $15 million to a small group of former employees. The employees suffered health problems from being exposed to chemicals used in the company's production process. As of December 31, 2018, management's note to the draft financial statements indicates that the company is the subject of a "formal inquiry by a group of employees regarding the status of their long term health care benefits, but no further reliable information regarding the status of the claim is available at this time." On December 15"\" 2018, one of the company's 3 manufacturing plants was damaged by a ood caused by a nearby river that overowed its banks due to heavy rains. Initial estimates are that the damage to the facility is at least $15 million. The company has started paying for the cleanup while the insurance adjusters review the claim. In February 2019, Management found out that the insurance policy will only cover $12 million of the loss. 3mm purchased 58 million bulk order of chemicals from a manufacturer located in China on December 15, 2018. Under the terms of the purchase and sale contract, Mammals title and possession of the chemicals dockside in China when they were loaded onto the container ship. As at December 31, 2018, mm recorded the $8 million payable and inventory into its accounts. In January 2019, while the container ship was in transit across the Pacific Ocean, the ship was struck by a storm and the cargo was lost at sea. Aftermath Co's insurance company advised that it was not responsible to cover the loss. Required: Analyze each of these subsequent event situations and indicate what changes you would require management to make to the December 2018 year-end financial statements andr'or notes to the financial statements. Be specific. Give reasons to support your responses. State any assumptions you make. [2 marks each)