Answered step by step

Verified Expert Solution

Question

1 Approved Answer

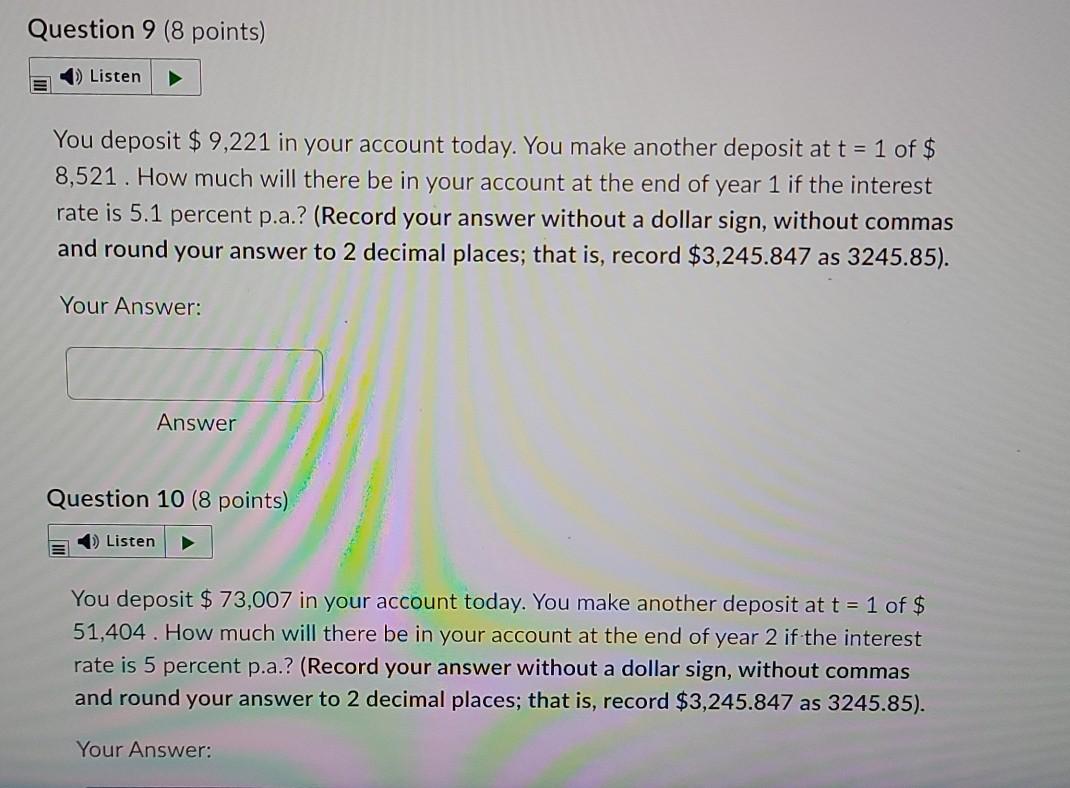

Question 9 (8 points) Listen You deposit $ 9,221 in your account today. You make another deposit at t = 1 of $ 8,521. How

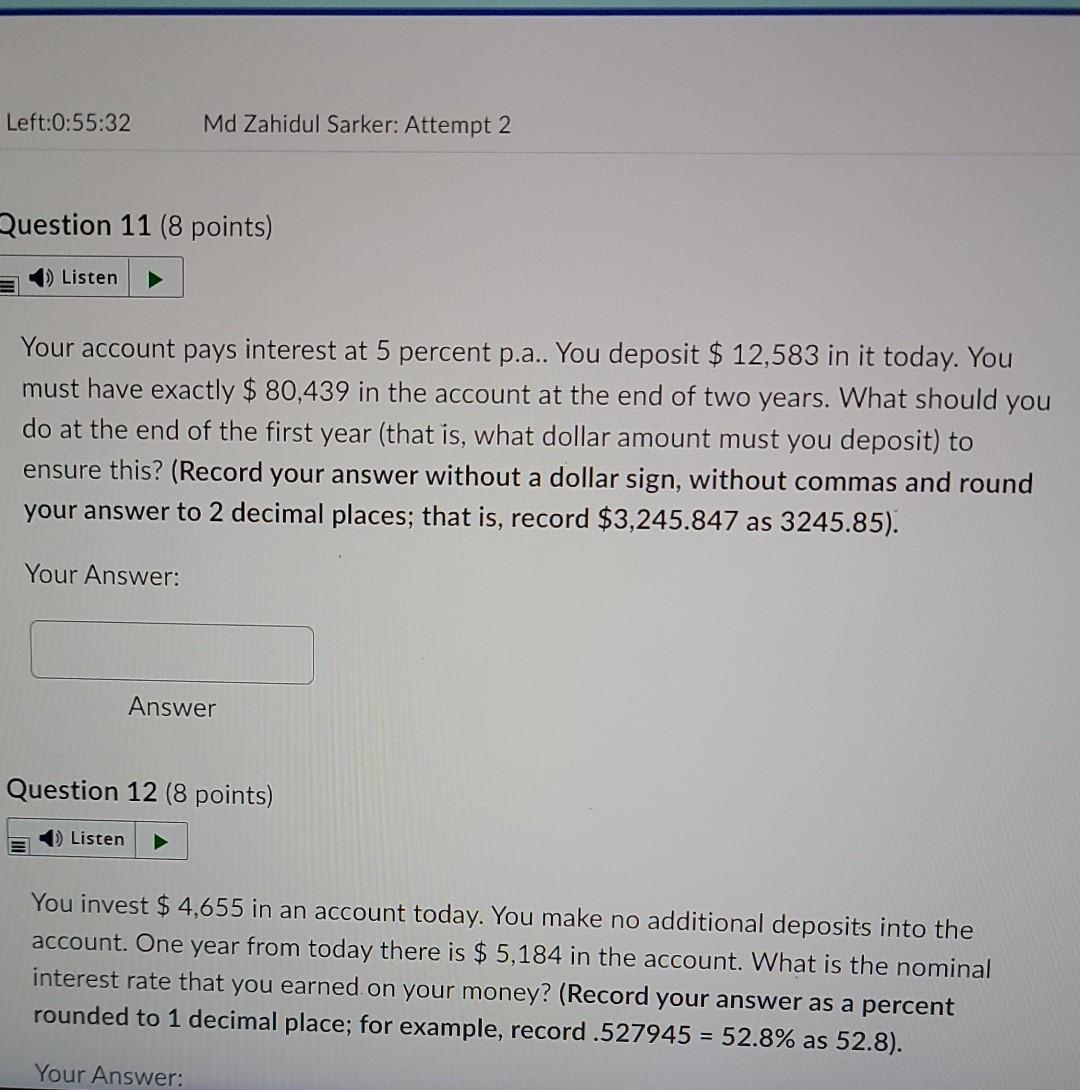

Question 9 (8 points) Listen You deposit $ 9,221 in your account today. You make another deposit at t = 1 of $ 8,521. How much will there be in your account at the end of year 1 if the interest rate is 5.1 percent p.a.? (Record your answer without a dollar sign, without commas and round your answer to 2 decimal places; that is, record $3,245.847 as 3245.85). Your Answer: Answer Question 10 (8 points) ) Listen You deposit $ 73,007 in your account today. You make another deposit at t = 1 of $ 51,404. How much will there be in your account at the end of year 2 if the interest rate is 5 percent p.a.? (Record your answer without a dollar sign, without commas and round your answer to 2 decimal places; that is, record $3,245.847 as 3245.85). Your Answer: Left:0:55:32 Md Zahidul Sarker: Attempt 2 Question 11 (8 points) Listen Your account pays interest at 5 percent p.a.. You deposit $ 12,583 in it today. You must have exactly $ 80,439 in the account at the end of two years. What should you do at the end of the first year (that is, what dollar amount must you deposit) to ensure this? (Record your answer without a dollar sign, without commas and round your answer to 2 decimal places; that is, record $3,245.847 as 3245.85). Your Answer: Answer Question 12 (8 points) Listen You invest $ 4,655 in an account today. You make no additional deposits into the account. One year from today there is $ 5,184 in the account. What is the nominal interest rate that you earned on your money? (Record your answer as a percent rounded to 1 decimal place; for example, record.527945 = 52.8% as 52.8). Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started