Answered step by step

Verified Expert Solution

Question

1 Approved Answer

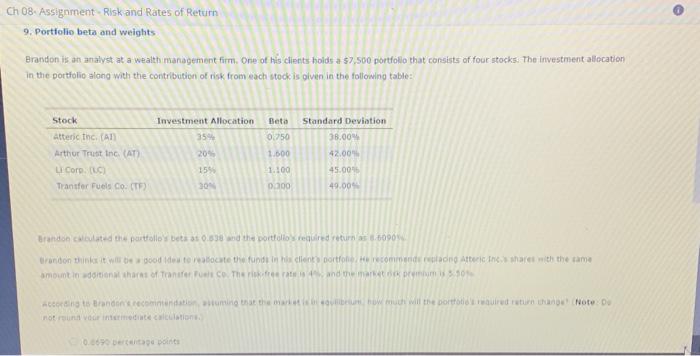

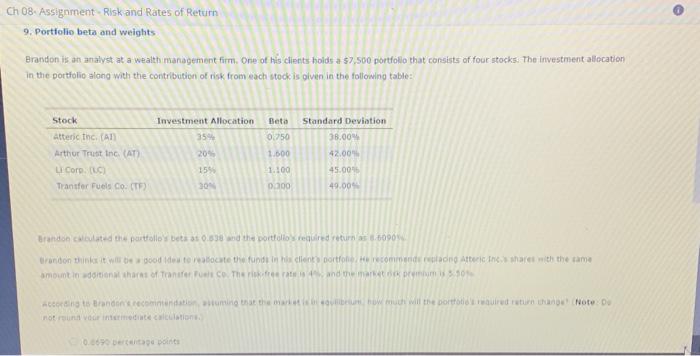

Question 9: 88. Assigniment-Riskand Rates of Return 9. Portfolio beta and weights Erandon is an anailyst at a wealth management firm, One of his clients

Question 9:

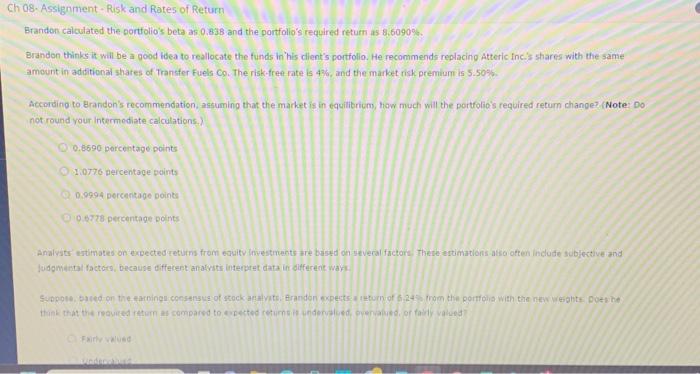

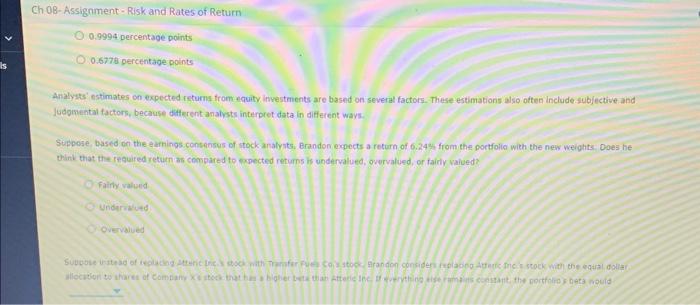

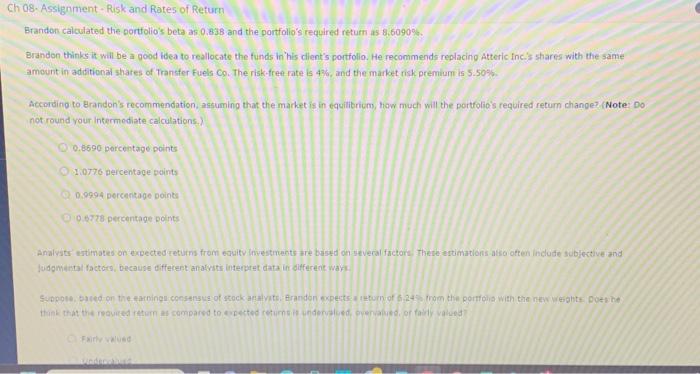

88. Assigniment-Riskand Rates of Return 9. Portfolio beta and weights Erandon is an anailyst at a wealth management firm, One of his clients hoids a 57,500 portfollo that consists of four stocks: The investrient allecation in the portfolio along with the contribution of risk from each stock is oiven in the followino table: not rouns vour interinediate calculations. 0.0670 bersentape point: Ch 0B-Assignment - Risk and Rates of Return 0.9994 percentage points 0.6776 percentage points Analysts' estimates on expected rsturns from-equity investments are based on several factors. These estimations also often include subjective and Judomental factors, because difterent analysts interpret data in diffecent wavs. Suppose, based on the earnings consensus of atock analysts, Brandon expects a return of 6.24% from the portfolie with the new weights, Does he Wink that the required return an compared to expected returns is undervalued, overvalued, or fairly valued? Fairby valued Overvilued Brandon calculated the portfolio's beta as 0.838 and the portfolio's required return as 8,6090%. Erandon thinls it wail be a pood hiea to reallocate the funds in his client's portfolio. He recommends replacing Atteric inc's shares with the same amount in additional shares of Transfer Fuels Co. The risk-freet rate is 4%, and the market risk premiam is 5.50%5. According to Brandon's recommendation, astuming that the market is in equilibricm, how much will the portfolio's required return change? (Note: Do not round your intermediate calculations.) 0.8690 percentage points Ioj76 percentage points 05994 percentage points Analysts estimates on expected returns from equitv investments are bastd on several factors. These ectimations atso often include sublective and fudgmantal factcos, becausise diffecent an afvits interptet data in differenc wark. Frifleveused

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started