Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 9 The draft statements of financial position of Atia Ltd and that of Santana Ltd as at 30 June 2019 are as follows:

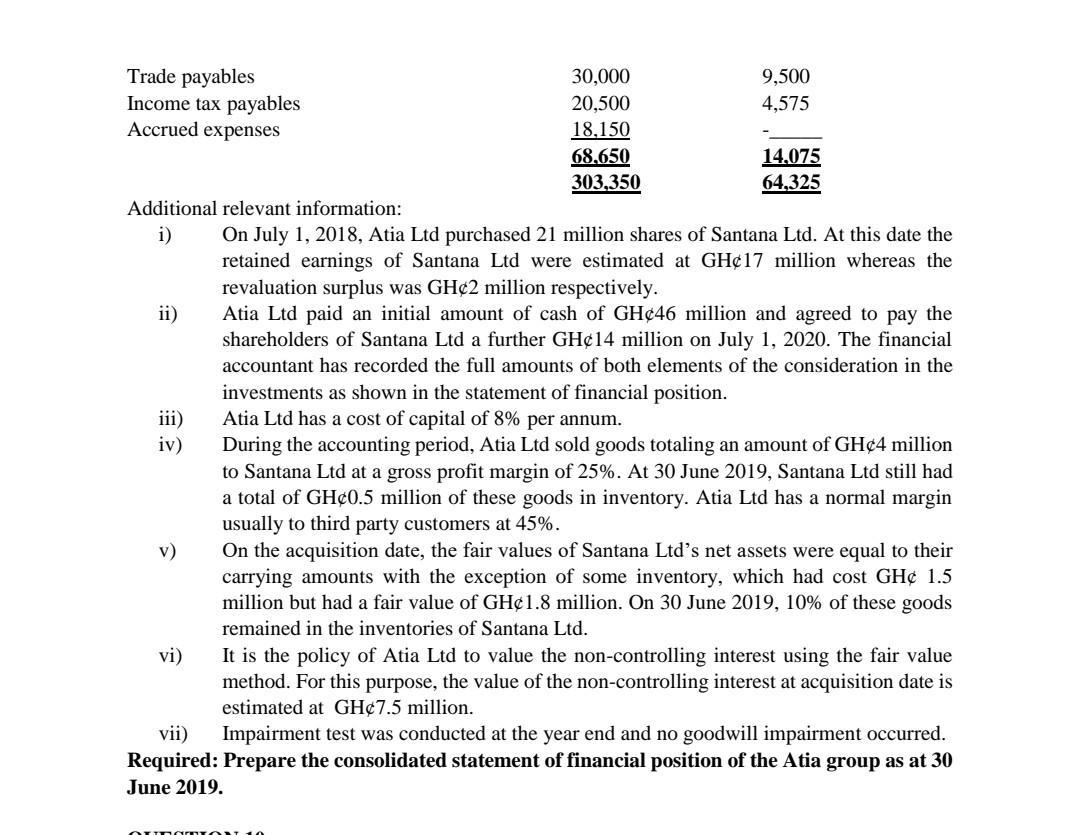

QUESTION 9 The draft statements of financial position of Atia Ltd and that of Santana Ltd as at 30 June 2019 are as follows: Assets Non-current assets Property, plant and equipment Investments Current assets: Inventories Trade receivable Cash and bank balance Total assets Equity and liabilities Ordinary share capital (issued at GHC1 each) Retained earnings Revaluation surplus Non-current liabilities: Deferred consideration Current liabilities: Atia Ltd GH'000 196,000 60,000 256.000 20,000 19,000 8,350 47,350 303,350 95,000 105,000 20,700 220,700 14,000 Santana Ltd GH'000 42,000 42,000 10,000 8,500 3,825 22,325 64,325 30,000 18,250 2,000 50,250 10/17 Trade payables Income tax payables Accrued expenses Additional relevant information: i) ii) iii) iv) v) vi) 30,000 20,500 18,150 68,650 303,350 9,500 4,575 oungDION 10 14.075 64,325 On July 1, 2018, Atia Ltd purchased 21 million shares of Santana Ltd. At this date the retained earnings of Santana Ltd were estimated at GH17 million whereas the revaluation surplus was GH2 million respectively. Atia Ltd paid an initial amount of cash of GH46 million and agreed to pay the shareholders of Santana Ltd a further GH14 million on July 1, 2020. The financial accountant has recorded the full amounts of both elements of the consideration in the investments as shown in the statement of financial position. Atia Ltd has a cost of capital of 8% per annum. During the accounting period, Atia Ltd sold goods totaling an amount of GH4 million to Santana Ltd at a gross profit margin of 25%. At 30 June 2019, Santana Ltd still had a total of GH0.5 million of these goods in inventory. Atia Ltd has a normal margin usually to third party customers at 45%. On the acquisition date, the fair values of Santana Ltd's net assets were equal to their carrying amounts with the exception of some inventory, which had cost GH 1.5 million but had a fair value of GH1.8 million. On 30 June 2019, 10% of these goods remained in the inventories of Santana Ltd. It is the policy of Atia Ltd to value the non-controlling interest using the fair value method. For this purpose, the value of the non-controlling interest at acquisition date is estimated at GH7.5 million. vii) Impairment test was conducted at the year end and no goodwill impairment occurred. Required: Prepare the consolidated statement of financial position of the Atia group as at 30 June 2019.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Atia group Consolidated Statement of Financial Position as at 30 June 2019 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started