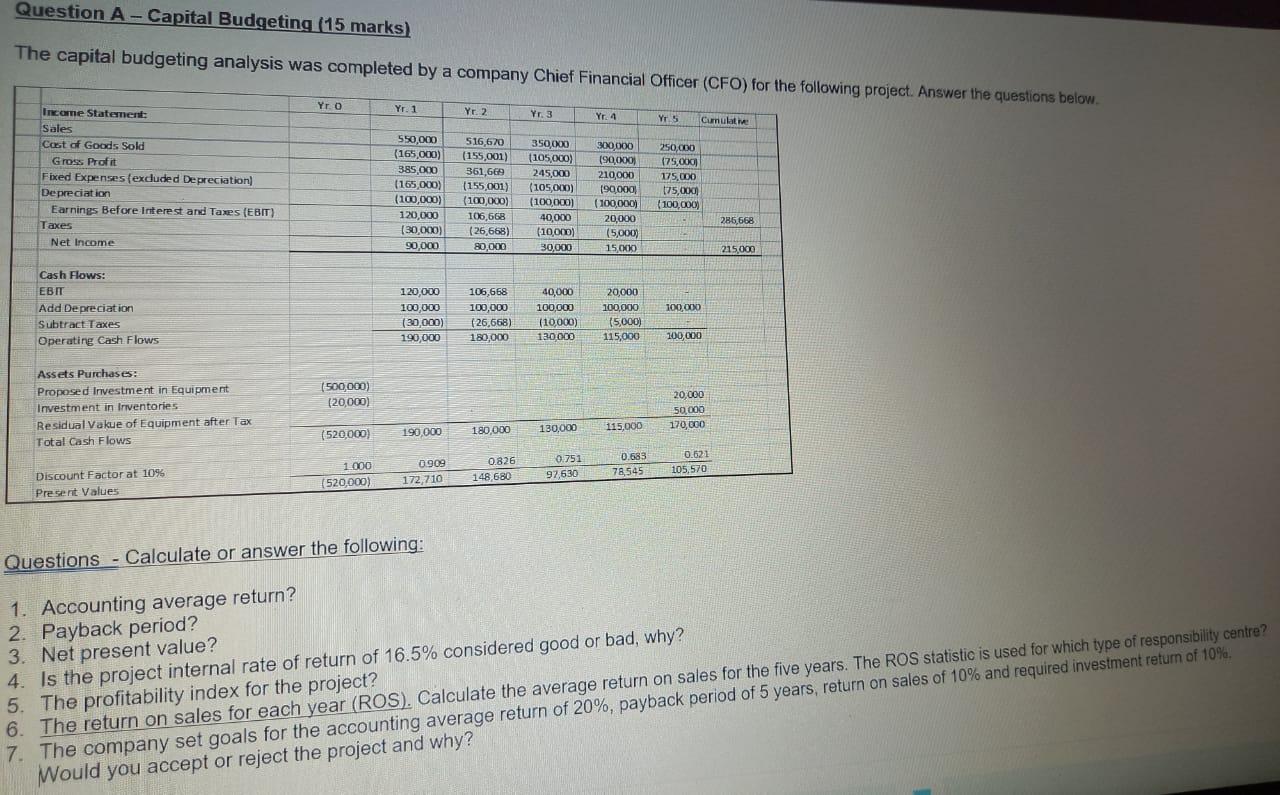

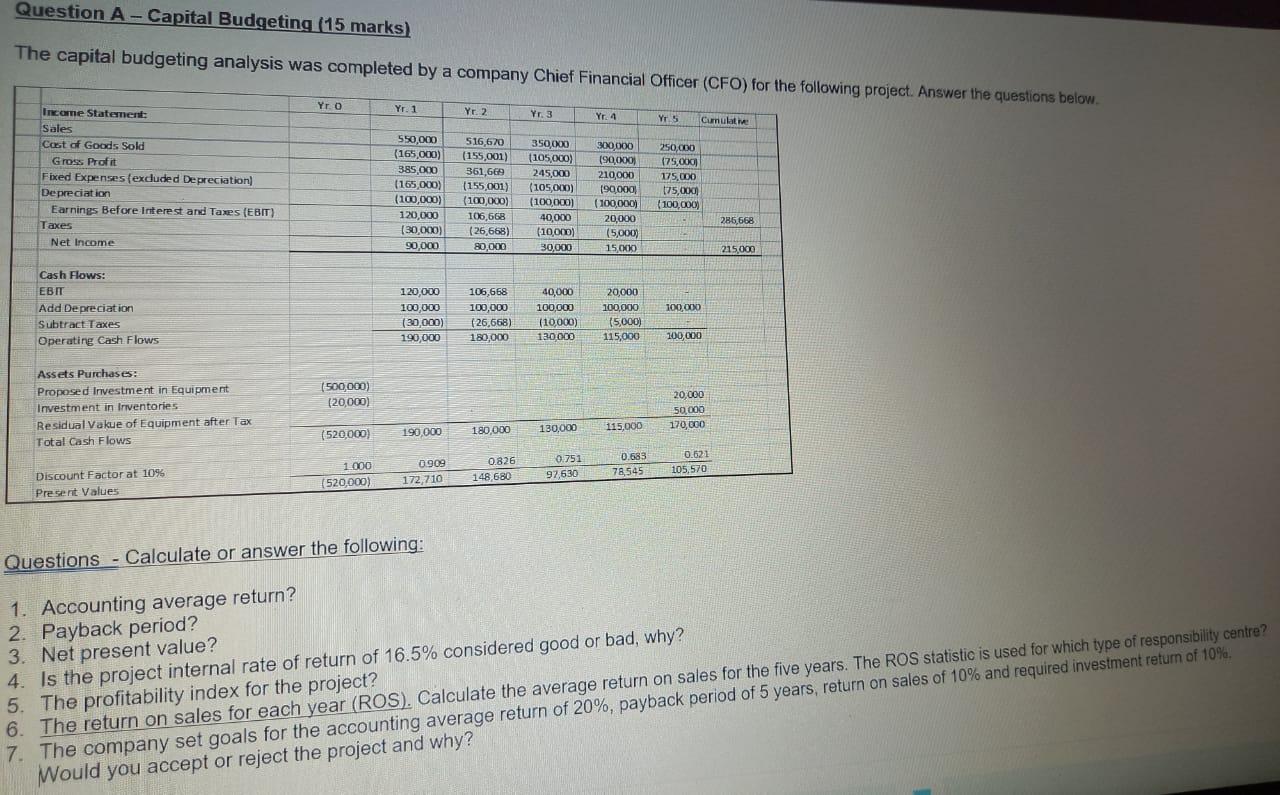

Question A - Capital Budgeting (15 marks) The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. Yr. O Yr. 1 Yr. 2 Yr. 3 Yr.4 Yr 5 Cumulatie Income Statement: Sales Cort of Goods Sold Gross Profit Fixed Expenses (exduded Depreciation) Depreciation Earnings Before Interest and Taxes (EBIT) Taxes Net Income 550,000 (165,000) 385.000 (165,000) (100,000) 120,000 (30,000) 90,000 516,670 (155,001) 361,669 (155,001) (100,000) 106,668 (26,668) 80,000 350,000 (105,000) 245,000 (105.000) (100,000) 40,000 (10,000) 30,000 300,000 (90,000) 210,000 190.000 (100,000) 20,000 (5,000) 15.000 250.000 175,000 175.000 175.000 (100.000 285,668 215.000 Cash Flows: EBIT Add Depreciation Subtract Taxes Operating Cash Flows 100.000 120,000 100,000 (30,000) 190,000 106,668 100,000 (26,668) 180,000 40,000 100,000 (10,000) 130.000 20,000 100.000 (5000) 115,000 100,000 Assets Purchases: Proposed Investment in Equipment Investment in Inventories Residual Vakue of Equipment after Tax Total Cash Flows (500,000) (20,000) 20,000 50,000 170,000 (520.000) 180,000 115,000 190,000 130,000 1000 (520.000) 0.826 148,680 0909 172,710 0.751 97,630 0.683 78,545 Discount Factor at 1095 Present Values 0.521 105,570 Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS). Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20%, payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why? Question A - Capital Budgeting (15 marks) The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. Yr. O Yr. 1 Yr. 2 Yr. 3 Yr.4 Yr 5 Cumulatie Income Statement: Sales Cort of Goods Sold Gross Profit Fixed Expenses (exduded Depreciation) Depreciation Earnings Before Interest and Taxes (EBIT) Taxes Net Income 550,000 (165,000) 385.000 (165,000) (100,000) 120,000 (30,000) 90,000 516,670 (155,001) 361,669 (155,001) (100,000) 106,668 (26,668) 80,000 350,000 (105,000) 245,000 (105.000) (100,000) 40,000 (10,000) 30,000 300,000 (90,000) 210,000 190.000 (100,000) 20,000 (5,000) 15.000 250.000 175,000 175.000 175.000 (100.000 285,668 215.000 Cash Flows: EBIT Add Depreciation Subtract Taxes Operating Cash Flows 100.000 120,000 100,000 (30,000) 190,000 106,668 100,000 (26,668) 180,000 40,000 100,000 (10,000) 130.000 20,000 100.000 (5000) 115,000 100,000 Assets Purchases: Proposed Investment in Equipment Investment in Inventories Residual Vakue of Equipment after Tax Total Cash Flows (500,000) (20,000) 20,000 50,000 170,000 (520.000) 180,000 115,000 190,000 130,000 1000 (520.000) 0.826 148,680 0909 172,710 0.751 97,630 0.683 78,545 Discount Factor at 1095 Present Values 0.521 105,570 Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS). Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20%, payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why