Question:

and this's the information that might be used

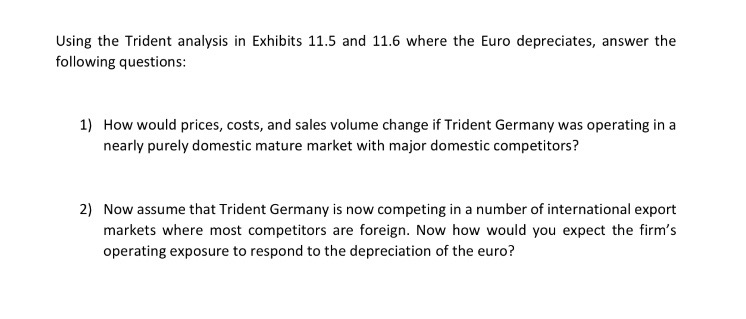

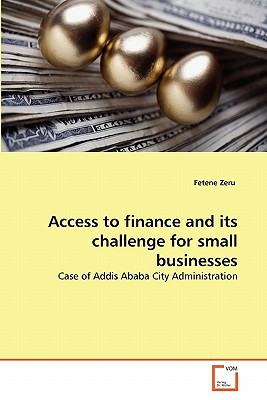

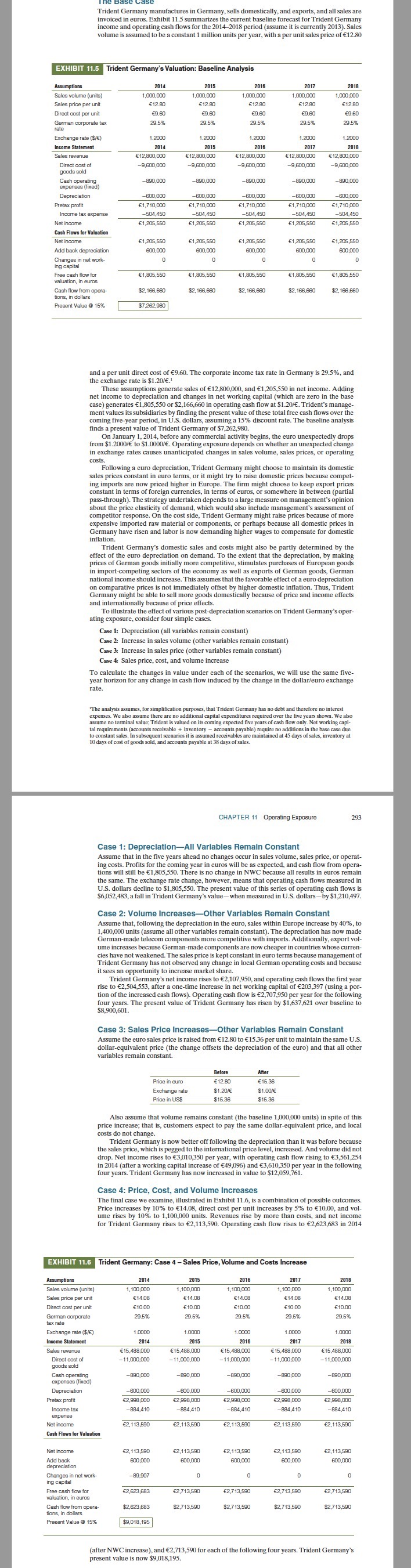

Using the Trident analysis in Exhibits 11.5 and 11.6 where the Euro depreciates, answer the following questions: 1) How would prices, costs, and sales volume change if Trident Germany was operating in a nearly purely domestic mature market with major domestic competitors? 2) Now assume that Trident Germany is now competing in a number of international export markets where most competitors are foreign. Now how would you expect the firm's operating exposure to respond to the depreciation of the euro? ine Base Case Trident Germany manufactures in Germany, sells domestically, and exports, and all sales are invoiced in euros. Exhibit 11.5 summarizes the current baseline forecast for Trident Germany income and operating cash flows for the 2014-2018 period (assume it is currently 2013). Sales volume is assumed to be a constant 1 million units per year, with a per unit sales price of 12.80 EXHIBIT 11.5 Trident Germany's Valuation: Baseline Analysis 2016 1.000.000 2014 1,000,000 12.80 9.60 29.5% 2015 1,000,000 12.80 9.60 29.5% 12.80 9.60 29.5% 2017 1,000,000 12.80 9.60 29.5% 2018 1,000,000 12.00 9.60 29.5% 1.2000 2014 12,800,000 -9,600,000 1.2000 2015 12,800,000 -9,600,000 1.2000 2016 12,800,000 -9,600,000 1.2000 2017 12,800,000 -9,600,000 1.2000 2018 12,800,000 -9,600,000 -890,000 -890,000 -890,000 -890,000 -890,000 Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax prolit Income tax expense Net income for Valuation Net income Add back depreciation Changes in net work- ing capital Free cash flow for valuation, in euros Cash flow from opera- tions, in dollars Present Value @ 15% -600,000 1,710,000 -504,450 1,205,550 -600,000 1,710,000 _504,450 1,205,550 -600,000 1,710,000 -504,450 1,205,550 -600,000 1,710,000 -504,450 1,205,550 -600,000 1,710,000 -504,450 1,205,550 Cash Flows 1,205,550 1,205,550 600,000 1,205,550 600,000 1,205,550 800,000 0 1,205,550 600,000 600.000 1,805,550 1,805,550 1,805,550 1,805,550 1,806,550 $2,166,660 $2,166,660 $2,166,660 $2,166,660 $2,166,660 $7,262,980 and a per unit direct cost of 9.60. The corporate income tax rate in Germany is 29.5%, and the exchange rate is $1.20/. These assumptions generate sales of 12,800,000, and 1,205,550 in net income. Adding net income to depreciation and changes in net working capital (which are zero in the base case) generates 1,805,550 or $2,166,660 in operating cash flow at $1.20/. Trident's manage- ment values its subsidiaries by finding the present value of these total free cash flows over the coming five-year period, in U.S. dollars, assuming a 15% discount rate. The baseline analysis finds a present value of Trident Germany of $7,262,980. On January 1, 2014, before any commercial activity begins, the euro unexpectedly drops from $1.2000/ to $1.0000/. Operating exposure depends on whether an unexpected change in exchange rates causes unanticipated changes in sales volume, sales prices, or operating costs. Following a euro depreciation, Trident Germany might choose to maintain its domestic sales prices constant in euro terms, or it might try to raise domestic prices because compet- ing imports are now priced higher in Europe. The firm might choose to keep export prices constant in terms of foreign currencies, in terms of euros, or somewhere in between (partial pass-through). The strategy undertaken depends to a large measure on management's opinion about the price elasticity of demand, which would also include management's assessment of competitor response. On the cost side, Trident Germany might raise prices because of more expensive imported raw material or components, or perhaps because all domestic prices in Germany have risen and labor is now demanding higher wages compensate for domestic inflation Trident Germany's domestic sales and costs might also be partly determined by the effect of the euro depreciation on demand. To the extent that the depreciation, by making prices of German goods initially more competitive, stimulates purchases of European goods in import-competing sectors of the economy as well as exports of German goods, German national income should increase. This assumes that the favorable effect of a euro depreciation on comparative prices is not immediately offset by higher domestic inflation. Thus, Trident Germany might be able to sell more goods domestically because of price and income effects and internationally because of price effects. To illustrate the effect of various post-depreciation scenarios on Trident Germany's oper- ating exposure, consider four simple cases. Case 1: Depreciation (all variables remain constant) Case 2: Increase in sales volume (other variables remain constant) Case 3: Increase in sales price (other variables remain constant) Case 4 Sales price, cost, and volume increase To calculate the changes in value under each of the scenarios, we will use the same five- year horizon for any change in cash flow induced by the change in the dollar/euro exchange rate. "The analysis assumes, for simplification purposes, that Trident Germany has no debt and therefore no interest expenses. We also assume there are no additional capital expenditures required over the five years shown. We also assume no terminal value; Trident is valued on its coming expected five years of cash flow only. Net working capi- tal requirements (accounts receivable + inventory - accounts payable) require no additions in the base case due to constant sales. In subsequent scenarios it is assumed receivables are maintained at 45 days of sales, inventory at 10 days of cost of goods sold, and accounts payable at 38 days of sales. CHAPTER 11 Operating Exposure 293 Case 1: Depreciation-All Variables Remain Constant Assume that in the five years ahead no changes occur in sales volume, sales price, or operat- ing costs. Profits for the coming year in euros will be as expected, and cash flow from opera- tions will still be 1,805,550. There is no change in NWC because all results in euros remain the same. The exchange rate change, however, means that operating cash flows measured in U.S. dollars decline to $1,805,550. The present value of this series of operating cash flows is $6,052,483, a fall in Trident Germany's value-when measured in U.S. dollars-by $1,210,497. Case 2: Volume Increases Other Variables Remain Constant Assume that, following the depreciation in the euro, sales within Europe increase by 40%, to 1,400,000 units (assume all other variables remain constant). The depreciation has now made German-made telecom components more competitive with imports. Additionally, export vol- ume increases because German-made components are now cheaper in countries whose curren- cies have not weakened. The sales price is kept constant in euro terms because management of Trident Germany has not observed any change local German operating costs and because it sees an opportunity to increase market share. Trident Germany's net income rises to 2,107,950, and operating cash flows the first year rise to 2,504,553, after a one-time increase in net working capital of 203,397 (using a por- tion of the increased cash flows). Operating cash flow is 2,707,950 per year for the following four years. The present value of Trident Germany has risen by $1,637,621 over baseline to $8,900,601. Case 3: Sales Price Increases-Other Variables Remain Constant Assume the euro sales price is raised from 12.80 to 15.36 per unit to maintain the same U.S. dollar-equivalent price (the change offsets the depreciation of the euro) and that all other variables remain constant. Price in euro Exchange rate Price in US$ Before 12.90 $1.2016 $15.36 After 15.36 $1.00/ $15.36 Also assume that volume remains constant (the baseline 1,000,000 units) in spite of this price increase; that customers expect to pay the same dollar-equivalent price, and local costs do not change. Trident Germany is now better off following the depreciation than it was before because the sales price, which is pegged to the international price level, increased. And volume did not drop. Net income rises to 3,010,350 per year, with operating cash flow rising to 3,561,254 in 2014 (after a working capital increase of 49,096) and 3,610,350 per year in the following four years. Trident Germany has now increased in value to $12,059,761. Case 4: Price, Cost, and Volume Increases The final case we examine, illustrated in Exhibit 11.6, is a combination of possible outcomes. Price increases by 10% to 14.08, direct cost per unit increases by 5% to 10.00, and vol- ume rises by 10% to 1,100,000 units. Revenues rise by more than costs, and net income for Trident Germany rises to 2,113,590. Operating cash flow rises to 2,623,683 in 2014 EXHIBIT 11.6 Trident Germany: Case 4 - Sales Price, Volume and Costs Increase 2014 1,100,000 14.08 10.00 2015 1.100.000 14.08 10.00 29.5% 2016 1,100,000 14.08 10.00 29.5% 2017 1,100,000 14.08 2018 1,100,000 14.08 10.00 10.00 29.5% 29.5% 29.5% 1.0000 2016 Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax profit Income tax expense Net income Cash Flows for Valuation 1.0000 2014 15,488,000 - 11,000,000 1.0000 2015 15,488,000 -11,000,000 1.0000 2017 15,488,000 - 11,000,000 1.0000 2018 15,488,000 - 11.000.000 15,488,000 - 11,000,000 - 890,000 -890,000 -890,000 -890,000 -890,000 -600,000 2.998,000 -884,410 -600,000 2,998,000 -884,410 -600,000 2.998,000 -884,410 -600,000 2,990,000 -884,410 -600,000 2,998,000 -884,410 2,113,590 2,113,590 2,113,590 2, 113,590 2,113,590 2,113,590 600,000 2,113,590 600,000 2,113,590 600,000 2,113,590 600,000 2, 113,590 600,000 -89,907 0 0 0 0 Net income Add back depreciation Changes in net work ing capital Free cash flow for valuation, in euros Cash flow from opera- tions, in dollars Present Value @ 15% 2,623,683 2,713,590 2,713,590 2.713.590 2,713,590 $2.623,683 $2,713,590 $2,713,590 $2.713,590 $2,713,590 $9,018,195 (after NWC increase), and 2,713,590 for each of the following four years. Trident Germany's present value is now $9.018,195. Using the Trident analysis in Exhibits 11.5 and 11.6 where the Euro depreciates, answer the following questions: 1) How would prices, costs, and sales volume change if Trident Germany was operating in a nearly purely domestic mature market with major domestic competitors? 2) Now assume that Trident Germany is now competing in a number of international export markets where most competitors are foreign. Now how would you expect the firm's operating exposure to respond to the depreciation of the euro? ine Base Case Trident Germany manufactures in Germany, sells domestically, and exports, and all sales are invoiced in euros. Exhibit 11.5 summarizes the current baseline forecast for Trident Germany income and operating cash flows for the 2014-2018 period (assume it is currently 2013). Sales volume is assumed to be a constant 1 million units per year, with a per unit sales price of 12.80 EXHIBIT 11.5 Trident Germany's Valuation: Baseline Analysis 2016 1.000.000 2014 1,000,000 12.80 9.60 29.5% 2015 1,000,000 12.80 9.60 29.5% 12.80 9.60 29.5% 2017 1,000,000 12.80 9.60 29.5% 2018 1,000,000 12.00 9.60 29.5% 1.2000 2014 12,800,000 -9,600,000 1.2000 2015 12,800,000 -9,600,000 1.2000 2016 12,800,000 -9,600,000 1.2000 2017 12,800,000 -9,600,000 1.2000 2018 12,800,000 -9,600,000 -890,000 -890,000 -890,000 -890,000 -890,000 Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax prolit Income tax expense Net income for Valuation Net income Add back depreciation Changes in net work- ing capital Free cash flow for valuation, in euros Cash flow from opera- tions, in dollars Present Value @ 15% -600,000 1,710,000 -504,450 1,205,550 -600,000 1,710,000 _504,450 1,205,550 -600,000 1,710,000 -504,450 1,205,550 -600,000 1,710,000 -504,450 1,205,550 -600,000 1,710,000 -504,450 1,205,550 Cash Flows 1,205,550 1,205,550 600,000 1,205,550 600,000 1,205,550 800,000 0 1,205,550 600,000 600.000 1,805,550 1,805,550 1,805,550 1,805,550 1,806,550 $2,166,660 $2,166,660 $2,166,660 $2,166,660 $2,166,660 $7,262,980 and a per unit direct cost of 9.60. The corporate income tax rate in Germany is 29.5%, and the exchange rate is $1.20/. These assumptions generate sales of 12,800,000, and 1,205,550 in net income. Adding net income to depreciation and changes in net working capital (which are zero in the base case) generates 1,805,550 or $2,166,660 in operating cash flow at $1.20/. Trident's manage- ment values its subsidiaries by finding the present value of these total free cash flows over the coming five-year period, in U.S. dollars, assuming a 15% discount rate. The baseline analysis finds a present value of Trident Germany of $7,262,980. On January 1, 2014, before any commercial activity begins, the euro unexpectedly drops from $1.2000/ to $1.0000/. Operating exposure depends on whether an unexpected change in exchange rates causes unanticipated changes in sales volume, sales prices, or operating costs. Following a euro depreciation, Trident Germany might choose to maintain its domestic sales prices constant in euro terms, or it might try to raise domestic prices because compet- ing imports are now priced higher in Europe. The firm might choose to keep export prices constant in terms of foreign currencies, in terms of euros, or somewhere in between (partial pass-through). The strategy undertaken depends to a large measure on management's opinion about the price elasticity of demand, which would also include management's assessment of competitor response. On the cost side, Trident Germany might raise prices because of more expensive imported raw material or components, or perhaps because all domestic prices in Germany have risen and labor is now demanding higher wages compensate for domestic inflation Trident Germany's domestic sales and costs might also be partly determined by the effect of the euro depreciation on demand. To the extent that the depreciation, by making prices of German goods initially more competitive, stimulates purchases of European goods in import-competing sectors of the economy as well as exports of German goods, German national income should increase. This assumes that the favorable effect of a euro depreciation on comparative prices is not immediately offset by higher domestic inflation. Thus, Trident Germany might be able to sell more goods domestically because of price and income effects and internationally because of price effects. To illustrate the effect of various post-depreciation scenarios on Trident Germany's oper- ating exposure, consider four simple cases. Case 1: Depreciation (all variables remain constant) Case 2: Increase in sales volume (other variables remain constant) Case 3: Increase in sales price (other variables remain constant) Case 4 Sales price, cost, and volume increase To calculate the changes in value under each of the scenarios, we will use the same five- year horizon for any change in cash flow induced by the change in the dollar/euro exchange rate. "The analysis assumes, for simplification purposes, that Trident Germany has no debt and therefore no interest expenses. We also assume there are no additional capital expenditures required over the five years shown. We also assume no terminal value; Trident is valued on its coming expected five years of cash flow only. Net working capi- tal requirements (accounts receivable + inventory - accounts payable) require no additions in the base case due to constant sales. In subsequent scenarios it is assumed receivables are maintained at 45 days of sales, inventory at 10 days of cost of goods sold, and accounts payable at 38 days of sales. CHAPTER 11 Operating Exposure 293 Case 1: Depreciation-All Variables Remain Constant Assume that in the five years ahead no changes occur in sales volume, sales price, or operat- ing costs. Profits for the coming year in euros will be as expected, and cash flow from opera- tions will still be 1,805,550. There is no change in NWC because all results in euros remain the same. The exchange rate change, however, means that operating cash flows measured in U.S. dollars decline to $1,805,550. The present value of this series of operating cash flows is $6,052,483, a fall in Trident Germany's value-when measured in U.S. dollars-by $1,210,497. Case 2: Volume Increases Other Variables Remain Constant Assume that, following the depreciation in the euro, sales within Europe increase by 40%, to 1,400,000 units (assume all other variables remain constant). The depreciation has now made German-made telecom components more competitive with imports. Additionally, export vol- ume increases because German-made components are now cheaper in countries whose curren- cies have not weakened. The sales price is kept constant in euro terms because management of Trident Germany has not observed any change local German operating costs and because it sees an opportunity to increase market share. Trident Germany's net income rises to 2,107,950, and operating cash flows the first year rise to 2,504,553, after a one-time increase in net working capital of 203,397 (using a por- tion of the increased cash flows). Operating cash flow is 2,707,950 per year for the following four years. The present value of Trident Germany has risen by $1,637,621 over baseline to $8,900,601. Case 3: Sales Price Increases-Other Variables Remain Constant Assume the euro sales price is raised from 12.80 to 15.36 per unit to maintain the same U.S. dollar-equivalent price (the change offsets the depreciation of the euro) and that all other variables remain constant. Price in euro Exchange rate Price in US$ Before 12.90 $1.2016 $15.36 After 15.36 $1.00/ $15.36 Also assume that volume remains constant (the baseline 1,000,000 units) in spite of this price increase; that customers expect to pay the same dollar-equivalent price, and local costs do not change. Trident Germany is now better off following the depreciation than it was before because the sales price, which is pegged to the international price level, increased. And volume did not drop. Net income rises to 3,010,350 per year, with operating cash flow rising to 3,561,254 in 2014 (after a working capital increase of 49,096) and 3,610,350 per year in the following four years. Trident Germany has now increased in value to $12,059,761. Case 4: Price, Cost, and Volume Increases The final case we examine, illustrated in Exhibit 11.6, is a combination of possible outcomes. Price increases by 10% to 14.08, direct cost per unit increases by 5% to 10.00, and vol- ume rises by 10% to 1,100,000 units. Revenues rise by more than costs, and net income for Trident Germany rises to 2,113,590. Operating cash flow rises to 2,623,683 in 2014 EXHIBIT 11.6 Trident Germany: Case 4 - Sales Price, Volume and Costs Increase 2014 1,100,000 14.08 10.00 2015 1.100.000 14.08 10.00 29.5% 2016 1,100,000 14.08 10.00 29.5% 2017 1,100,000 14.08 2018 1,100,000 14.08 10.00 10.00 29.5% 29.5% 29.5% 1.0000 2016 Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax profit Income tax expense Net income Cash Flows for Valuation 1.0000 2014 15,488,000 - 11,000,000 1.0000 2015 15,488,000 -11,000,000 1.0000 2017 15,488,000 - 11,000,000 1.0000 2018 15,488,000 - 11.000.000 15,488,000 - 11,000,000 - 890,000 -890,000 -890,000 -890,000 -890,000 -600,000 2.998,000 -884,410 -600,000 2,998,000 -884,410 -600,000 2.998,000 -884,410 -600,000 2,990,000 -884,410 -600,000 2,998,000 -884,410 2,113,590 2,113,590 2,113,590 2, 113,590 2,113,590 2,113,590 600,000 2,113,590 600,000 2,113,590 600,000 2,113,590 600,000 2, 113,590 600,000 -89,907 0 0 0 0 Net income Add back depreciation Changes in net work ing capital Free cash flow for valuation, in euros Cash flow from opera- tions, in dollars Present Value @ 15% 2,623,683 2,713,590 2,713,590 2.713.590 2,713,590 $2.623,683 $2,713,590 $2,713,590 $2.713,590 $2,713,590 $9,018,195 (after NWC increase), and 2,713,590 for each of the following four years. Trident Germany's present value is now $9.018,195