Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Answer Sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer Sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

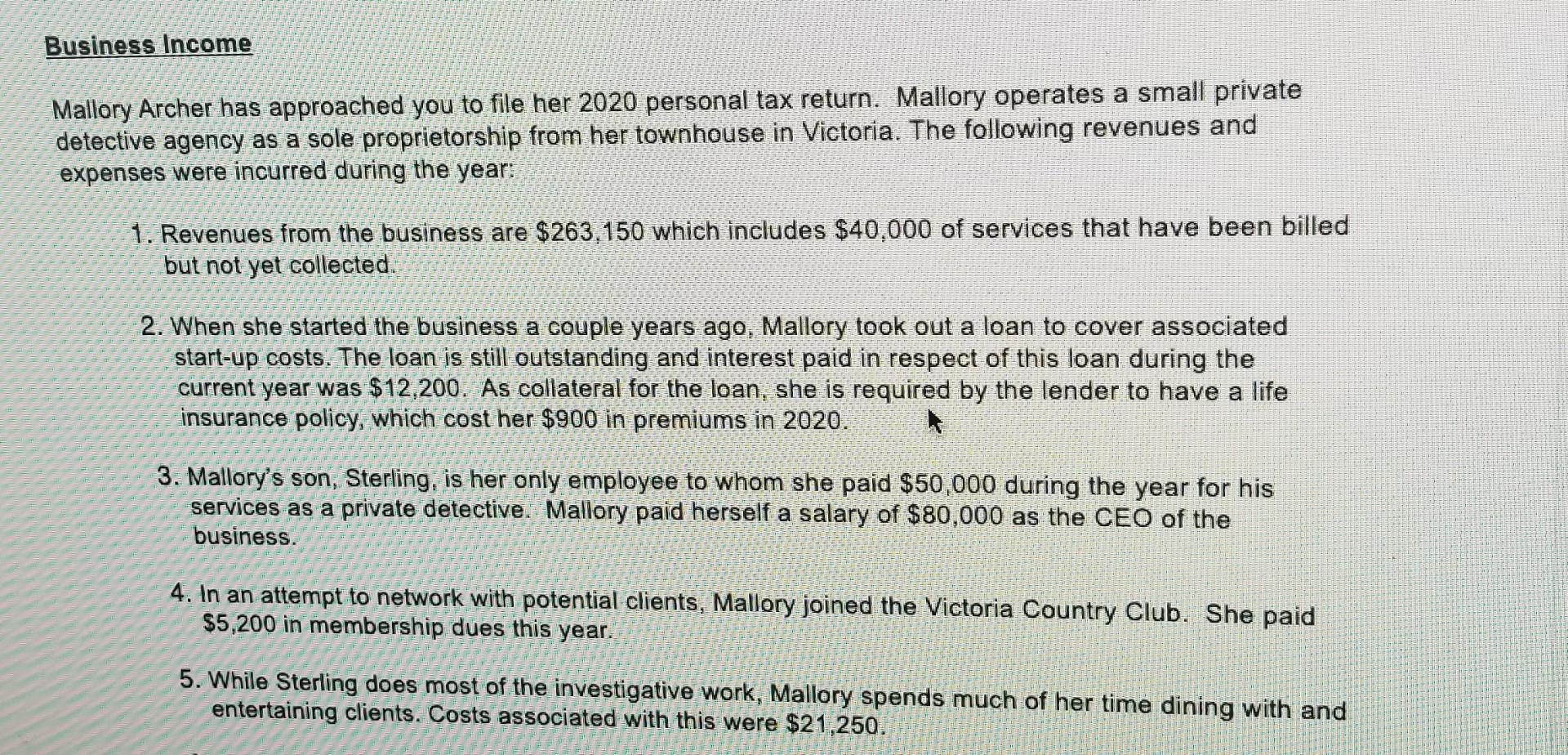

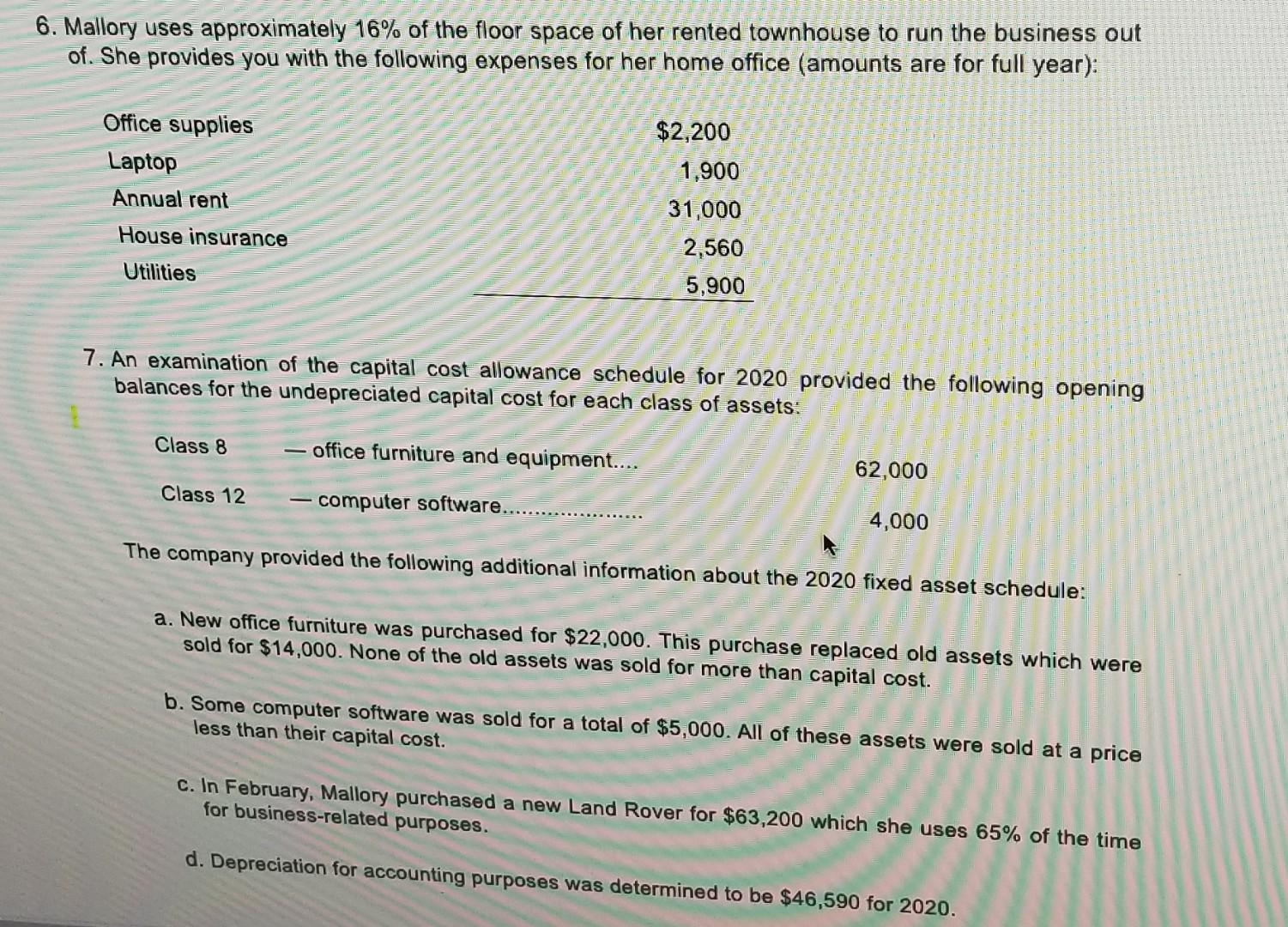

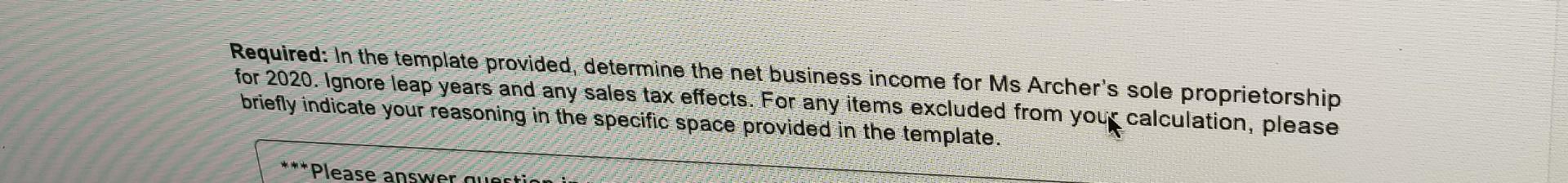

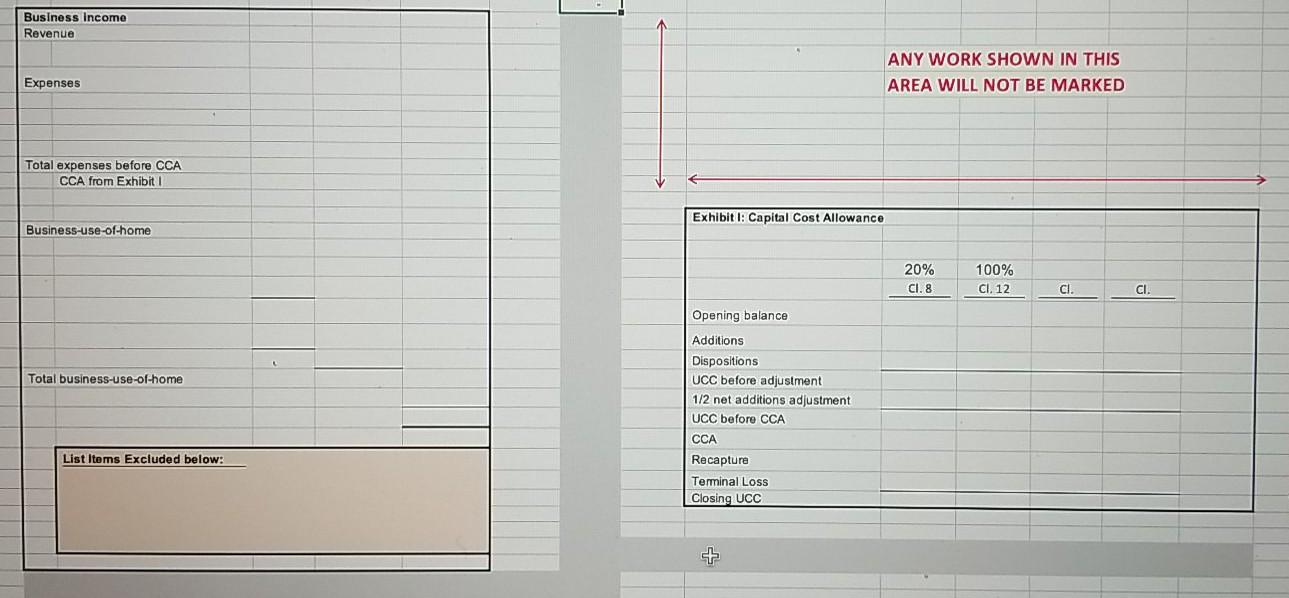

Business Income Mallory Archer has approached you to file her 2020 personal tax return. Mallory operates a small private detective agency as a sole proprietorship from her townhouse in Victoria. The following revenues and expenses were incurred during the year: 1. Revenues from the business are $263,150 which includes $40,000 of services that have been billed but not yet collected. 2. When she started the business a couple years ago, Mallory took out a loan to cover associated start-up costs. The loan is still outstanding and interest paid in respect of this loan during the current year was $12,200. As collateral for the loan, she is required by the lender to have a life insurance policy, which cost her $900 in premiums in 2020. 3. Mallory's son, Sterling, is her only employee to whom she paid $50,000 during the year for his services as a private detective. Mallory paid herself a salary of $80,000 as the CEO of the business. 4. In an attempt to network with potential clients, Mallory joined the Victoria Country Club. She paid $5,200 in membership dues this year. 5. While Sterling does most of the investigative work, Mallory spends much of her time dining with and entertaining clients. Costs associated with this were $21,250. 6. Mallory uses approximately 16% of the floor space of her rented townhouse to run the business out of. She provides you with the following expenses for her home office (amounts are for full year): Office supplies Laptop Annual rent $2,200 1,900 31,000 2,560 5,900 House insurance Utilities 7. An examination of the capital cost allowance schedule for 2020 provided the following opening balances for the undepreciated capital cost for each class of assets: Class 8 office furniture and equipment.... 62,000 Class 12 - computer software. 4,000 The company provided the following additional information about the 2020 fixed asset schedule: a. New office furniture was purchased for $22,000. This purchase replaced old assets which were sold for $14,000. None of the old assets was sold for more than capital cost. b. Some computer software was sold for a total of $5,000. All of these assets were sold at a price less than their capital cost. c. In February, Mallory purchased a new Land Rover for $63,200 which she uses 65% of the time for business-related purposes. d. Depreciation for accounting purposes was determined to be $46,590 for 2020. Required: In the template provided, determine the net business income for Ms Archer's sole proprietorship for 2020. Ignore leap years and any sales tax effects. For any items excluded from your calculation, please briefly indicate your reasoning in the specific space provided in the template. *** Please answer question Business Income Revenue ANY WORK SHOWN IN THIS AREA WILL NOT BE MARKED Expenses Total expenses before CCA CCA from Exhibit I Exhibiti: Capital Cost Allowance Business-use-of-home 20% CI. 8 100% CI. 12 Cl. CI. Opening balance Total business-use-of-home Additions Dispositions UCC before adjustment 1/2 net additions adjustment UCC before CCA CCA Recapture Terminal Loss Closing UCC List Items Excluded belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started