Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Answer sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

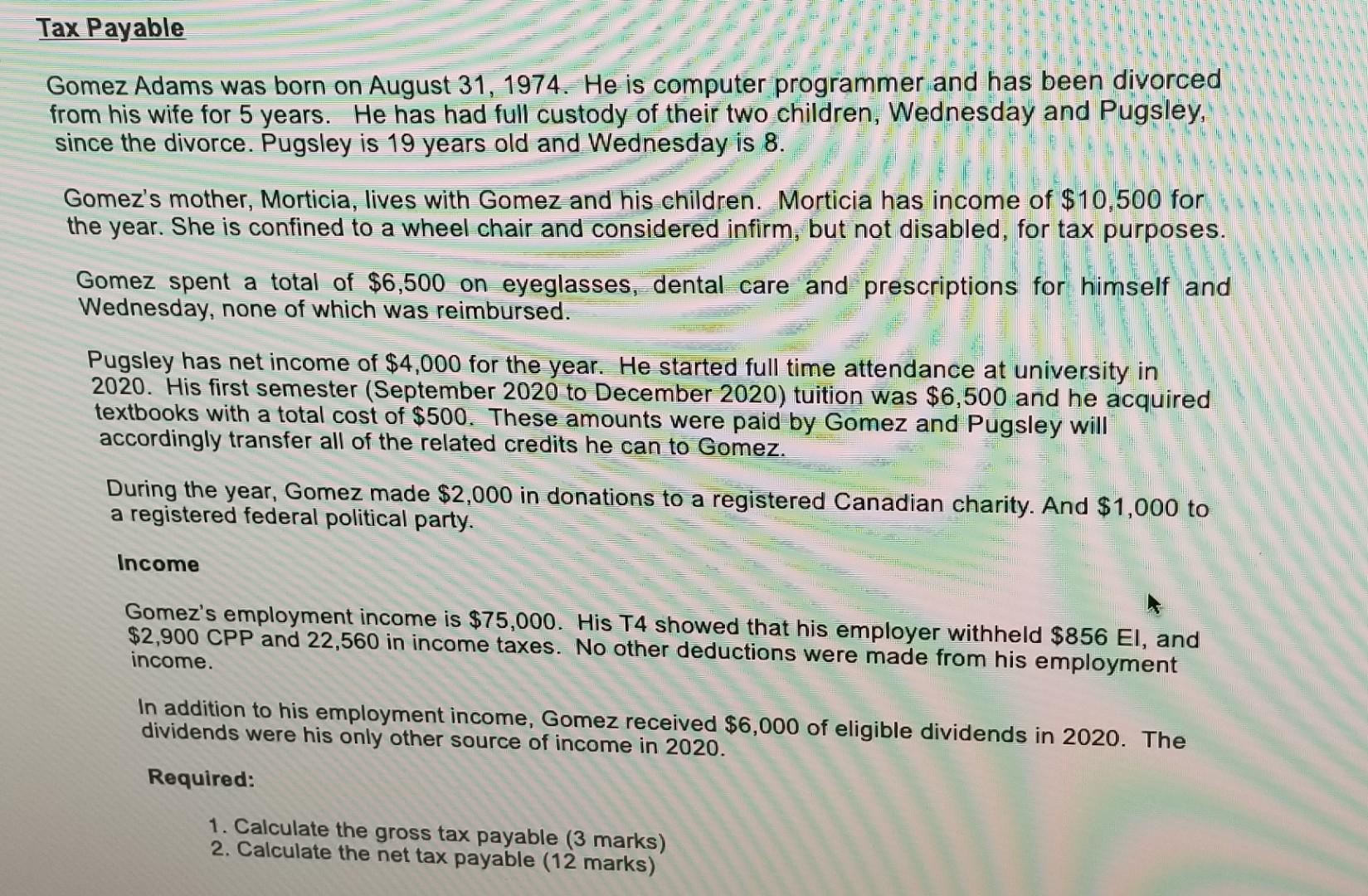

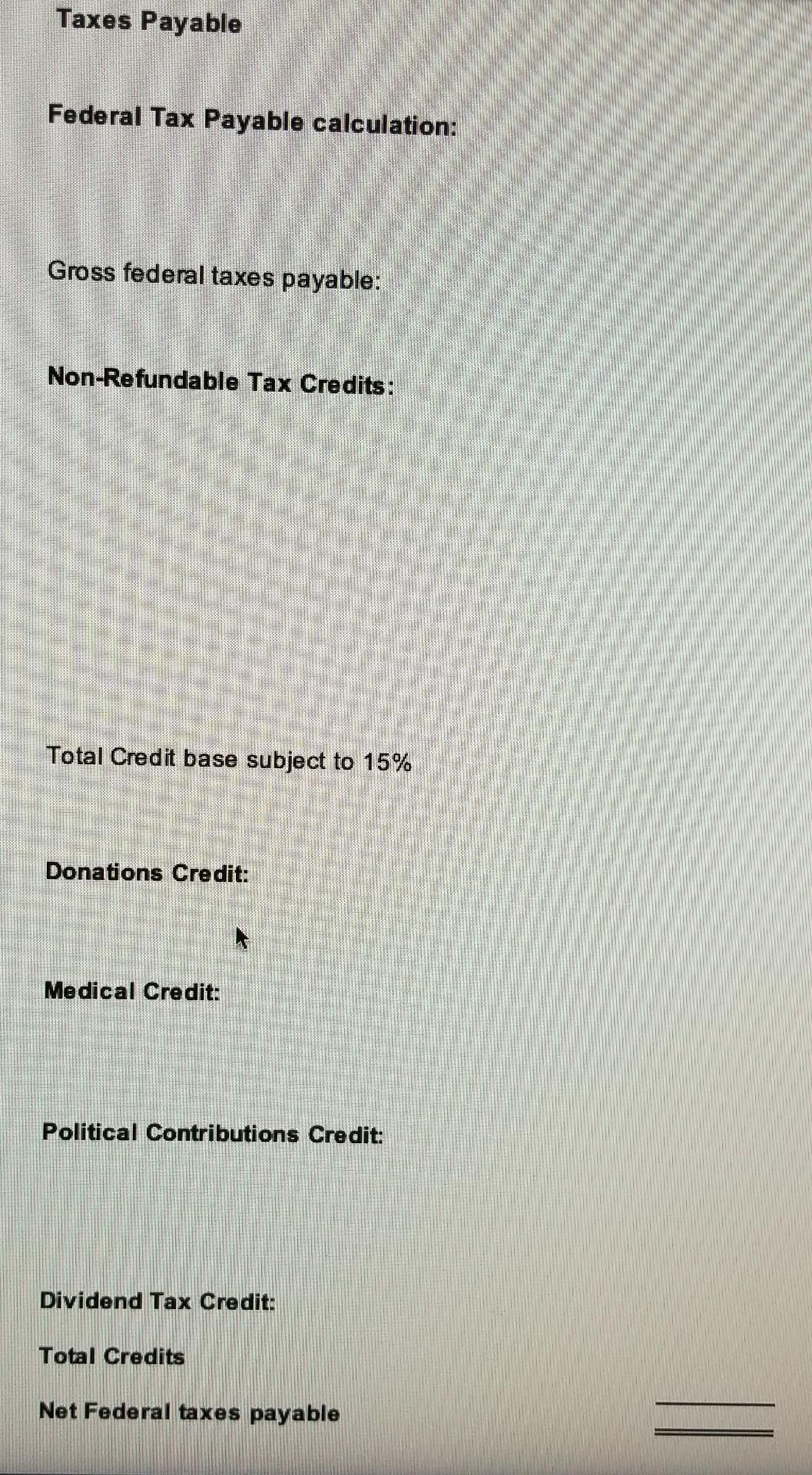

Tax Payable Gomez Adams was born on August 31, 1974. He is computer programmer and has been divorced from his wife for 5 years. He has had full custody of their two children, Wednesday and Pugsley, since the divorce. Pugsley is 19 years old and Wednesday is 8. Gomez's mother, Morticia, lives with Gomez and his children. Morticia has income of $10,500 for the year. She is confined to a wheel chair and considered infirm, but not disabled, for tax purposes. Gomez spent a total of $6,500 on eyeglasses, dental care and prescriptions for himself and Wednesday, none of which was reimbursed. Pugsley has net income of $4,000 for the year. He started full time attendance at university in 2020. His first semester (September 2020 to December 2020) tuition was $6,500 and he acquired textbooks with a total cost of $500. These amounts were paid by Gomez and Pugsley will accordingly transfer all of the related credits he can to Gomez. During the year, Gomez made $2,000 in donations to a registered Canadian charity. And $1,000 to a registered federal political party. Income Gomez's employment income is $75,000. His T4 showed that his employer withheld $856 EI, and $2,900 CPP and 22,560 in income taxes. No other deductions were made from his employment income. In addition to his employment income, Gomez received $6,000 of eligible dividends in 2020. The dividends were his only other source of income in 2020. Required: 1. Calculate the gross tax payable (3 marks) 2. Calculate the net tax payable (12 marks) Taxes Payable Federal Tax Payable calculation: Gross federal taxes payable: Non-Refundable Tax Credits: Total Credit base subject to 15% Donations Credit: Medical Credit: Political Contributions Credit: Dividend Tax Credit: Total Credits Net Federal taxes payable Tax Payable Gomez Adams was born on August 31, 1974. He is computer programmer and has been divorced from his wife for 5 years. He has had full custody of their two children, Wednesday and Pugsley, since the divorce. Pugsley is 19 years old and Wednesday is 8. Gomez's mother, Morticia, lives with Gomez and his children. Morticia has income of $10,500 for the year. She is confined to a wheel chair and considered infirm, but not disabled, for tax purposes. Gomez spent a total of $6,500 on eyeglasses, dental care and prescriptions for himself and Wednesday, none of which was reimbursed. Pugsley has net income of $4,000 for the year. He started full time attendance at university in 2020. His first semester (September 2020 to December 2020) tuition was $6,500 and he acquired textbooks with a total cost of $500. These amounts were paid by Gomez and Pugsley will accordingly transfer all of the related credits he can to Gomez. During the year, Gomez made $2,000 in donations to a registered Canadian charity. And $1,000 to a registered federal political party. Income Gomez's employment income is $75,000. His T4 showed that his employer withheld $856 EI, and $2,900 CPP and 22,560 in income taxes. No other deductions were made from his employment income. In addition to his employment income, Gomez received $6,000 of eligible dividends in 2020. The dividends were his only other source of income in 2020. Required: 1. Calculate the gross tax payable (3 marks) 2. Calculate the net tax payable (12 marks) Taxes Payable Federal Tax Payable calculation: Gross federal taxes payable: Non-Refundable Tax Credits: Total Credit base subject to 15% Donations Credit: Medical Credit: Political Contributions Credit: Dividend Tax Credit: Total Credits Net Federal taxes payableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started