Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Aqua (Pvt.) Ltd. is a manufacturing company making both taxable and exempt supplies. The Company Record reveals the following information for the Tax Period

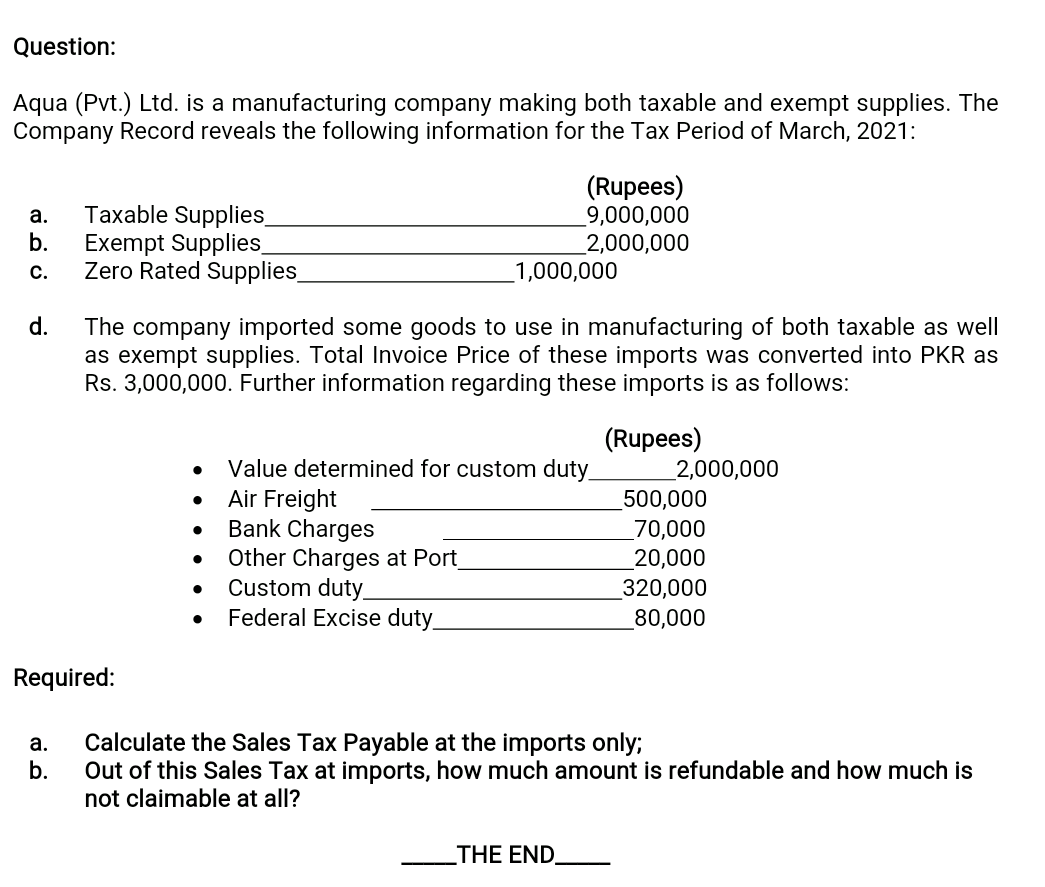

Question: Aqua (Pvt.) Ltd. is a manufacturing company making both taxable and exempt supplies. The Company Record reveals the following information for the Tax Period of March, 2021: a. b. c. Taxable Supplies Exempt Supplies Zero Rated Supplies (Rupees) 9,000,000 2,000,000 1,000,000 d. The company imported some goods to use in manufacturing of both taxable as well as exempt supplies. Total Invoice Price of these imports was converted into PKR as Rs. 3,000,000. Further information regarding these imports is as follows: . (Rupees) Value determined for custom duty. 2,000,000 Air Freight 500,000 Bank Charges 70,000 Other Charges at Port 20,000 Custom duty 320,000 Federal Excise duty_ 80,000 Required: a. b. Calculate the Sales Tax Payable at the imports only; Out of this Sales Tax at imports, how much amount is refundable and how much is not claimable at all? THE END

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started