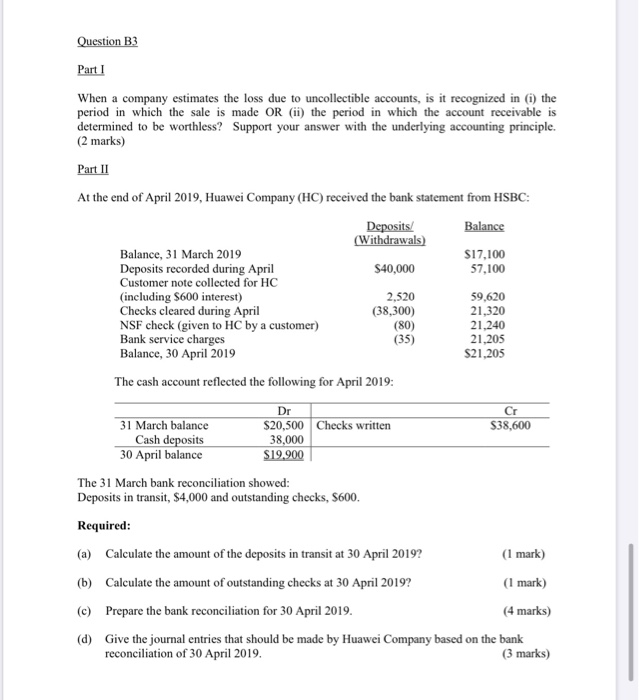

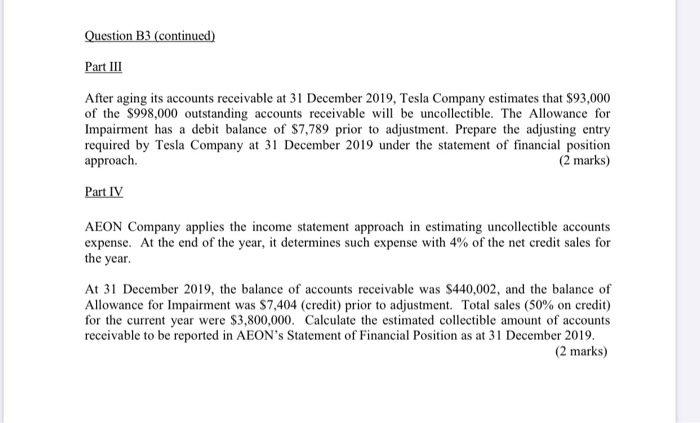

Question B3 Part I When a company estimates the loss due to uncollectible accounts, is it recognized in (i) the period in which the sale is made OR (ii) the period in which the account receivable is determined to be worthless? Support your answer with the underlying accounting principle. (2 marks) Part II At the end of April 2019, Huawei Company (HC) received the bank statement from HSBC: Deposits (Withdrawals) Balance $40,000 $17,100 57,100 Balance, 31 March 2019 Deposits recorded during April Customer note collected for HC (including $600 interest) Checks cleared during April NSF check (given to HC by a customer) Bank service charges Balance, 30 April 2019 2,520 (38,300) (80) (35) 59,620 21,320 21,240 21.205 $21,205 The cash account reflected the following for April 2019: Cr $38,600 Checks written 31 March balance Cash deposits 30 April balance Dr $20,500 38,000 $19.900 The 31 March bank reconciliation showed: Deposits in transit, $4,000 and outstanding checks, S600. Required: (a) Calculate the amount of the deposits in transit at 30 April 2019? (1 mark) (b) Calculate the amount of outstanding checks at 30 April 2019? (1 mark) (c) Prepare the bank reconciliation for 30 April 2019. (4 marks) (d) Give the journal entries that should be made by Huawei Company based on the bank reconciliation of 30 April 2019. (3 marks) Question B3 (continued) Part III After aging its accounts receivable at 31 December 2019, Tesla Company estimates that $93,000 of the $998,000 outstanding accounts receivable will be uncollectible. The Allowance for Impairment has a debit balance of $7,789 prior to adjustment. Prepare the adjusting entry required by Tesla Company at 31 December 2019 under the statement of financial position approach. (2 marks) Part IV AEON Company applies the income statement approach in estimating uncollectible accounts expense. At the end of the year, it determines such expense with 4% of the net credit sales for the year. At 31 December 2019, the balance of accounts receivable was $440,002, and the balance of Allowance for Impairment was $7,404 (credit) prior to adjustment. Total sales (50% on credit) for the current year were $3,800,000. Calculate the estimated collectible amount of accounts receivable to be reported in AEON's Statement of Financial Position as at 31 December 2019. (2 marks)