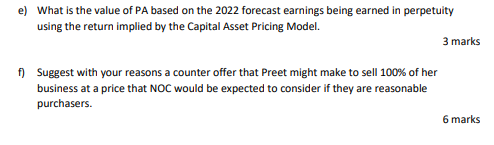

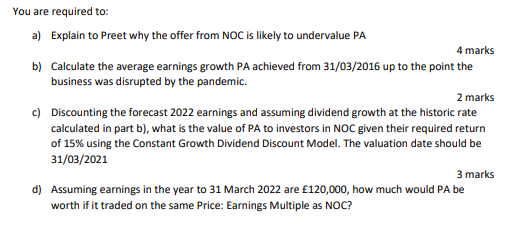

Question before:

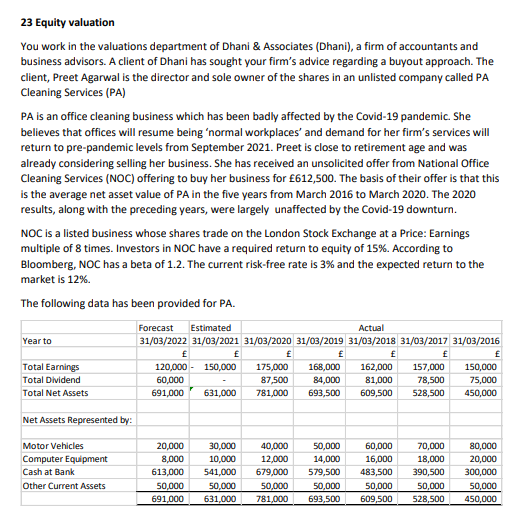

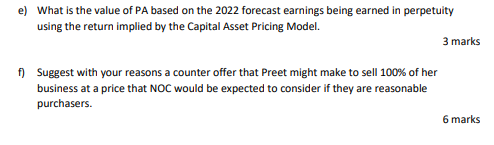

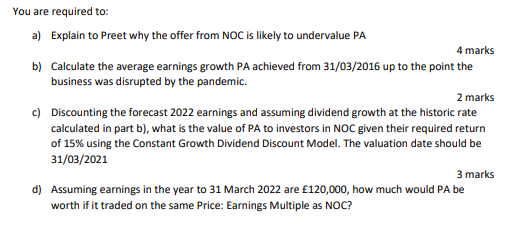

23 Equity valuation You work in the valuations department of Dhani & Associates (Dhani), a firm of accountants and business advisors. A client of Dhani has sought your firm's advice regarding a buyout approach. The client, Preet Agarwal is the director and sole owner of the shares in an unlisted company called PA Cleaning Services (PA) PA is an office cleaning business which has been badly affected by the Covid-19 pandemic. She believes that offices will resume being 'normal workplaces' and demand for her firm's services will return to pre-pandemic levels from September 2021. Preet is close to retirement age and was already considering selling her business. She has received an unsolicited offer from National Office Cleaning Services (NOC) offering to buy her business for 612,500. The basis of their offer is that this is the average net asset value of PA in the five years from March 2016 to March 2020. The 2020 results, along with the preceding years, were largely unaffected by the Covid-19 downturn. NOC is a listed business whose shares trade on the London Stock Exchange at a Price: Earnings multiple of 8 times. Investors in NOC have a required return to equity of 15%. According to Bloomberg, NOC has a beta of 1.2. The current risk-free rate is 3% and the expected return to the market is 12% The following data has been provided for PA. Year to Total Earnings Total Dividend Total Net Assets Forecast Estimated Actual 31/03/2022 31/03/2021 31/03/2020 31/03/2019 31/03/2018 31/03/2017 31/03/2016 E f f E 120,000 150,000 175,000 168,000 162,000 157,000 150,000 60,000 87,500 84,000 81,000 78,500 75,000 691,000 631,000 781,000 693,500 609,500 528,500 450,000 Net Assets Represented by: Motor Vehicles Computer Equipment Cash at Bank Other Current Assets 20.000 8,000 613,000 50,000 691,000 30,000 10,000 541,000 50,000 631,000 40,000 12,000 679,000 50,000 781,000 50,000 14,000 579,500 50,000 693,500 60,000 16,000 483,500 50,000 609,500 70,000 18,000 390,500 50,000 528,500 80,000 20,000 300,000 50,000 450,000 e) What is the value of PA based on the 2022 forecast earnings being earned in perpetuity using the return implied by the Capital Asset Pricing Model. 3 marks f) Suggest with your reasons a counter offer that Preet might make to sell 100% of her business at a price that NOC would be expected to consider if they are reasonable purchasers. 6 marks You are required to: a) Explain to Preet why the offer from NOC is likely to undervalue PA 4 marks b) Calculate the average earnings growth PA achieved from 31/03/2016 up to the point the business was disrupted by the pandemic. 2 marks c) Discounting the forecast 2022 earnings and assuming dividend growth at the historic rate calculated in part b), what is the value of PA to investors in NOC given their required return of 15% using the Constant Growth Dividend Discount Model. The valuation date should be 31/03/2021 d) Assuming earnings in the year to 31 March 2022 are 120,000, how much would PA be worth if it traded on the same Price: Earnings Multiple as NOC? 3 marks