Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question c,d,e,f,g this is the first part of the question. All the offices are also up for sale. The sale prices for each office are

question c,d,e,f,g

this is the first part of the question.

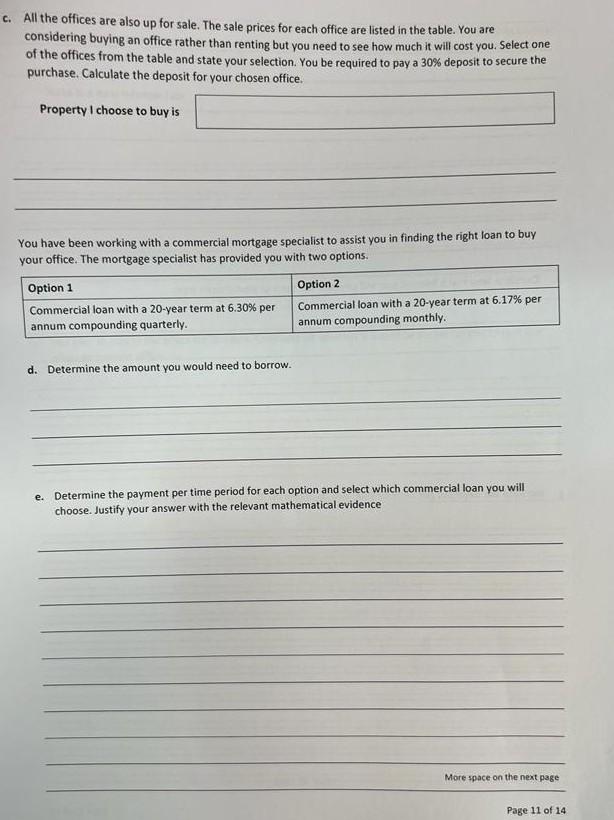

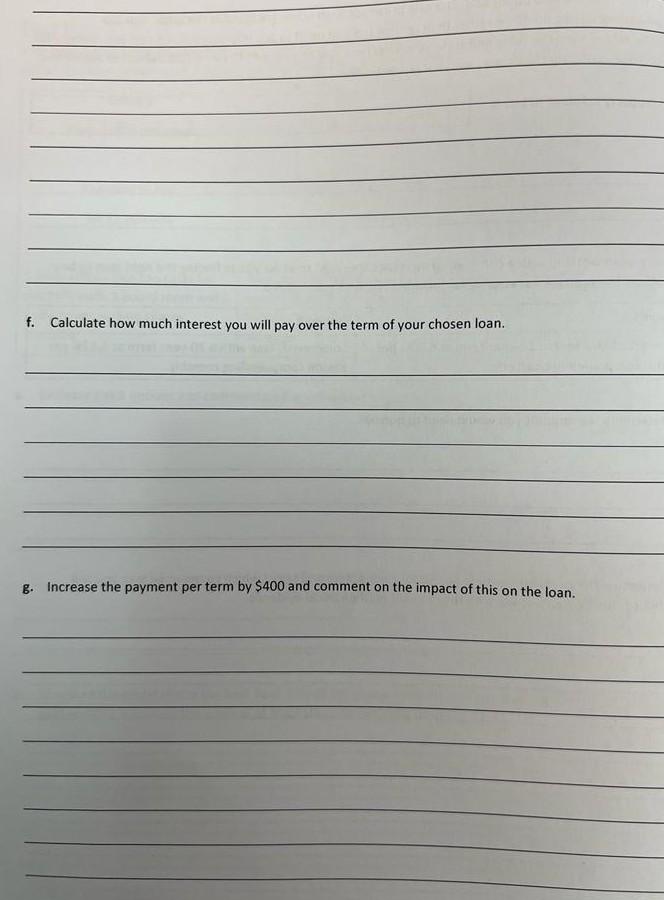

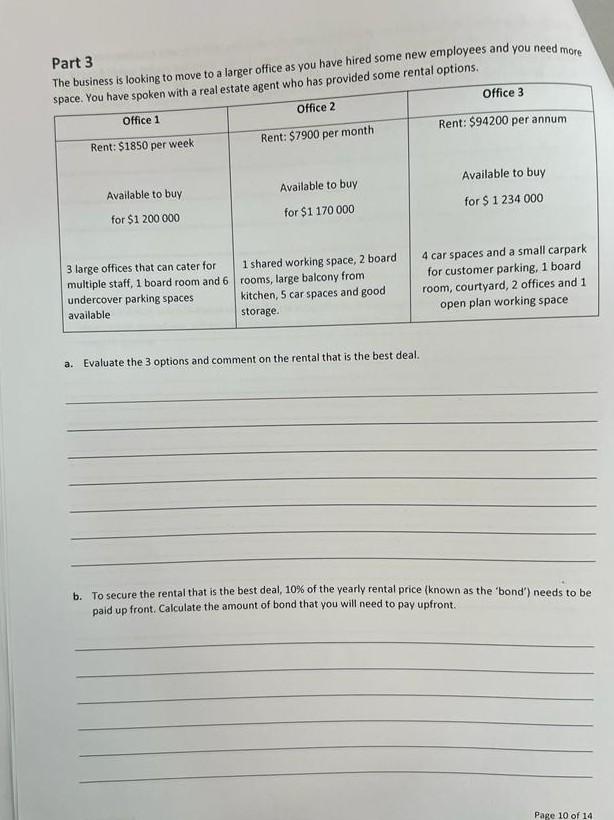

All the offices are also up for sale. The sale prices for each office are listed in the table. You are considering buying an office rather than renting but you need to see how much it will cost you. Select one of the offices from the table and state your selection. You be required to pay a 30% deposit to secure the purchase. Calculate the deposit for your chosen office. Property I choose to buy is You have been working with a commercial mortgage specialist to assist you in finding the right loan to buy your office. The mortgage specialist has provided you with two options. d. Determine the amount you would need to borrow. e. Determine the payment per time period for each option and select which commercial loan you will choose. Justify your answer with the relevant mathematical evidence f. Calculate how much interest you will pay over the term of your chosen loan. g. Increase the payment per term by $400 and comment on the impact of this on the loan. Part 3 Th- Luminnce ie lnoking to move to a larger office as you have hired some new employees a a. Evaluate the 3 options and comment on the rental that is the best deal. b. To secure the rental that is the best deal, 10% of the yearly rental price (known as the 'bond') needs to be paid up front. Calculate the amount of bond that you will need to pay upfrontStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started