Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION: Class, for your next post, review the findings of another student. Explain in detail why the CAPM or the WACC for these firms differ

QUESTION: Class, for your next post, review the findings of another student. Explain in detail why the CAPM or the WACC for these firms differ from each other. If you were the Stock Analyst, what would be your recommendations? Remember to always share your references and use your own words.

PLEASE USE THE FOLLOWING POST BELOW TO ANSWER THE QUESTION ABOVE.

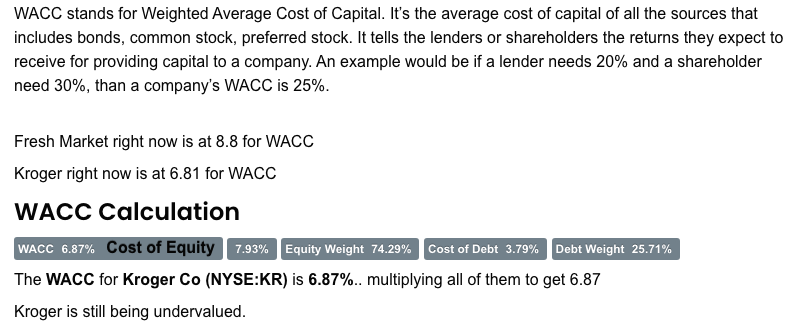

WACC stands for Weighted Average Cost of Capital. It's the average cost of capital of all the sources that includes bonds, common stock, preferred stock. It tells the lenders or shareholders the returns they expect to receive for providing capital to a company. An example would be if a lender needs 20% and a shareholder need 30%, than a company's WACC is 25%. Fresh Market right now is at 8.8 for WACC Kroger right now is at 6.81 for WACC WACC Calculation WACC 6.87% Cost of Equity 7.93% Equity Weight 74.29% Cost of Debt 3.79% Debt Weight 25.71% The WACC for Kroger Co (NYSE:KR) is 6.87%.. multiplying all of them to get 6.87 Kroger is still being undervalued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started