Answered step by step

Verified Expert Solution

Question

1 Approved Answer

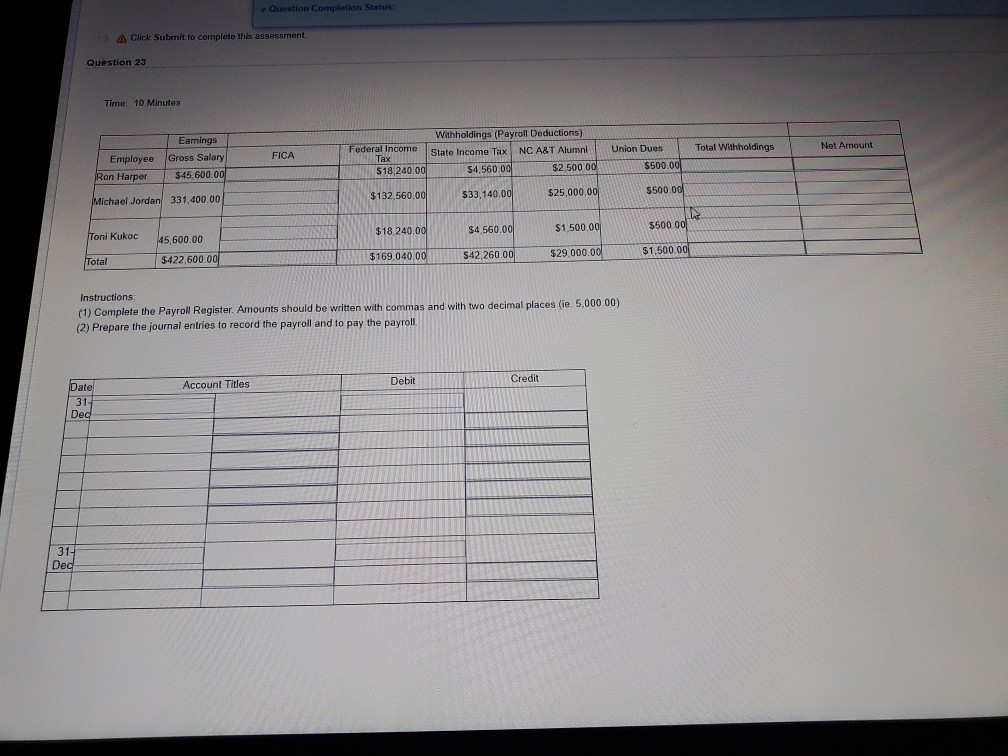

Question Completion Status Click Submit to complete this assessment Question 23 Time: 10 Minutes Earnings Employee Gross Salary Ron Harper 345,600.00 Withholdings (Payroll Deductions) Federal

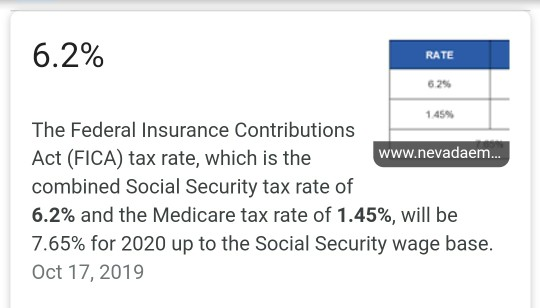

Question Completion Status Click Submit to complete this assessment Question 23 Time: 10 Minutes Earnings Employee Gross Salary Ron Harper 345,600.00 Withholdings (Payroll Deductions) Federal Income State Income Tax NC ART Alumni Union Dues Union Dues S18,240.00 54,560 00 $2.500 000 $500.00 Total Withholdings Net Amount Michael Jordan 331,400.00 $132.560.00 $33,140,00 $25,000.00 550000 $18.240,00 $4,560.00 $1,500.00 550000 Toni Kukoc Total 45,600.00 5422,600.00 5169.040.00 $42,260.00 $29,000.00 $1,500.00 Instructions: (1) Complete the Payroll Register Amounts should be written with commas and with two decimal places (ie 5,000.00) (2) Prepare the journal entries to record the payroll and to pay the payroll Date Account Titles Debit Credit 6.2% RATE 145 The Federal Insurance Contributions Act (FICA) tax rate, which is the www.nevadaem... combined Social Security tax rate of 6.2% and the Medicare tax rate of 1.45%, will be 7.65% for 2020 up to the Social Security wage base. Oct 17, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started