Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question Compute the Income Tax payable for January Bhd. for the Year Assessment of 2021 (Show all workings). January Bhd. is a resident SME company

question

Compute the Income Tax payable for January Bhd. for the Year Assessment of 2021 (Show all workings).

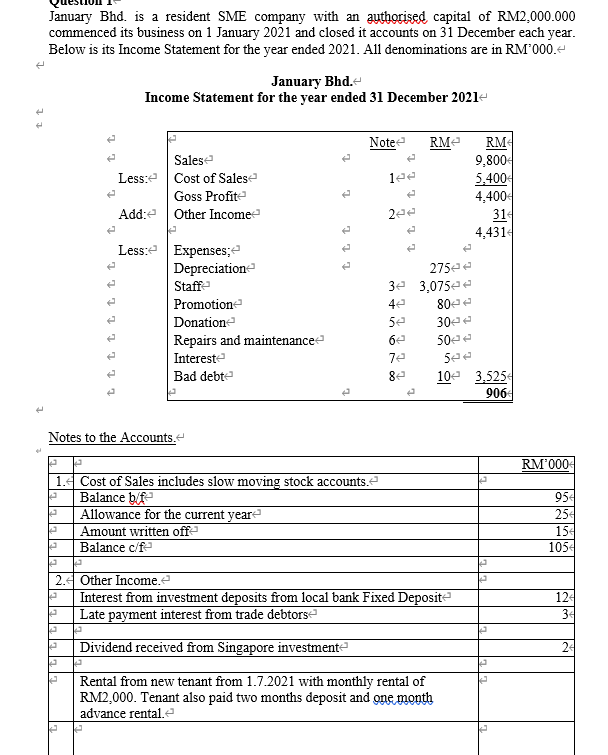

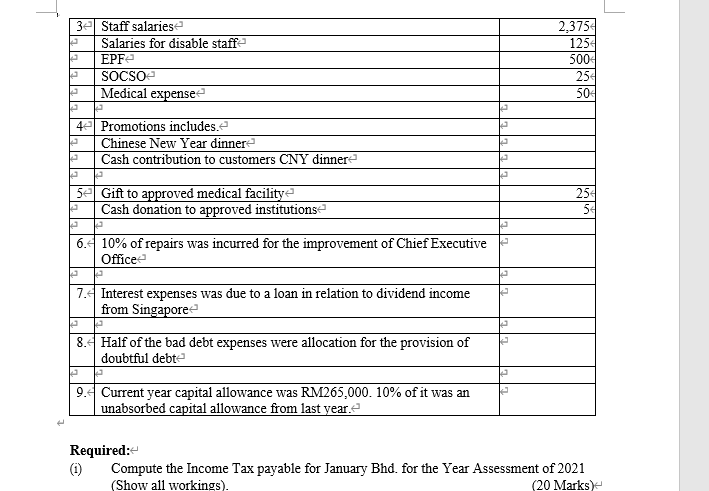

January Bhd. is a resident SME company with an authorised capital of RM2.000.000 commenced its business on 1 January 2021 and closed it accounts on 31 December each year. Below is its Income Statement for the year ended 2021. All denominations are in RM 000.- January Bhd. Income Statement for the year ended 31 December 20214 Note RM 10 Salese Less: Cost of Salese Goss Profit Add:e Other Income RM 9,800 5.400 4,400 31 4,4314 2ee ttt :275 Lesse Expenses;e Depreciation Staffe Promotion Donation Repairs and maintenance Interest Bad debte 3e 3,0752 4e 5e be 80 30-2 50e :7 8e 100 3.5254 906 Notes to the Accounts. RM'000 1. Cost of Sales includes slow moving stock accounts.e Balance bife Allowance for the current year Amount written off Balance c/fe 954 25 15 1054 2. Other Income. Interest from investment deposits from local bank Fixed Deposite Late payment interest from trade debtorse 124 34 Dividend received from Singapore investment 24 Rental from new tenant from 1.7.2021 with monthly rental of RM2,000. Tenant also paid two months deposit and one month advance rentale 3e Staff salariese Salaries for disable staff EPF SOCSO Medical expense 2.3754 1254 500 254 50 42 Promotions includes. Chinese New Year dinner Cash contribution to customers CNY dinner 5e Gift to approved medical facilitye Cash donation to approved institutions 254 5 le 6.10% of repairs was incurred for the improvement of Chief Executive Office le 7. Interest expenses was due to a loan in relation to dividend income from Singapore 8. Half of the bad debt expenses were allocation for the provision of doubtful debte 9. Current year capital allowance was RM265,000. 10% of it was an unabsorbed capital allowance from last year. Required: (1) Compute the Income Tax payable for January Bhd. for the Year Assessment of 2021 (Show all workings). (20 Marks January Bhd. is a resident SME company with an authorised capital of RM2.000.000 commenced its business on 1 January 2021 and closed it accounts on 31 December each year. Below is its Income Statement for the year ended 2021. All denominations are in RM 000.- January Bhd. Income Statement for the year ended 31 December 20214 Note RM 10 Salese Less: Cost of Salese Goss Profit Add:e Other Income RM 9,800 5.400 4,400 31 4,4314 2ee ttt :275 Lesse Expenses;e Depreciation Staffe Promotion Donation Repairs and maintenance Interest Bad debte 3e 3,0752 4e 5e be 80 30-2 50e :7 8e 100 3.5254 906 Notes to the Accounts. RM'000 1. Cost of Sales includes slow moving stock accounts.e Balance bife Allowance for the current year Amount written off Balance c/fe 954 25 15 1054 2. Other Income. Interest from investment deposits from local bank Fixed Deposite Late payment interest from trade debtorse 124 34 Dividend received from Singapore investment 24 Rental from new tenant from 1.7.2021 with monthly rental of RM2,000. Tenant also paid two months deposit and one month advance rentale 3e Staff salariese Salaries for disable staff EPF SOCSO Medical expense 2.3754 1254 500 254 50 42 Promotions includes. Chinese New Year dinner Cash contribution to customers CNY dinner 5e Gift to approved medical facilitye Cash donation to approved institutions 254 5 le 6.10% of repairs was incurred for the improvement of Chief Executive Office le 7. Interest expenses was due to a loan in relation to dividend income from Singapore 8. Half of the bad debt expenses were allocation for the provision of doubtful debte 9. Current year capital allowance was RM265,000. 10% of it was an unabsorbed capital allowance from last year. Required: (1) Compute the Income Tax payable for January Bhd. for the Year Assessment of 2021 (Show all workings). (20 MarksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started