Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Draw a rough picture of your selection on the Efficient Frontier. (A rough drawing isok, table of all values is not required) BUT for

Question: Draw a rough picture of your selection on the Efficient Frontier. (A rough drawing isok, table of all values is not required) BUT for Extra Credit - but not required- generate a table and graph of your selection for the efficient frontier. [EXCEL IS GOOD]

Side note to the person answering: Please give the steps of how the efficient frontier graph was generated. Thank you!

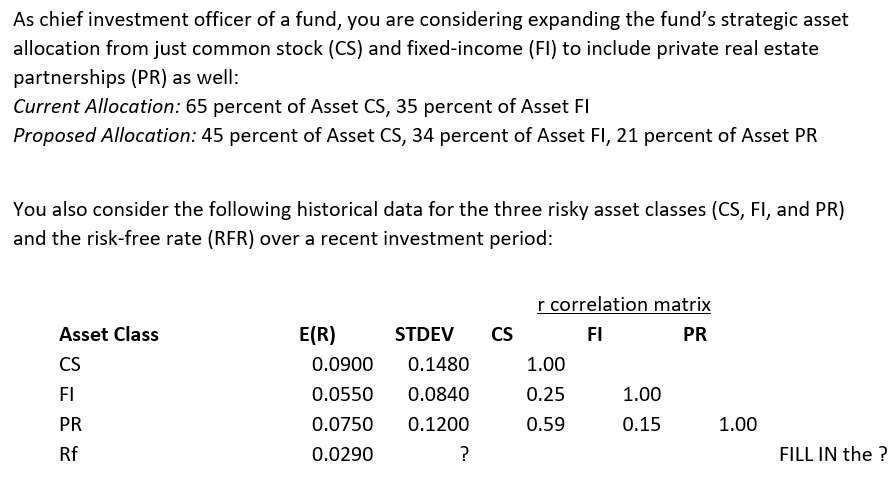

As chief investment officer of a fund, you are considering expanding the fund's strategic asset allocation from just common stock (CS) and fixed-income (FI) to include private real estate partnerships (PR) as well: Current Allocation: 65 percent of Asset CS, 35 percent of Asset FI Proposed Allocation: 45 percent of Asset CS, 34 percent of Asset FI, 21 percent of Asset PR You also consider the following historical data for the three risky asset classes (CS, FI, and PR) and the risk-free rate (RFR) over a recent investment period: CS Asset Class CS FI PR E(R) 0.0900 0.0550 0.0750 0.0290 STDEV 0.1480 0.0840 0.1200 ? r correlation matrix FI PR 1.00 0.25 1.00 0.59 0.15 1.00 Rf FILL IN the ? As chief investment officer of a fund, you are considering expanding the fund's strategic asset allocation from just common stock (CS) and fixed-income (FI) to include private real estate partnerships (PR) as well: Current Allocation: 65 percent of Asset CS, 35 percent of Asset FI Proposed Allocation: 45 percent of Asset CS, 34 percent of Asset FI, 21 percent of Asset PR You also consider the following historical data for the three risky asset classes (CS, FI, and PR) and the risk-free rate (RFR) over a recent investment period: CS Asset Class CS FI PR E(R) 0.0900 0.0550 0.0750 0.0290 STDEV 0.1480 0.0840 0.1200 ? r correlation matrix FI PR 1.00 0.25 1.00 0.59 0.15 1.00 Rf FILL IN the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started