Answered step by step

Verified Expert Solution

Question

1 Approved Answer

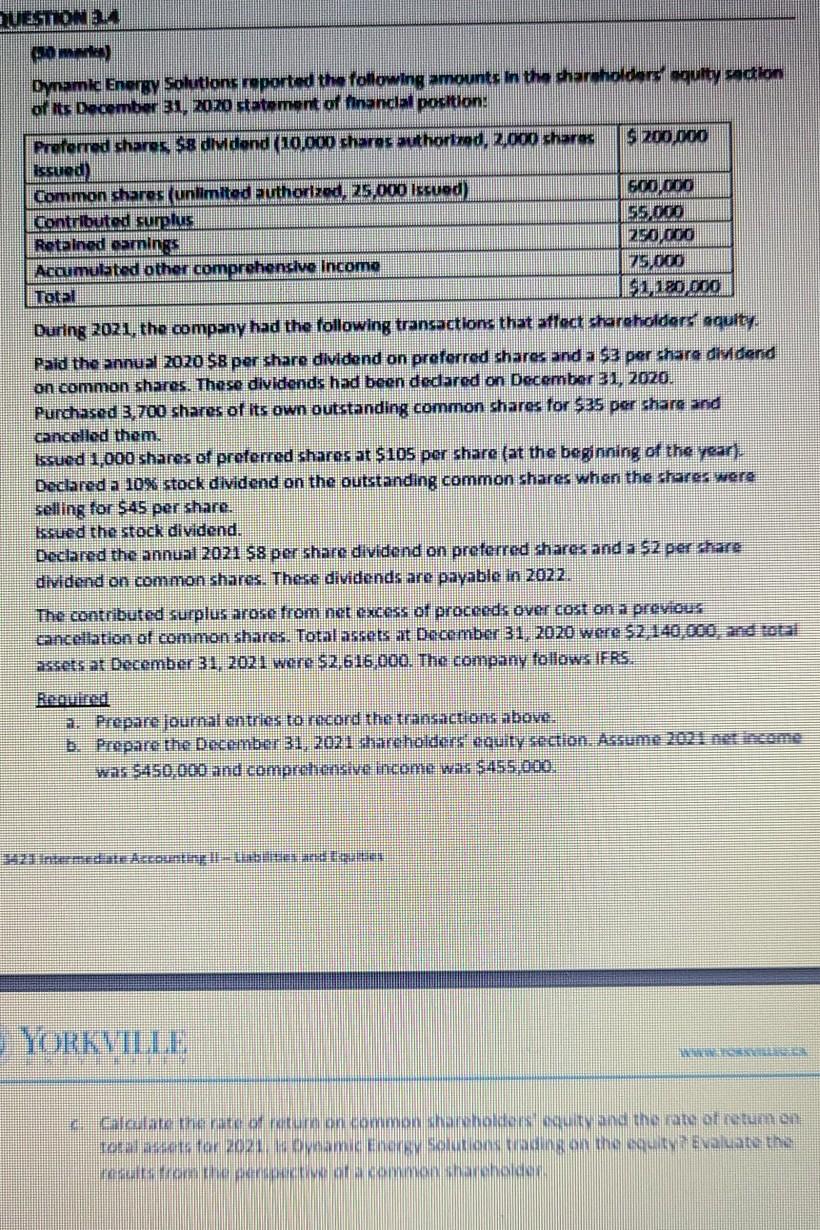

QUESTION ) Dynamic Energy Solutions reported the following amounts in the shareholders gulty saction of its December 31, 2020 statement of financial position: Preremed shares

QUESTION ) Dynamic Energy Solutions reported the following amounts in the shareholders gulty saction of its December 31, 2020 statement of financial position: Preremed shares $8 Mdend 10,000 shares authorized, 2,000 chora $ 200,000 Issued) Common shares unlimited authorized. 25.000 issued) 600.000 Contributed surplus Retained oamines 250,000 Accumulated other comprehensive Income 25,000 Total F2 120.000 During 2021, the company had the following transactions that affect shareholders' aquity. Paid the annual 2020 $B per share dividend on preferred chares and a 52 per share dividend on common shares. These dividends had been dedared on December 31, 2020. Purchased 3,700 shares of its own outstanding common shares for $35 per share and cancelled them. ksued 1,000 shares of preferred shares at $105 per share (at the beginning of the year. Declared a 10% stock dividend on the outstanding common shares when the shares were selling for $45 per share. ksued the stock dividend. Declared the annual 2021 $8 per share dividendon preferred shares and a $2 per share dividend on common shares. These dividends are payable in 2022. The contributed surplus arose from net excess of proceeds over cost on a previous cancellation of common shares. Total assets at December 31, 2020 were $2 140,000, and tota assets at December 31, 2021 were $2,616,000. The company follows IFRS. a. Prepare journal entries to record the transactions above. b. Prepare the December 31, 2021 shareholders' equity section. Assume 20% net income was $450,000 and comprehensive income was $455,000. 21 intermediate Account YORKVILLE TO calculate the rate of mature on common shanbolders out and the rate at tunnen total acts for 2021. ovnamic Energy Solutions and on the equityisenaluate the CHECK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started