Answered step by step

Verified Expert Solution

Question

1 Approved Answer

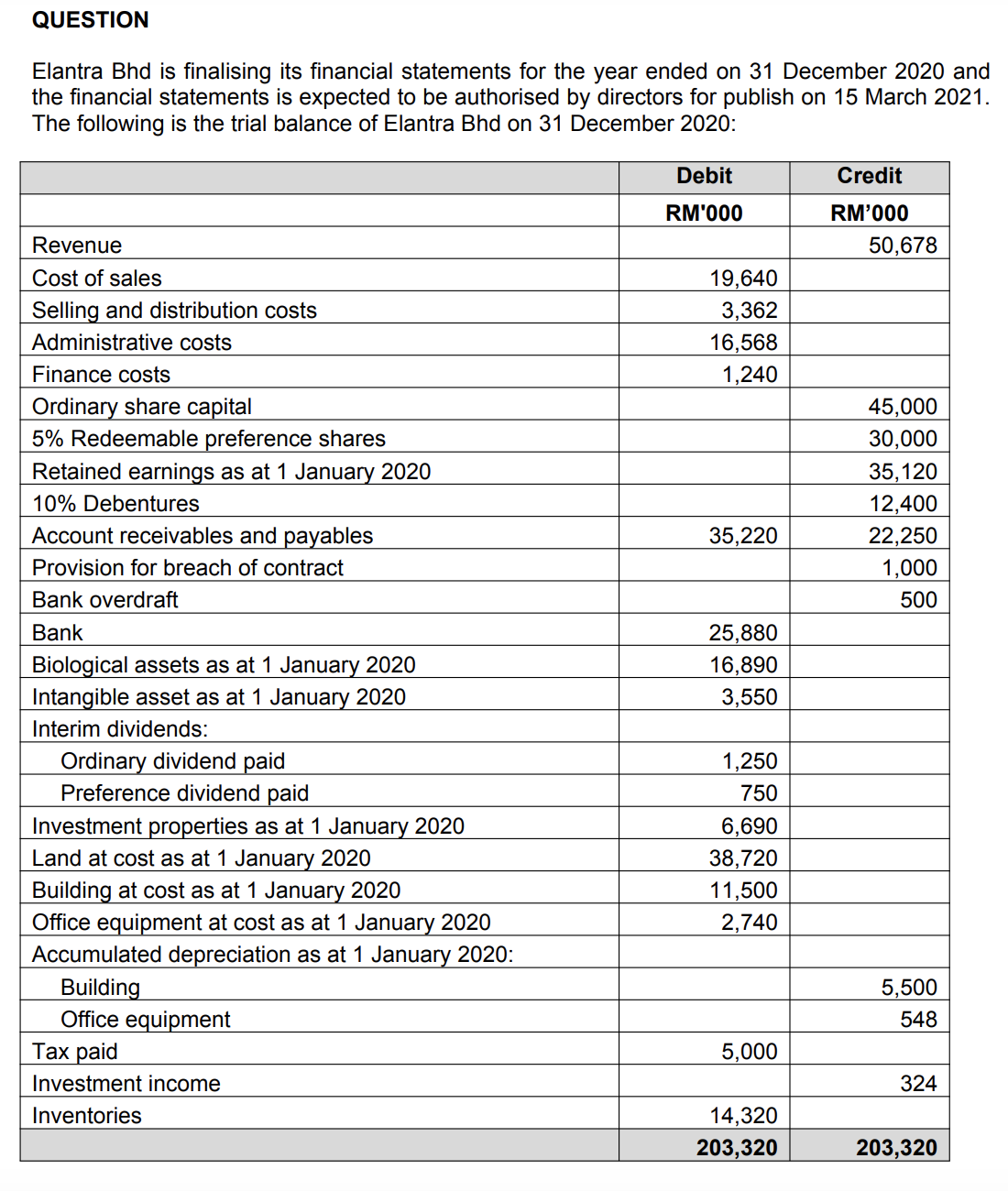

QUESTION Elantra Bhd is finalising its financial statements for the year ended on 31 December 2020 and the financial statements is expected to be authorised

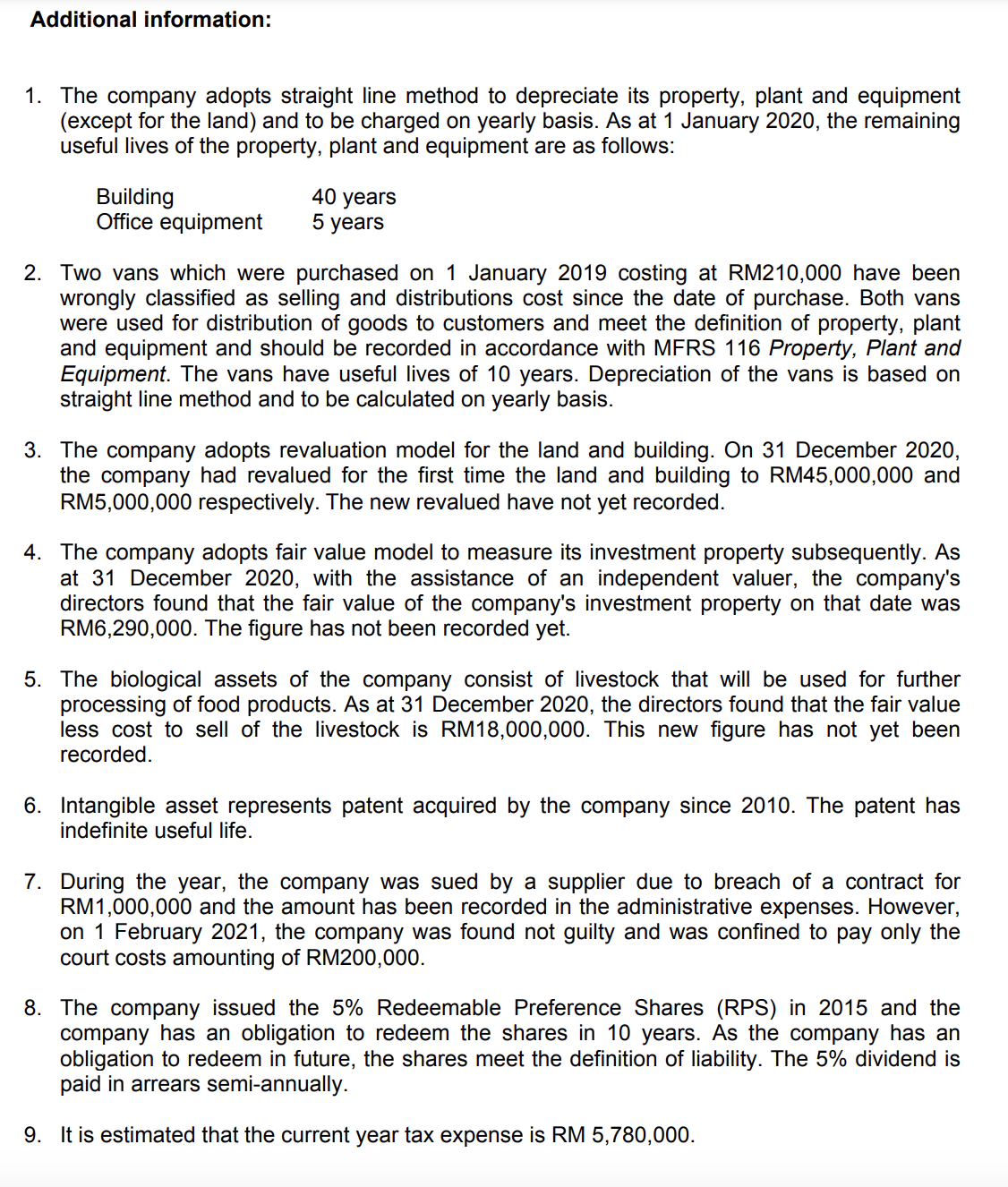

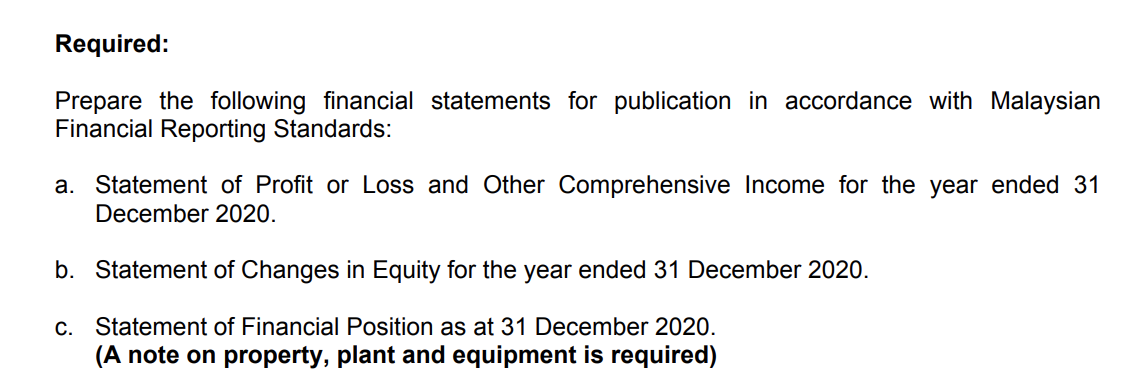

QUESTION Elantra Bhd is finalising its financial statements for the year ended on 31 December 2020 and the financial statements is expected to be authorised by directors for publish on 15 March 2021. 1. The company adopts straight line method to depreciate its property, plant and equipment (except for the land) and to be charged on yearly basis. As at 1 January 2020, the remaining useful lives of the property, plant and equipment are as follows: BuildingOfficeequipment40years5years 2. Two vans which were purchased on 1 January 2019 costing at RM210,000 have been wrongly classified as selling and distributions cost since the date of purchase. Both vans were used for distribution of goods to customers and meet the definition of property, plant and equipment and should be recorded in accordance with MFRS 116 Property, Plant and Equipment. The vans have useful lives of 10 years. Depreciation of the vans is based on straight line method and to be calculated on yearly basis. 3. The company adopts revaluation model for the land and building. On 31 December 2020 , the company had revalued for the first time the land and building to RM45,000,000 and RM5,000,000 respectively. The new revalued have not yet recorded. 4. The company adopts fair value model to measure its investment property subsequently. As at 31 December 2020, with the assistance of an independent valuer, the company's directors found that the fair value of the company's investment property on that date was RM6,290,000. The figure has not been recorded yet. 5. The biological assets of the company consist of livestock that will be used for further processing of food products. As at 31 December 2020, the directors found that the fair value less cost to sell of the livestock is RM18,000,000. This new figure has not yet been recorded. 6. Intangible asset represents patent acquired by the company since 2010. The patent has indefinite useful life. 7. During the year, the company was sued by a supplier due to breach of a contract for RM1,000,000 and the amount has been recorded in the administrative expenses. However, on 1 February 2021, the company was found not guilty and was confined to pay only the court costs amounting of RM200,000. 8. The company issued the 5% Redeemable Preference Shares (RPS) in 2015 and the company has an obligation to redeem the shares in 10 years. As the company has an obligation to redeem in future, the shares meet the definition of liability. The 5% dividend is paid in arrears semi-annually. 9. It is estimated that the current year tax expense is RM 5,780,000. Required: Prepare the following financial statements for publication in accordance with Malaysian Financial Reporting Standards: a. Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020. b. Statement of Changes in Equity for the year ended 31 December 2020. c. Statement of Financial Position as at 31 December 2020. (A note on property, plant and equipment is required)

QUESTION Elantra Bhd is finalising its financial statements for the year ended on 31 December 2020 and the financial statements is expected to be authorised by directors for publish on 15 March 2021. 1. The company adopts straight line method to depreciate its property, plant and equipment (except for the land) and to be charged on yearly basis. As at 1 January 2020, the remaining useful lives of the property, plant and equipment are as follows: BuildingOfficeequipment40years5years 2. Two vans which were purchased on 1 January 2019 costing at RM210,000 have been wrongly classified as selling and distributions cost since the date of purchase. Both vans were used for distribution of goods to customers and meet the definition of property, plant and equipment and should be recorded in accordance with MFRS 116 Property, Plant and Equipment. The vans have useful lives of 10 years. Depreciation of the vans is based on straight line method and to be calculated on yearly basis. 3. The company adopts revaluation model for the land and building. On 31 December 2020 , the company had revalued for the first time the land and building to RM45,000,000 and RM5,000,000 respectively. The new revalued have not yet recorded. 4. The company adopts fair value model to measure its investment property subsequently. As at 31 December 2020, with the assistance of an independent valuer, the company's directors found that the fair value of the company's investment property on that date was RM6,290,000. The figure has not been recorded yet. 5. The biological assets of the company consist of livestock that will be used for further processing of food products. As at 31 December 2020, the directors found that the fair value less cost to sell of the livestock is RM18,000,000. This new figure has not yet been recorded. 6. Intangible asset represents patent acquired by the company since 2010. The patent has indefinite useful life. 7. During the year, the company was sued by a supplier due to breach of a contract for RM1,000,000 and the amount has been recorded in the administrative expenses. However, on 1 February 2021, the company was found not guilty and was confined to pay only the court costs amounting of RM200,000. 8. The company issued the 5% Redeemable Preference Shares (RPS) in 2015 and the company has an obligation to redeem the shares in 10 years. As the company has an obligation to redeem in future, the shares meet the definition of liability. The 5% dividend is paid in arrears semi-annually. 9. It is estimated that the current year tax expense is RM 5,780,000. Required: Prepare the following financial statements for publication in accordance with Malaysian Financial Reporting Standards: a. Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020. b. Statement of Changes in Equity for the year ended 31 December 2020. c. Statement of Financial Position as at 31 December 2020. (A note on property, plant and equipment is required) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started