using market weights, compute the weight of debt and equity:

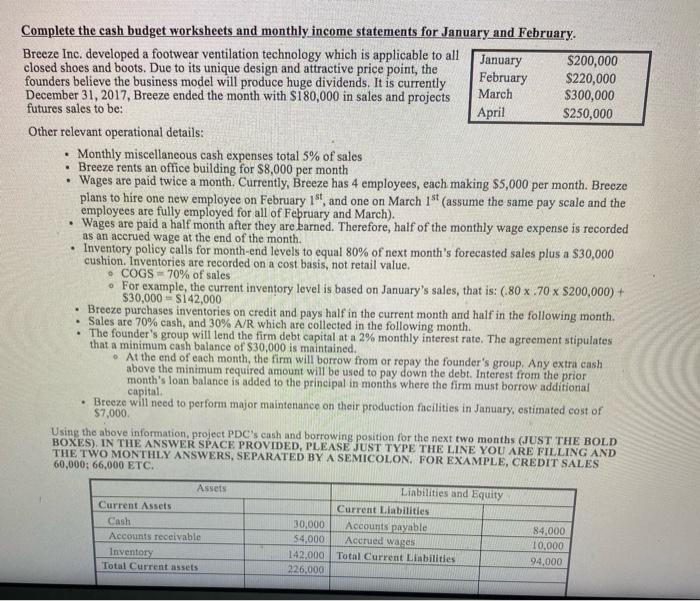

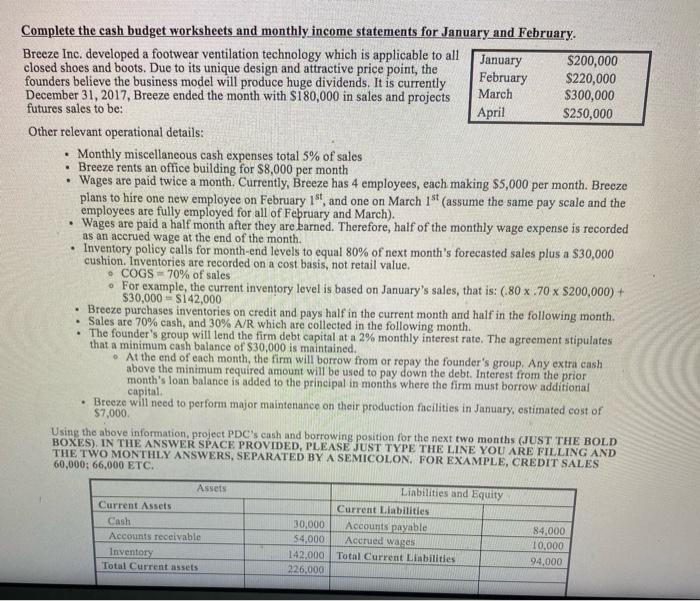

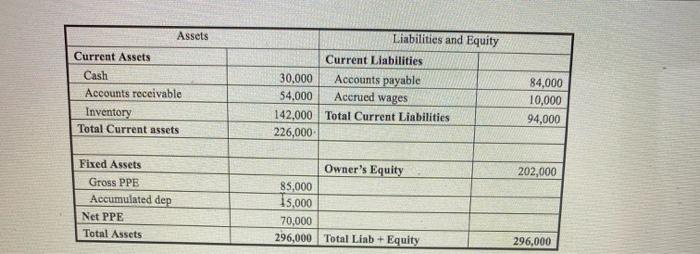

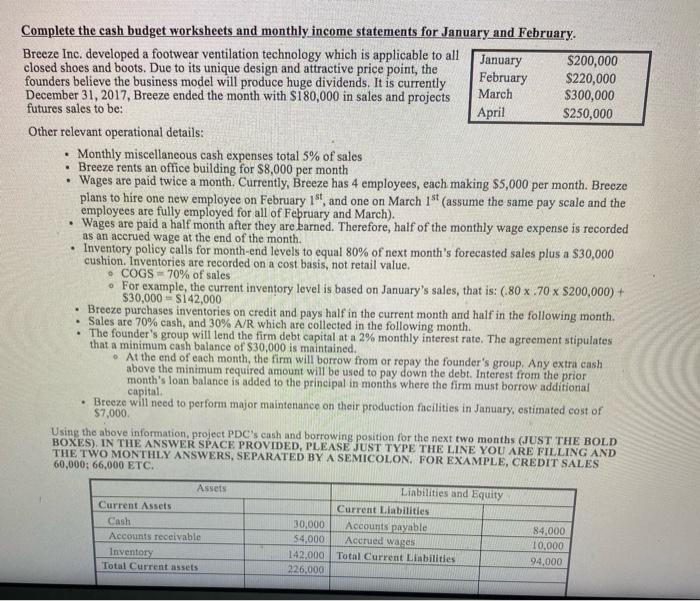

Complete the cash budget worksheets and monthly income statements for January and February Breeze Inc. developed a footwear ventilation technology which is applicable to all January $200,000 closed shoes and boots. Due to its unique design and attractive price point, the February $220,000 founders believe the business model will produce huge dividends. It is currently March December 31, 2017, Breeze ended the month with $180,000 in sales and projects $300,000 futures sales to be: April $250,000 Other relevant operational details: Monthly miscellaneous cash expenses total 5% of sales Breeze rents an office building for $8,000 per month Wages are paid twice a month. Currently, Breeze has 4 employees, each making $5,000 per month. Breeze plans to hire one new employee on February 18, and one on March 1" (assume the same pay scale and the employees are fully employed for all of February and March). Wages are paid a half month after they are barned. Therefore, half of the monthly wage expense is recorded as an accrued wage at the end of the month. Inventory policy calls for month-end levels to equal 80% of next month's forecasted sales plus a $30,000 cushion. Inventories are recorded on a cost basis, not retail value. COGS -70% of sales For example, the current inventory level is based on January's sales, that is: (80 x 70 x $200,000) + $30,000 = $142,000 Breeze purchases inventories on credit and pays half in the current month and half in the following month. Sales are 70% cash, and 30% A/R which are collected in the following month. The founder's group will lend the firm debt capital at a 2% monthly interest rate. The agreement stipulates that a minimum cash balance of $30,000 is maintained. At the end of each month, the firm will borrow from or repay the founder's group. Any extra cash above the minimum required amount will be used to pay down the debt. Interest from the prior month's loan balance is added to the principal in months where the firm must borrow additional capital Breeze will need to perform major maintenance on their production facilities in January, estimated cost of $7,000 Using the above information, project PDC's cash and borrowing position for the next two months (JUST THE BOLD BOXES). IN THE ANSWER SPACE PROVIDED, PLEASE JUST TYPE THE LINE YOU ARE FILLING AND THE TWO MONTHLY ANSWERS, SEPARATED BY A SEMICOLON. FOR EXAMPLE, CREDIT SALES 60,000; 66,000 ETC. Assets Current Assets Cash Accounts receivable Inventory Total Current assets 30,000 54.000 142.000 226,000 Liabilities and Equity Current Liabilities Accounts payable Accrued wages Total Current Linbilities 84.000 10.000 94,000 Assets Current Assets Cash Accounts receivable Inventory Total Current assets Liabilities and Equity Current Liabilities 30,000 Accounts payable 54.000 Accrued wages 142.000 Total Current Liabilities 226,000 84,000 10,000 94,000 202,000 Fixed Assets Gross PPE Accumulated dep Net PPE Total Assets Owner's Equity 85,000 15.000 70,000 296,000 Total Liab + Equity 296,000