Question EX 14-2

Based on the data in Exercise 14-1 what factors other than earnings per share shold be considered in evaluating these alternative financing plans?

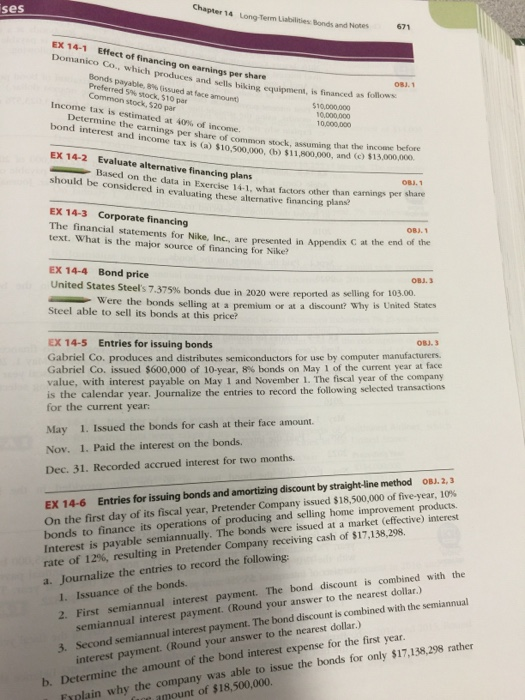

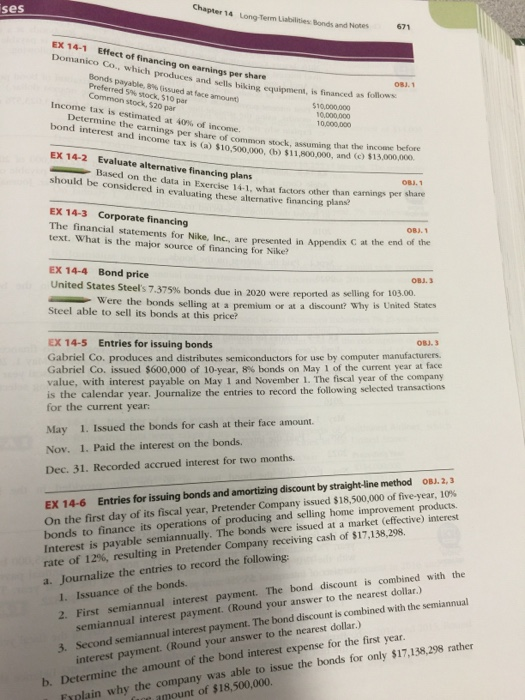

Chapter 14 Longterm uabilities Bonds and Notes SeS 671 EX 14-1 Effect of financi ng on ear which per share payable biking equipment, financed as follows is 08 1 at face Common stock, $10 par S20 come tax is bond interest earnings per share of common stock, assuming that the income before and tax is Ca) s10 and Ex 14-2 Evaluate ternative financing plans should Based on the data in Exercise 14-1, factors other earnings per share be in evaluat these than ng alternative financing plans EX 14-3 Corporate financing The financial statements for Nike, Inc. are presented in Appendix C at the end of the text. What is the major source of financing for Nike EX 14-4 Bond price United States Steel's 7.375% bonds due in 2020 were reported as selling for a Were the bonds selling at a premium or at a discount? Why is United States Steel able to sell its bonds at this price? EX 14-5 Entries for issuing bonds Gabriel Co. produces and distributes semiconductors for use by computer manufacturers. Gabriel Co. issued $600,000 of 10-year, 8% bonds on May 1 of the current year at face value, with interest payable on May 1 and November 1. The fiscal year of the company the entries to record the following calendar year. Journalize for the current year: May 1. Issued the bonds for cash at their face amount. Nov. 1. Paid the interest on the bonds Dec. 31. Recorded accrued interest for two months. Ex 14-6 Entries for issuing bonds and amortizing discount by straight-line method 08.2,3 On the first day of its fiscal year, Pretender Company issued $18,500,000 of five-year, 10% bonds to finance its operations of producing and selling home improvement products. Interest is payable nnually. The bonds were issued at a market (effective) interest rate of 12%, resulting in Pretender Company receiving cash of a. Journalize the entries to record the following: the 1. Issuance of the bonds. discount is combined with 2. rst semiannual interest payment. The bond nearest dollar.) nual interest payment. your answer to the semiannual interest payment. The bond discount combined with the 3, Second Round your answer to the nearest dollar) year. rather rest payment. expense for the first $17,138,298 b. Determine the amount of the bond interest bonds for only Fyplain why the company was able to issue the