Question:

Example:

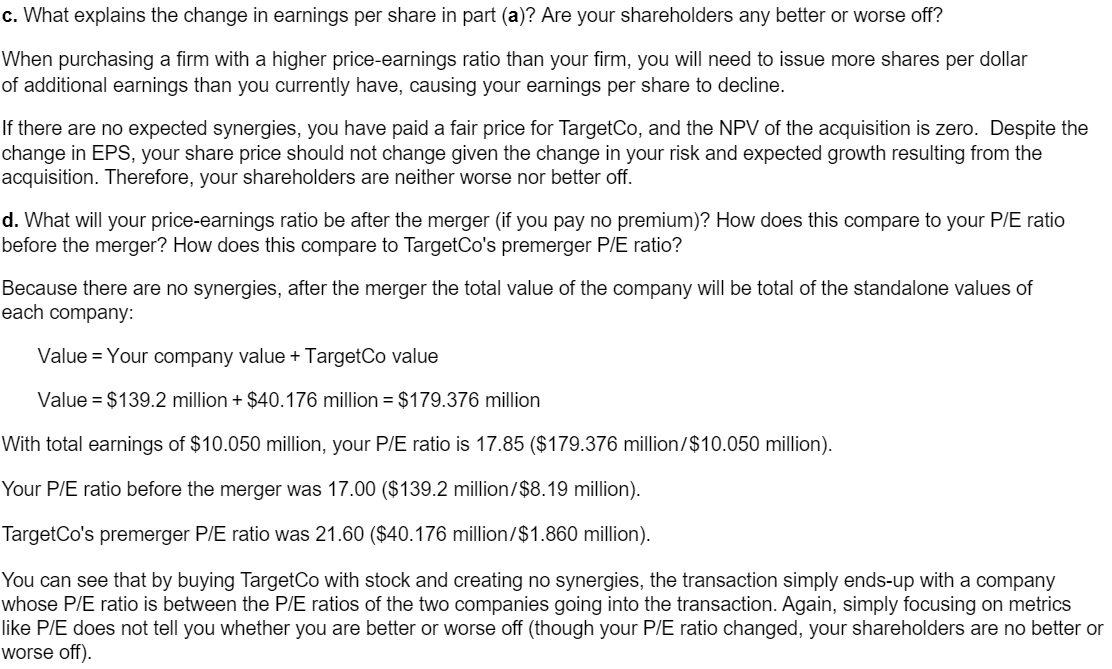

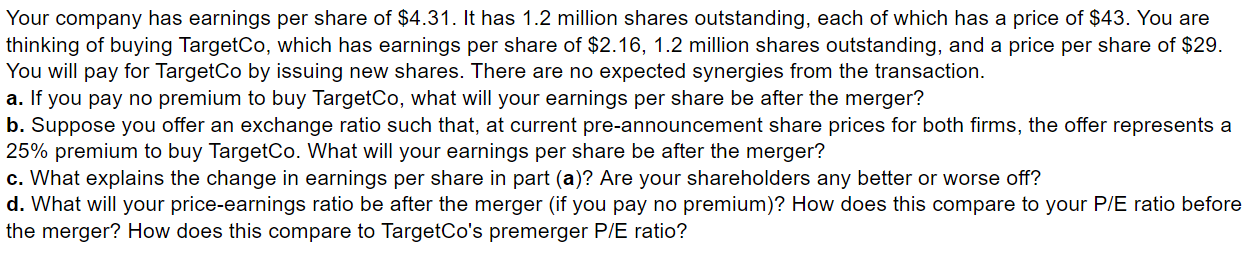

Your company has earnings per share of $4.31. It has 1.2 million shares outstanding, each of which has a price of $43. You are thinking of buying TargetCo, which has earnings per share of $2.16,1.2 million shares outstanding, and a price per share of $29. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? b. Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 25% premium to buy TargetCo. What will your earnings per share be after the merger? c. What explains the change in earnings per share in part (a)? Are your shareholders any better or worse off? d. What will your price-earnings ratio be after the merger (if you pay no premium)? How does this compare to your P/E ratio before the merger? How does this compare to TargetCo's premerger P/E ratio? a. If you pay no premium to buy TargetCo, what will your earnings per share be after the merger? To compute earnings per share, we need to compute the total earnings and the total number of shares post-merger. TargetCo's shares are worth $32.40 and your shares are worth $96. TargetCo has a market cap of $40.176 million ( $32.401.24 million shares), so you will have to issue 0.4185 million new shares (\$40.176 million/ $96 ). Thus, after the merger you will have a total of 1.869 million shares outstanding, the original 1.45 million plus the 0.4185 million new shares. Your total earnings after the merger will be the combined earnings of both firms. Your company has earnings of $8.19 million (\$5.65 EPS 1.45 million shares), and TargetCo has earnings of $1.860 million (\$1.50 EPS 1.24 million shares), for a total of $10.050 million. Therefore, after the merger, your earnings per share will be $5.38 per share (\$10.050 million/1.869 million shares). b. Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 10% premium to buy TargetCo. What will your earnings per share be after the merger? In this case you will pay a total of $44.194 million (1.10$32.40 per share 1.24 million shares), so you will have to issue 0.460 million new shares (\$44.194 million/\$96 per share). Thus, after the merger you will have a total of 1.910 million shares outstanding and total earnings of $10.050 million, for an earnings per share post-merger of $5.26 per share (\$10.050 million/1.910 million shares). c. What explains the change in earnings per share in part (a)? Are your shareholders any better or worse off? When purchasing a firm with a higher price-earnings ratio than your firm, you will need to issue more shares per dollar of additional earnings than you currently have, causing your earnings per share to decline. If there are no expected synergies, you have paid a fair price for TargetCo, and the NPV of the acquisition is zero. Despite the change in EPS, your share price should not change given the change in your risk and expected growth resulting from the acquisition. Therefore, your shareholders are neither worse nor better off. d. What will your price-earnings ratio be after the merger (if you pay no premium)? How does this compare to your P/E ratio before the merger? How does this compare to TargetCo's premerger P/E ratio? Because there are no synergies, after the merger the total value of the company will be total of the standalone values of each company: Value=Yourcompanyvalue+TargetCovalueValue=$139.2million+$40.176million=$179.376million With total earnings of $10.050 million, your P/E ratio is 17.85 (\$179.376 million/ $10.050 million). Your P/E ratio before the merger was 17.00 (\$139.2 million/ $8.19 million). TargetCo's premerger P/E ratio was 21.60 (\$40.176 million/ $1.860 million). You can see that by buying TargetCo with stock and creating no synergies, the transaction simply ends-up with a company whose P/E ratio is between the P/E ratios of the two companies going into the transaction. Again, simply focusing on metrics like P/E does not tell you whether you are better or worse off (though your P/E ratio changed, your shareholders are no better or Worse off)