Answered step by step

Verified Expert Solution

Question

1 Approved Answer

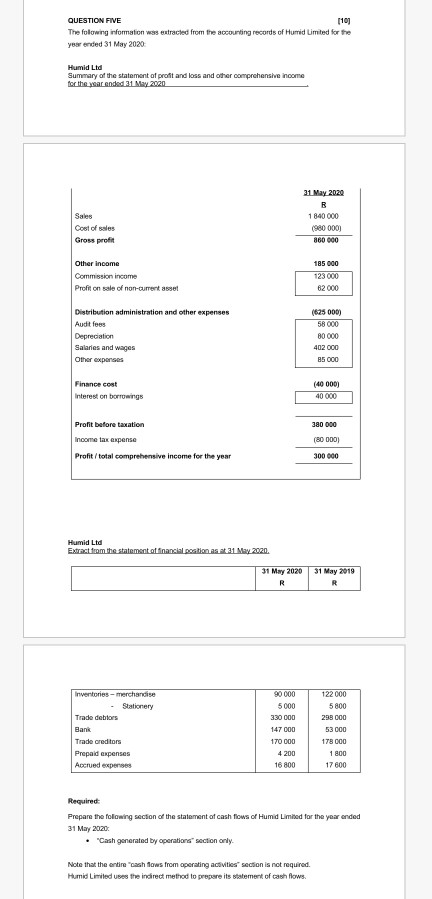

QUESTION FIVE [10] The following information was extracted from the accounting records of Humid Limited for the year ended 31 May 2020 Humid Ltd Summary

QUESTION FIVE [10] The following information was extracted from the accounting records of Humid Limited for the year ended 31 May 2020 Humid Ltd Summary of the statement of profit and loss and other comprehensive income for the war ended 31 May 2020 Sales Cost of sales Gross profit 31 May 2020 B 1 840 000 (980 000 860000 Other income Commission income Profit on sale of non-current et 185 000 123 000 62000 Distribution administration and other expenses Audit foes Depreciation Salaries and wages Other expenses (625 000) 58 000 80 000 402 000 85000 Finance cost Interest on borrowings (40000) 40 000 380 000 Profit before taxation Income tax expense Profit /total comprehensive income for the year 180 000) 300 000 Humid Ltd Extract from the statement of financialogbon as at 31 May 2020. 31 May 2020 R 31 May 2019 R Inventories - merchandise Stationery Trade debtors 90 000 5000 330 000 147 000 170 000 4 200 16800 122 000 5800 298 000 53 000 178 000 1 800 17 600 Trade creditors Prepaid expenses Accrued expenses Required: Prepare the following section of the statement of cash flows of Humid Limited for the year ended 31 May 2020: "Cash generated by operations' section only. Note that the entire Gashows from operating activities section is not required. Humid Limited uses the indirect method to prepare its statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started