Answered step by step

Verified Expert Solution

Question

1 Approved Answer

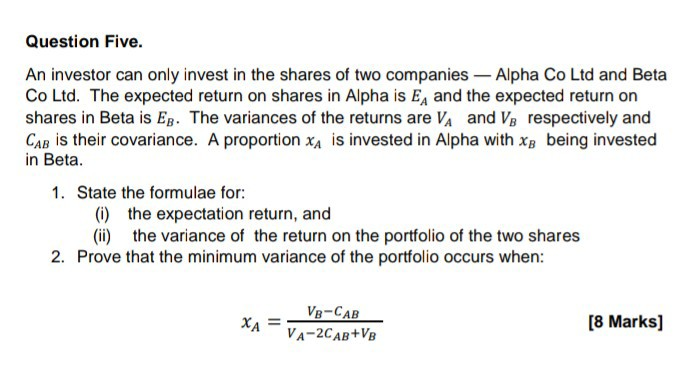

Question Five. An investor can only invest in the shares of two companies - Alpha Co Ltd and Beta Co Ltd. The expected return on

Question Five. An investor can only invest in the shares of two companies - Alpha Co Ltd and Beta Co Ltd. The expected return on shares in Alpha is EA and the expected return on shares in Beta is Ep. The variances of the returns are VA and VB respectively and CAB is their covariance. A proportion XA is invested in Alpha with XB being invested in Beta. 1. State the formulae for: (i) the expectation return, and (ii) the variance of the return on the portfolio of the two shares 2. Prove that the minimum variance of the portfolio occurs when: VB-CAB XA - VA-2CAB+VB [8 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started