Question

QUESTION FIVE Dash (Pty) Ltd provided the following information that was extracted from the financial records for the year ended 31 December 2021. Relevant financial

QUESTION FIVE

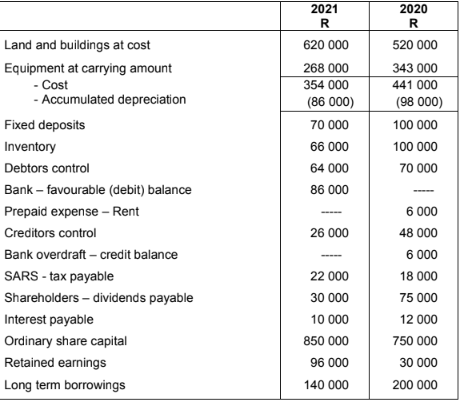

Dash (Pty) Ltd provided the following information that was extracted from the financial records for the year ended 31 December 2021. Relevant financial information are shown below. Information from the statement of financial position as at 31 December:

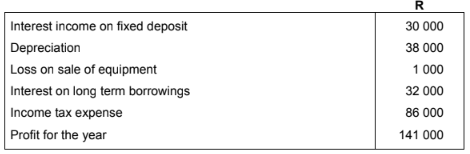

Extract of items shown on the statement of profit and loss and other comprehensive income for the year ended 31 December 2021:

Additional information: 1. Inventory is disclosed at cost. 2. Land has not been revalued in the current financial year. 3. An extension was added to the building and completed in the current financial year. All building costs were paid for in cash. Buildings are not depreciated. 4. Interest on the long term loan is not capitalised. 5. No equipment was purchased during the current financial year but some equipment was sold during the year for cash. 6. Dividends for the year as shown in the statement of changes in equity was R75 000.

Required: Prepare the statement of cash flows of Dash (Pty) Ltd for the year ended 31 December 2021 to comply with the International Financial Reporting Standards (IFRS) in as much as the above information allows. Use the indirect method. Comparative figures are not required.

\begin{tabular}{l|c|c} \hline & 2021 & 2020 \\ & R & R \\ \hline Land and buildings at cost & 620000 & 520000 \\ Equipment at carrying amount & 268000 & 343000 \\ \cline { 2 - 3 } - Cost & 354000 & 441000 \\ - Accumulated depreciation & (86000) & (98000) \\ \cline { 2 - 3 } Fixed deposits & 70000 & 100000 \\ Inventory & 66000 & 100000 \\ Debtors control & 64000 & 70000 \\ Bank - favourable (debit) balance & 86000 & \\ Prepaid expense - Rent & & 6000 \\ Creditors control & 26000 & 48000 \\ Bank overdraft - credit balance & & 6000 \\ SARS - tax payable & 22000 & 18000 \\ Shareholders - dividends payable & 30000 & 75000 \\ Interest payable & 10000 & 12000 \\ Ordinary share capital & 850000 & 750000 \\ Retained earnings & 96000 & 30000 \\ Long term borrowings & 140000 & 200000 \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline Interest income on fixed deposit & R \\ Depreciation & 30000 \\ Loss on sale of equipment & 38000 \\ Interest on long term borrowings & 1000 \\ Income tax expense & 32000 \\ Profit for the year & 86000 \\ \hline \end{tabular} \begin{tabular}{l|c|c} \hline & 2021 & 2020 \\ & R & R \\ \hline Land and buildings at cost & 620000 & 520000 \\ Equipment at carrying amount & 268000 & 343000 \\ \cline { 2 - 3 } - Cost & 354000 & 441000 \\ - Accumulated depreciation & (86000) & (98000) \\ \cline { 2 - 3 } Fixed deposits & 70000 & 100000 \\ Inventory & 66000 & 100000 \\ Debtors control & 64000 & 70000 \\ Bank - favourable (debit) balance & 86000 & \\ Prepaid expense - Rent & & 6000 \\ Creditors control & 26000 & 48000 \\ Bank overdraft - credit balance & & 6000 \\ SARS - tax payable & 22000 & 18000 \\ Shareholders - dividends payable & 30000 & 75000 \\ Interest payable & 10000 & 12000 \\ Ordinary share capital & 850000 & 750000 \\ Retained earnings & 96000 & 30000 \\ Long term borrowings & 140000 & 200000 \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline Interest income on fixed deposit & R \\ Depreciation & 30000 \\ Loss on sale of equipment & 38000 \\ Interest on long term borrowings & 1000 \\ Income tax expense & 32000 \\ Profit for the year & 86000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started